This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

The great automation adventure for insurers: Separating the wheat from the chaff

Business Process Services

September 7, 2018

Unless you’ve missed catching up on any business news for the last five years or so, you’ve probably heard of automation. There are multiple innovative assorted variants of automation as well, such as robotic process automation, service delivery automation, machine learning, cognitive automation etc. Insurers have acted and acted decisively. The results though, have been a mixed bag. Some of the automation variants claim great success, others a moderate success and the rest claim extreme dissatisfaction.

Post conducting a study with HfS on the state of automation for insurers, we found only 42% were satisfied with the cost savings and 44% with the business value. What is it then? Are all those claims about Robotic Process Automation and Machine learning false? And what does this mean for insurers? We will try to address these questions through this blog post.

First, some background though, Insurers worldwide are coping with a barrage of changes to their operating environments. Some of the changes include regulation, born digital competition and the increasing power and ubiquity of data to cope with. And, most of their markets aren’t growing. Few industries can match insurance though, in the resiliency its players display.

So why is it that multiple insurers report no great benefits from deploying WorkFusion, Automation Anywhere and the other major platforms? Even as the others report great and scarcely believable results. Swap out these platforms with any new technology and it would still make sense. Adopting any new technology is hard. There are acute talent shortages, vendors with no incentive to automate and problems convincing internal stakeholders. And if you can get past all these, you still need to have a deeper understanding to figure which processes or business areas needs to be automated. The key thing to note here is that a lot of insurers who found it hard in the beginning, have not given up and are now starting to see the umpteen benefits that automated, agile operations can deliver.

To sum it up, the claims over the efficacy of these interventions are not false. The methods and organizational roadblocks used to deploy them contribute to the variability in results. As organizations grow more and more comfortable with this new landscape, they are starting to see the benefits on their investments. Enterprise wide adoption of automation is still a way off, though. There are hungry and agile competitors on the horizon, and disruption surrounds us.

Insurers must future proof their business processes at the earliest. This involves becoming a data driven enterprise that realigns itself from product silos into customer centric units that can exploit niche needs and get to market faster with new insurance products. Technology can help massively here, be it Cognitive OCR, Natural Language Processing and Generation or Machine Learning powered chat and voice bots.

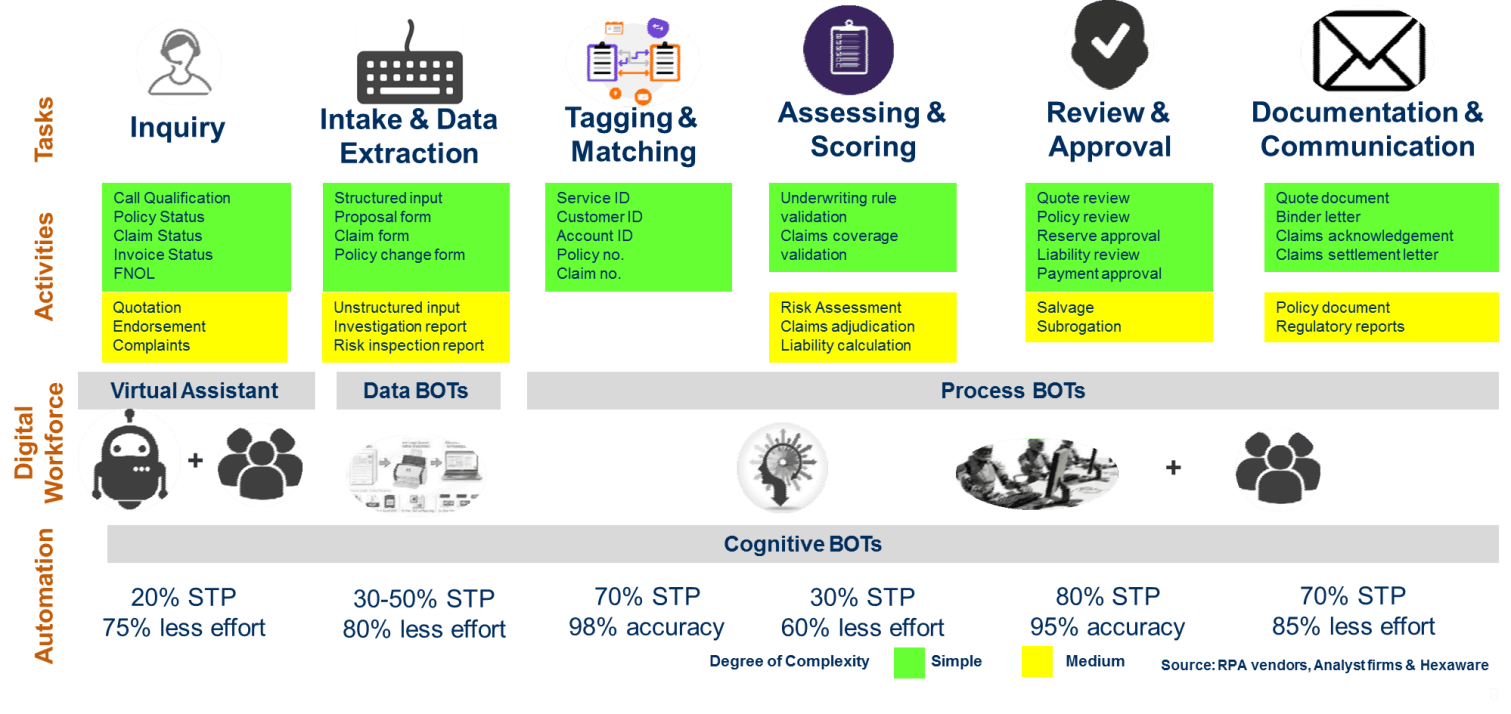

For example, the image below gives an example of how STP in new business can be improved significantly.

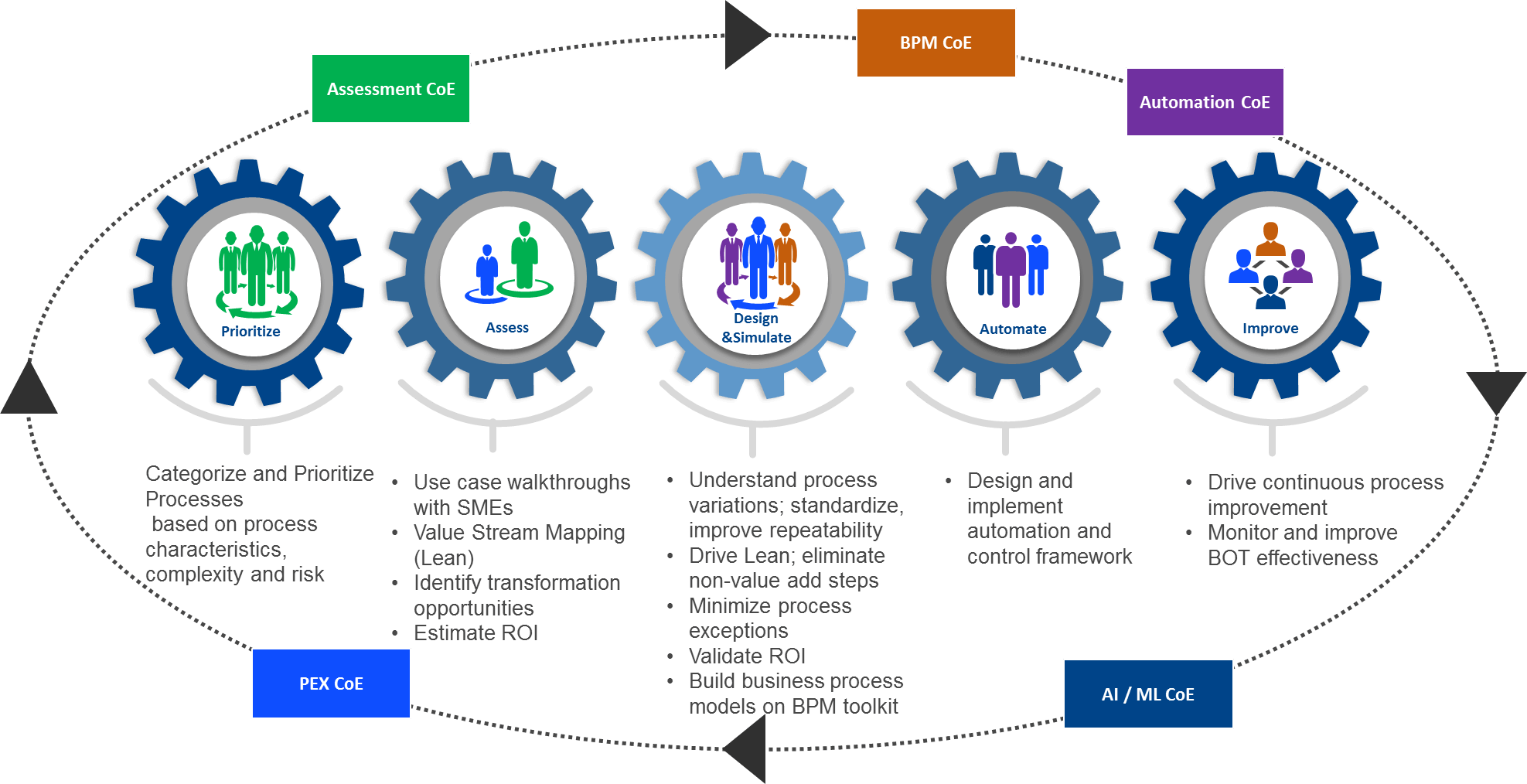

The key for insurers is to drive enterprise wide automation initiatives at a breakneck pace. The process must involve identifying the right workstreams through a consulting exercise and then prioritizing these for quick wins that can win over internal opposition. This opportunity must also be seized to make fragmented, disparate and global processes standardized such as to increase their attractiveness for automation. It is in this process, that the role of a strategic partner becomes more important than ever. Partners must work with insurers across the automation spectrum, while providing value additions such as predictive analytics and chatbots enabled customer interactions. Instead of creating the capabilities that enterprise wide automation needs, and all the time, effort and cost to create them, the modern insurer must demand more from his partners. A switch towards outcome-based pricing, higher straight through processing and digital transformation from traditional FTE based pricing is already happening, but not fast enough due to large legacy contracts and decades old relationships.

We’ve encountered much of this ourselves at Hexaware, and thanks to our considerable consulting and implementation expertise, we have been able to dislodge large incumbents from our accounts. The below graphic gives an idea of how we approach the transformation process for our customers, an iterative product of our vast experience with automation.

As a part of our focus on automation led operations, we have worked with multiple insurers. One of these stands out. A leading European insurer wanted to drive automation across their organization, and we were chosen as their strategic partner. Working with their experts, our consulting team identified, prioritized and proposed the transformation program. The in-scope processes were across both life and non-life for their retail business. We took over the operations in a right shore model, brought in standardization and process excellence best practices, while implementing robotic process automation. The end results? A 58% savings across the total cost of operations, along with improved accuracy and guaranteed cost benefits from the first day of the engagement, leveraging our Digital Managed Services model.

Some more automation success stories:

- Reduced over 50% FTEs for a high volume process, while achieving 30% savings over the engagement for a leading US benefits administrator

- Helped set up a Centre of Excellence, while delivering over 40% in savings through process automation for a European bank and insurer

The bottom line, literally in this case is that insurers need to act, and act now. Be it through their capabilities or through a partner. The key aspect is to not be deterred by some early failures but understand what went wrong and incorporate those learnings in successive reattempts. With standardization, process excellence and process automation, most insurers can begin to unlock the value of the massive amounts of data they possess and collect. Exciting, exciting times.

As Jonathan Taplin said, ‘Move fast and Break things’.

The insurance industry needs specific and targeted solutions more than ever, and Hexaware aims to provide just that with our solutions.

Author Bio: Archit, a Solutions architect helps in reimagining business processes in this era of automation led transformation for insurers. He possesses expertise across the insurance lifecycle, while also being comfortable with the major RPA tools and Machine Learning interventions.

Related Blogs

From Manual to Machine: Maximizing Cost Savings with Intelligent Process Automation

- Business Process Services

Achieving Cost Efficiency Through Global Business Services Strategy

- Business Process Services

Generative AI for Marketing: The Future of Cost-effective Engagement

- Generative AI

- Business Process Services

Unlocking Generative AI for Hyper-personalized Customer Experiences

- Generative AI

- Business Process Services

Executive Administration Services: BFSI’s Right-hand Partner

- Generative AI

- Business Process Services

Generative AI in Customer Service: Going Beyond Traditional Chatbots

- Generative AI

- Business Process Services

Generative AI for Content Creation: The Future of Content Ops

- Business Process Services

- Generative AI

Fund Services Back Office Digitalization: A Transformation Long Overdue?

- Business Process Services

Mastering Customer Service Experience: Strategies for Success

- Business Process Services

The Rise of Omnichannel Customer Service: Unlocking Excellence in Customer Care

- Business Process Services

Ready to Pursue Opportunity?

Every outcome starts with a conversation