In this digital economy, the commercial insurance sector stands at the precipice of transformation. Data and artificial intelligence (AI) are no longer buzzwords—they are the strategic levers driving innovation, efficiency, and competitive advantage.

At ITC Vegas 2024, Hexaware hosted a pivotal session, bringing together industry trailblazers from leading insurance organizations to discuss how data and AI are reshaping commercial insurance.

The Panel:

- Sandesh Shetti, SVP, Business Solutions Leader, Insurance, Hexaware

- Bob Olson, CIO, AON

- Colleen Thomas, VP, Business Relationship Management & Innovation, CNA

- Venkat Krishnamoorthy, Chief CDO and CTO, Hamilton

- Kate Riordan, Director, Automation Initiatives, Verisk

The discussion revealed the untapped opportunities and challenges that lie ahead, offering a roadmap for businesses ready to embrace the future.

In this blog, we distill the session’s insights into actionable strategies, helping you navigate this transformative journey.

The Complex Dynamics of Insurance Placement

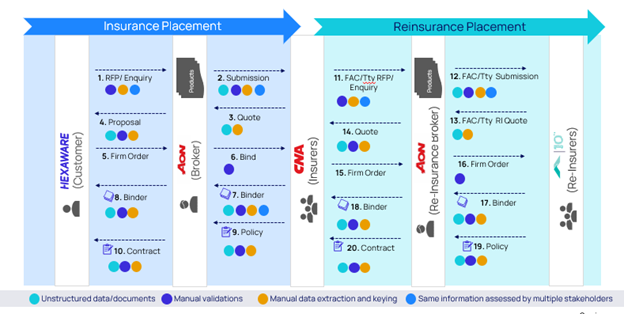

Insurance placement, at its core, is a labyrinthine process—one that spans multiple stakeholders, complex workflows, and intricate decision trees. A customer submits an inquiry to a broker, who manages the placement and presents it to insurers. The insurers respond with quotes, which the broker shares with the customer. Once the customer provides a firm order, the broker sends a bind message to the insurers, leading to the issuance of a policy. The process becomes more complex when reinsurance is required, adding an additional layer of coordination.

Challenges in the Current Landscape

Despite its critical role, the insurance placement process is plagued by inefficiencies. At the panel discussion, our industry experts identified several challenges in the current insurance placement process as follows:

- Unstructured Data: The dominance of unstructured documents and data hinders insurance automation and scalability.

- Manual Validation: Reliance on manual processes leads to delays, errors, and inefficiencies.

- Redundant Efforts: Insurers repeatedly assess the same information, resulting in wasted resources.

- Lack of Standardization: The absence of industry-wide data standards creates communication gaps and slows processes.

These inefficiencies inflate the Time to Bind and Time to Quote—two key metrics that impact organizational profitability and competitiveness.

The opportunity? Advanced data and AI insurance automation solutions present an unprecedented opportunity to address these challenges, streamline workflows, accelerate operations, and unlock business potential.

Data: The Foundation of Insurance Transformation

Data is the cornerstone of the insurance industry, holding the power to drive transformative efficiencies and competitive advantages. Yet, many organizations struggle to fully harness its potential due to fragmented systems, unstructured formats, and outdated processes. By embracing data standardization, insurance workflow automation through APIs, and leveraging advanced analytics, insurers can transcend operational bottlenecks to deliver exceptional customer value.

Our panelists at ITC Vegas 2024 highlighted that the key to success lies in building a robust data foundation—one that not only streamlines processes but also enables smarter, faster decision-making. Industry leaders like Aon, Hamilton Insurance Group, and Verisk are already proving the value of these approaches, showcasing how data-driven innovation can reshape the insurance landscape.

Insights from Industry Leaders

Key participants in the session shared their experiences in leveraging data to drive transformation:

- Bob on Aon’s Data Standardization Journey

Bob Olson, CIO of Aon, highlighted their adoption of ACORD Global Reinsurance and Large Commercial (GRLC) standards. By aligning stakeholders across reinsurers, carriers, and brokers, Aon achieved expedited claims handling and improved client outcomes. - Venkat on Hamilton Insurance Group’s Focus on Data Capture

Venkat Krishnamurthy, CDO and CTO at Hamilton Insurance Group, emphasized the importance of capturing structured and unstructured data. Hamilton’s data initiatives have laid the groundwork for actionable insights and better decision-making. - Kate on Verisk’s Data Automation Initiatives

Kate Riordon, Director of Automation Initiatives at Verisk, discussed their efforts in converting unstructured data into actionable intelligence. This approach not only addressed operational inefficiencies but also tackled talent attrition challenges.

At Hexaware, we specialize in turning raw data into actionable insights. By leveraging data standardization and automation, we help organizations unlock growth opportunities and gain a competitive edge. Learn more about Hexaware’s data transformation solutions.

AI in Commercial Insurance

Artificial intelligence is no longer an aspirational technology—it is a business imperative. From quote ingestion to claims management, AI is revolutionizing the insurance value chain, making processes faster, smarter, and more efficient.

Leaders Talk About Real-World Examples of AI’s Transformative Impact

Our session featured some of the powerful use cases of AI innovations:

- CNA’s AI-Powered Process Optimization

Colleen Thomas, VP of Business Relationship Management & Innovation at CNA Insurance, shared how AI has streamlined new business submission intake, improving broker support and optimizing claims processes. - Hamilton’s Adoption of AI and GenAI

Hamilton Insurance Group is leveraging AI and Generative AI (GenAI) for claim summarization, contract data extraction, and comparison. GenAI’s natural language capabilities have enhanced adoption rates and operational outcomes. - Aon’s AI-Driven Quote Ingestion

Bob Olson highlighted Aon’s success with large language models to extract terms and conditions with unmatched accuracy, enabling faster and more comprehensive client quotes.

At Hexaware, we are early adopters of emerging technologies like AI and GenAI in commercial insurance. Our expertise empowers organizations to reduce execution times, accelerate proof-of-concept development, and jumpstart productivity.

Explore how AI can transform your insurance operations.

Navigating the Regulatory Landscape

AI’s transformative potential comes with its own set of challenges, particularly in terms of governance, ethics, and compliance. As regulatory oversight evolves, companies must address concerns around data security, transparency, and bias.

Kate Riordon from Verisk underscored the importance of robust governance frameworks to ensure responsible AI deployments. Organizations must stay ahead of regulatory changes while adopting ethical AI practices.

At Hexaware, we help organizations navigate this complex landscape, ensuring insurance regulatory compliance without compromising innovation. Our ethical AI practices prioritize transparency, fairness, and accountability.

Learn insurance industry best practices for implementation.

Key Takeaways: Preparing for the Future of Commercial Insurance

The session concluded with a clear message: the future of commercial insurance lies in embracing data and AI to drive transformation. Here are the key takeaways:

- Digital Integration: Seamless integration across the insurance value chain is no longer optional—it’s essential.

- Customer-Centric Focus: Technology must enhance customer value and experience.

- Data Foundation: A robust data foundation is the gateway to AI-driven insights and efficiency.

- Regulatory Alignment: Staying compliant ensures sustainable innovation.

- AI as a Disruptor: The potential of AI to revolutionize the industry cannot be overstated.

Hexaware is uniquely positioned to help organizations navigate this journey. With expertise in data-driven transformation and AI innovation, we’ve delivered tangible results for over 100 customers, saving months of development time and improving operational efficiency.

Accelerating Insurance Transformation with Data & AI: Hexaware’s Data & AI-Powered Case Studies

Here’s how Hexaware is transforming insurance operations through innovative data and AI-driven solutions, delivering measurable results and driving business growth.

Data-Powered Process Enhancements

Client: Top Life & Annuities Insurer

Hexaware faced the challenge of migrating complex, high-volume records for a top life and annuities insurer. With over 2 million records to migrate, Hexaware ensured 100% test data coverage. Their meticulous approach and expertise led to the successful migration of these records, demonstrating their capability to handle large-scale data projects with precision.

Client: London Market Insurer

A London market insurer struggled with time-consuming data transfer and validation processes. Hexaware stepped in and made a significant impact by reducing the transfer time by 85% and cutting down validation time by 30%. This not only simplified the large volume data comparison but also streamlined their operations, showcasing Hexaware’s efficiency in data migration.

Client: Personal Lines Insurer (US)

Hexaware’s prowess in data quality enhancement was evident in their work with a personal lines insurer in the US. The insurer faced persistent data quality issues that hindered their operations. Leveraging the power of Snowflake, Hexaware quickly identified and fixed these issues, resulting in an 80% improvement in data quality. This enhancement also led to a 20% increase in new business, showcasing the tangible benefits of their solutions.

Gen AI-Powered Process Enhancements

Client: Home & Personal Auto Insurance (US)

Hexaware revolutionized the test planning and execution processes for a home and personal auto insurance company in the US. By implementing Gen AI-powered enhancements, they achieved a tenfold increase in productivity. This transformation significantly boosted efficiency and showcased Hexaware’s ability to leverage advanced technologies for process improvements.

Client: Top Insurance Brokers

In the domain of customer data extraction, Hexaware assisted top insurance brokers in enhancing accuracy. The brokers initially struggled with maintaining high accuracy levels. Hexaware’s intervention increased accuracy from 95% to 98%, leading to a 50% boost in operational efficiency. This improvement not only optimized their processes but also enhanced overall performance.

Client: P&C Insurer

Hexaware’s claims extraction automation solution proved to be a game-changer for the P&C line of business. Our AI in claims management solution improved the claims handling experience by automating the extraction process, saving carriers from sifting through hundreds of pages of documents. This led to a significant reduction in processing time, making the claims process more efficient and user-friendly.

Client: Top Life & Annuities Broker

Hexaware’s automated solution for a top life and annuities broker addressed the challenge of manual effort in Q&A processes. By automating these processes, Hexaware reduced manual effort by over 50% and improved customer satisfaction scores by over 30%. This not only streamlined operations but also enhanced the overall customer experience.

Conclusion

The commercial insurance industry is at a tipping point. By embracing data and AI, organizations can move beyond inefficiencies to deliver unprecedented value to customers. However, this transformation requires not just technology, but also strategic vision, industry expertise, and a commitment to innovation. At Hexaware, we partner with organizations to turn vision into reality. With our deep expertise in data and AI, we empower businesses to lead in this new era. Are you ready to transform your organization? Contact us at marketing@hexaware.com to learn how Hexaware can help drive your journey.