This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Enterprise-wide Intelligent Automation is here, Are you ready?

Business Process Services

October 24, 2018

The world is moving fast, especially for insurers. Large multinational corporations, are further adding to the fast pace and are taken away by incessant mergers and acquisitions. Insurtech has grown rapidly and is posing to be a new threat to the traditional insurance business. With the explosion in digital data and the democratization of immense computing power, disruption is fast becoming the norm.

Most insurers have been around for a long time through. They have thrived in intense competition and are at home in an ever-changing industry landscape. There have been massive investments into technology; be it blockchain, cloud, enterprise-wide business process automation and machine learning across new business, policy administration, customer experience, and other business units. Yet many insurers report less than satisfying results, especially when it comes to intelligent automation. We wrote about this in the previous blog post, while imploring insurers to act now. In this installment, we will be dwelling on what we believe is essential for continued, beneficial adoption of automation.

The special something is the construct of a center of excellence (COE). Most organizations have multiple such centers, in areas as diverse as product pricing, marketing, and process excellence. It is a model that has been practiced efficiently by organizations and can comfortably delineate accountability across global operations, through tested and well-demarcated accountability constructs. Why shouldn’t the same apply to automation? Well, as part of our Survey with HfS on the state of adoption in insurance, we found that over 58% of customers had put in a COE in place and over 87% of these were satisfied or very satisfied with the ensuing benefits.

It is worth acknowledging the organizational sprawl that most modern corporates have become. Be it headquarters or a grouped organization, decentralized operating units, global shared services and captives. Each would want to drive transformation in their own areas. This exercise needs careful allocation of budgets, which are used for an all-rounded benefit, from building a seed team to implementation or even outsourcing. Global organizations would be familiar with issues of accountability and task duplication that crop up while driving new enterprise wide initiatives. No wonder centers of excellence have worked out so well. They offer a clear demarcation of specific duties and areas, while being empowered from the top to carry out their duties.

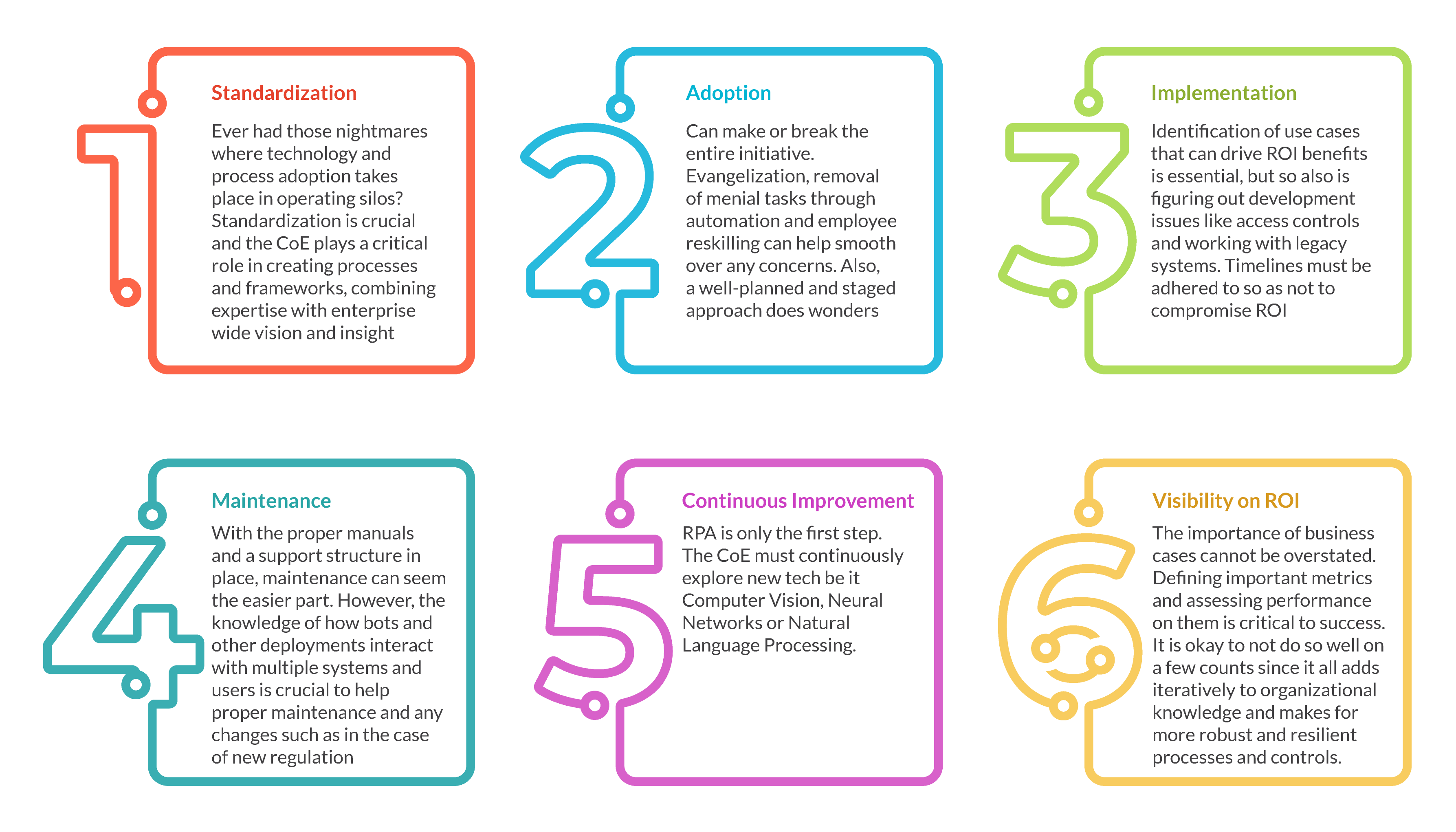

Some enterprise level benefits that we have seen with specific reference to CoEs in the automation and transformation space are enumerated below:

Our experience with a CoE setup:

We have seen these benefits firsthand while working with a major European Insurer, where we have helped drive automation adoption across enterprise operations. This was achieved by constant participation of stakeholders from business, IT, infrastructure providers and our automation experts. After initial efforts, there is now a scalable structure in place that has helped ease development time and faster adoption of automation. The journey has been a complex one with initial development on legacy systems and the subsequent migration to a new VDI infrastructure. We have 11+ bots live, with multiple more in development, iterating faster than ever due to a standardized methodology developed and refined over multiple iterations.

Investing in a CoE is just a beginning. Executive sponsorship and continuous evaluation of progress is critical to ensure transformational goals are met.

Our Approach:

The insurance industry today needs specific and targeted solutions more than ever, and Hexaware aims to provide just that with our Insurance solutions.

With our levers of process automation, process excellence and Machine Learning/AI, we excel at value creation for our customers by best in class service delivery underpinned by true transformation. Our insurance footprint ensured we were ranked as ‘High Performers’ by HfS in their Insurance as a Service’ report.

For over 20+ years, Hexaware has been working with life and annuity insurers, property and casualty insurers, providing them value, transforming their business processes through end-to-end solutions.

To understand more about Hexaware’s insurance solutions and RPA offerings, read our articles:

- Digital Operations for the Insurance Industry

For a leading insurer, Hexaware guaranteed optimization of operations TCO by 30-50 % from Day 1 with risk of implementation and performance of BOTs on us with 40+ pre-built BOTS (Chat, Voice, Data, Process, Cognitive) to reduce implementation time by 30% - The State of Automation in Insurance 2017

HfS Research with support from Hexaware interviewed Insurance leaders about current and future use of automation within their business operations.

Related Blogs

From Manual to Machine: Maximizing Cost Savings with Intelligent Process Automation

- Business Process Services

Achieving Cost Efficiency Through Global Business Services Strategy

- Business Process Services

Generative AI for Marketing: The Future of Cost-effective Engagement

- Generative AI

- Business Process Services

Unlocking Generative AI for Hyper-personalized Customer Experiences

- Generative AI

- Business Process Services

Executive Administration Services: BFSI’s Right-hand Partner

- Generative AI

- Business Process Services

Generative AI in Customer Service: Going Beyond Traditional Chatbots

- Generative AI

- Business Process Services

Generative AI for Content Creation: The Future of Content Ops

- Business Process Services

- Generative AI

Fund Services Back Office Digitalization: A Transformation Long Overdue?

- Business Process Services

Mastering Customer Service Experience: Strategies for Success

- Business Process Services

The Rise of Omnichannel Customer Service: Unlocking Excellence in Customer Care

- Business Process Services

Ready to Pursue Opportunity?

Every outcome starts with a conversation