In the world of digital banking, processing and analyzing cheque data efficiently is crucial for operational accuracy, risk management, and fraud mitigation.

As financial institutions handle trillions in digital transactions, the need for robust systems that can swiftly interpret and validate cheque data has never been more critical.

According to a McKinsey report, advanced analytics has enabled banks to significantly reduce fraud losses. Global fraud-related losses are estimated to exceed $31 billion annually, especially in the face of increasingly sophisticated schemes like synthetic identities and sleeper frauds.

In our blog post, we explore how we built an AI-powered cheque fraud detection solution, a highly orchestrated and intelligent pipeline designed to process Image Cash Letters (ICL) end-to-end using AWS cloud-native services, Amazon Bedrock, Amazon SageMaker, and ultimately, integrated with Snowflake for its analytics layer.

Why Modernize Cheque Processing?

Cheque fraud is a growing threat. Manual and semi-automated cheque processing systems often fail to scale efficiently or detect fraud in real time. To tackle these challenges, our use case presents a highly orchestrated, event-driven, AI-augmented pipeline that delivers:

- Real-time ingestion and intelligent document processing

- Serverless and containerized compute for scalability

- Analytics-read outputs for BI and compliance

- Fraud Prediction using ML Models

Building the AWS AI-Powered Cheque Fraud Detection Solution

Our solution was built with AWS services, leveraging serverless and containerized compute layers, AI-driven document intelligence, and real-time event handling to transform traditional cheque processing into a scalable and automated workflow.

Snowflake then provided advanced analytics capabilities, delivering deep insights and enabling predictive analytics in banking and reporting analytics.

AWS Services Used to Build the Solution

- Amazon S3 & EventBridge for ingestion triggers

- Amazon Bedrock for intelligent document analysis

- DynamoDB & Streams for metadata storage and progression

- Amazon SageMaker for fraud prediction

- ECS Fargate for batch processing

Step-by-Step Architecture Flow

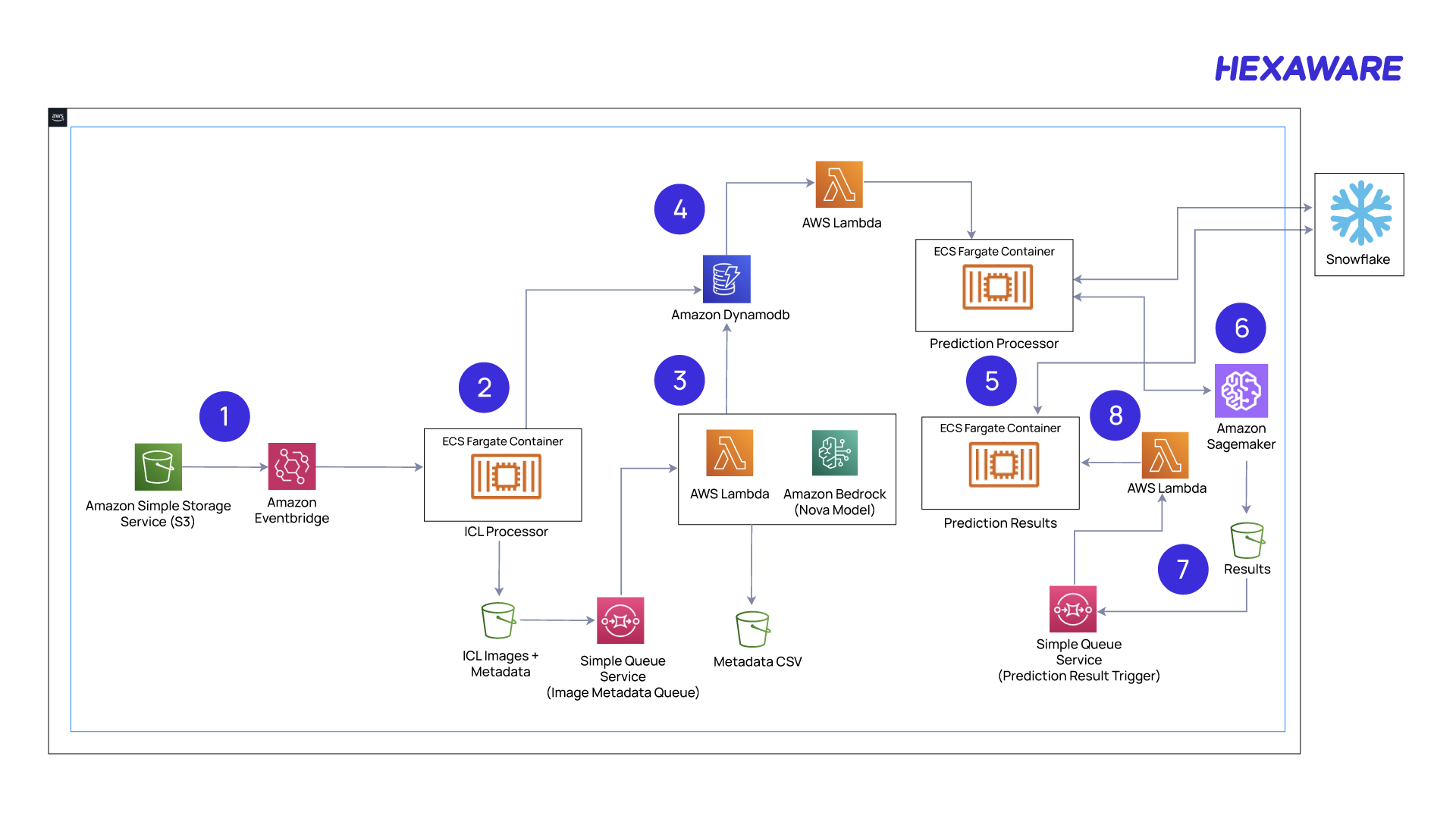

The following describes the step-by-step flow of data through the implemented architecture, as illustrated in the reference diagram below.

1. ICL File Ingestion & Initial Trigger

- ICL File Upload: A raw ICL file is uploaded into an Amazon S3 bucket.

- EventBridge Trigger: An EventBridge rule listens for this upload event and triggers an ECS Task (named ICL Processor).

2. ICL File Processing in ECS

- ICL Processor Task: Within ECS, the task processes the ICL file:

- Extracts cheque images and metadata (e.g., cheque number, account info).

- Stores:

- Images into Amazon S3 (possibly a different bucket/prefix).

- Metadata into Amazon DynamoDB for structured access.

3. Image Processing via Amazon Bedrock

- Once the images are in S3:

- An SQS Queue collects images in batches of 10.

- A Lambda Function is triggered for each batch to:

- Invoke Amazon Bedrock using the Nova Model for intelligent extraction (e.g., amount, date, signature presence).

- Store:

- Extracted structured data into DynamoDB.

- Per-cheque metadata files into S3 (used later for Snowflake import).

4. DynamoDB Streams and Conditional Progression

- DynamoDB Streams detect metadata updates.

- A Lambda function reads from the stream:

- If the processed cheque count matches the expected Bedrock count, it triggers the next ECS task: Prediction Processor.

5. Prediction Processor – Snowflake Integration

- This ECS task handles:

- Importing metadata into Snowflake via stored procedures.

- Exporting processed records (based on ICL file and transaction date).

- Exported data includes cheque images and metadata.

6. Amazon SageMaker Predictions

- Image Preparation:

- Exported cheque images are converted to Base64.

- Stored in an Amazon SageMaker-specific S3 bucket.

- Amazon SageMaker API call is made to:

- Send the input features.

- Get predicted outcomes (e.g., fraud probability, risk score).

- Store prediction results back into the same S3 bucket.

7. Prediction Result Trigger

- This event triggers an SQS message, which invokes a Lambda function.

- The Lambda function then initiates the final ECS task.

8. Final Storage and Reporting

- The final ECS task (Prediction Results Processor):

- Stores results into DynamoDB.

- Triggers a stored procedure to import prediction results into Snowflake.

- This data is now ready for dashboards, audits, or business logic.

Features of the Solution We Built using AWS

Our solution’s features improve fraud detection’s performance and reliability. It also helps speed up innovation, making it easier to use the cloud and providing better insights through advanced analytics.

This way, our solution stays adaptable and cost-effective while keeping security and smooth operation a top priority. Here are the features:

- End-to-End Automation: Fully orchestrated, serverless-to-container pipeline eliminates manual steps and human dependencies.

- Event-Driven Architecture: Real-time responsiveness using EventBridge, SQS, and DynamoDB Streams enables instant downstream processing.

- AI-Powered Intelligence: Amazon Bedrock extracts structured data from unstructured cheque images. Additionally, Amazon SageMaker enriches data with fraud detection, risk scoring, and pattern recognition.

- Hybrid Compute Model: Combines ECS for compute-intensive tasks and AWS Lambda for lightweight, event-based triggers—delivering optimal performance.

- Batch-Based Parallelism: Efficient SQS-based batching ensures high-throughput processing of a huge number of cheque images.

- Seamless System Integration: Tight data flow across Amazon S3, DynamoDB, and Snowflake ensures smooth transitions between data formats and systems.

- Analytics-Ready Outputs: All processed and predicted data lands in Snowflake, ready for advanced analytics, dashboards, and business intelligence.

Key Benefits of the Fraud Detection Solution

Implementing this intelligent cheque processing solution and fraud detection system has already demonstrated transformative results, promising to redefine operational efficiency across the banking sector:

- Fraud Detection Time Slashed by 70%: What previously took hours or days can now be flagged and resolved in minutes. This improvement not only deters financial losses but also boosts customer trust and confidence.

- Manual Review Effort Cut by 50%: By automating routine verification tasks, teams can shift their focus from tedious evaluations to more strategic, high-value work—freeing up resources and encouraging smarter workforce utilization.

- 100% Pipeline Visibility: End-to-end tracking across ingestion, processing, and scoring gives unprecedented clarity. It’s like turning on the lights in a room that used to be half-shadowed—errors and bottlenecks now stand no chance of hiding.

- Audit-Friendly Metadata: Built-in transparency supports regulatory compliance with ease. The system’s structured metadata ensures that audits become less of a scramble and more of a seamless checkpoint.

- Scalable to Millions of Cheques: Designed for growth, this solution doesn’t just solve today’s problems—it’s equipped to handle tomorrow’s volume without compromising speed or accuracy.

Future Scope and Industry Outlook

Our implementation was more than a tech upgrade—it’s the foundation of a modern fraud prevention ecosystem. As cheque-based transactions continue to digitize, solutions like ours set the standard for:

- Cross-border and multi-format fraud detection, expanding its reach into international financial systems.

- AI-driven predictive modeling allows institutions to identify potential fraud before it occurs based on behavioral trends.

- Integration with real-time payment platforms, transforming legacy systems into agile frameworks for instant validation.

AWS for Cloud Native Architecture in Advanced Analytics

Our cloud-native AWS architecture modernizes cheque processing by bringing intelligence, scalability, and agility into the workflow.

It combines AWS’s event-driven and serverless capabilities with Bedrock’s AI extraction and SageMaker’s predictive modeling, letting financial institutions unlock real-time fraud detection proactively and accelerate operations—all while maintaining a secure and audit-ready data environment.

Curious about the right AWS data and analytics services for you? Learn more here.