For decades, the insurance model barely moved: policies were pushed through agents, brokers, and branches. The burden was on customers to seek out insurance, not the other way around.

Now, insurance is showing up where people already are. On e-commerce sites. Inside travel bookings. Embedded in car dashboards. Bundled with subscriptions. Invisible until you need it, but always within reach.

This is Embedded Insurance (EI). And it’s not just another distribution trend. It’s a fundamental rewiring of how protection is designed, delivered, and consumed.

The Scale of the Shift in the Embedded Insurance Market

Deloitte forecasts embedded insurance to become a dominant force in distribution. By 2030, the market could generate $700 billion in gross written premium—16% of the global total, up from just 3–4% today. For P&C carriers, penetration may climb to 20%, signaling not just growth but a fundamental reshaping of how insurance is bought and sold. But the story isn’t only about numbers. It’s about what those numbers signal:

- Customers no longer see insurance as something separate. They expect it to be built into the digital experiences they already use.

- Digital platforms are becoming the new distribution battlegrounds. Platforms like Amazon, Uber, or Apple don’t just move products—they set customer expectations across industries.

- The winners in embedded insurance won’t be those who simply “plug in.” They’ll be those who rethink underwriting, claims, and servicing for speed, context, and personalization.

In short: embedded insurance isn’t an add-on. It’s a new operating model.

What Is Embedded Insurance?

Embedded insurance is coverage that’s built directly into the products, services, or digital platforms people already use—delivered at the point of need, often with little or no extra effort from the customer.

Too often, people think of EI as “adding an insurance button at checkout.” That’s the shallow end of the pool. The real opportunity is much deeper.

Think of it this way: insurance has always been about trust and timing. Do I trust this policy will protect me? And am I buying it at the right moment? Embedded insurance solutions collapse those questions into the flow of a digital customer experience.

When you buy a plane ticket and see trip protection right there, the timing is perfect. When PayPal auto-covers fraud, trust is reinforced by default. When Tesla includes insurance in its vehicle package, convenience and loyalty lock in together.

These embedded insurance examples show how EI changes the very perception of insurance—from a chore to a natural, even valued, part of everyday life.

Different Models for Different Moments

Embedded insurance comes in several forms, each with unique implications:

- Passive: Automatic coverage built into a product or service, like PayPal’s fraud protection. Frictionless, invisible, and powerful for building trust.

- Opt-in: Coverage offered at checkout, like airlines adding trip cancellation. Simple but dependent on timing and UX.

- Bundled: Protection packaged with a product, like Tesla offering roadside assistance and battery coverage. Great for loyalty and upsell.

- Usage-based: Coverage that turns on only when used, like scooter companies insuring riders per trip. Flexible and highly contextual.

The point is, there’s no single “right” model. The best fit depends on context, customer expectations, and the value exchange between insurer, platform, and end user.

The Real Challenge: Readiness

Most insurers aren’t structurally ready for embedded insurance. They’re still wired for traditional channels—slow onboarding, rigid underwriting, complex claims, siloed systems. Plugging those into a digital platform isn’t going to cut it.

Success in EI demands new capabilities:

- High-speed APIs to integrate with partner ecosystems.

- Real-time risk engines to price policies instantly.

- Frictionless payments and documents so customers aren’t buried in paperwork.

- AI-driven claims that resolve in hours, not weeks.

- Privacy-first architecture so data sharing builds trust, not fear.

This isn’t just a technology challenge. It’s an Insurtech innovations challenge. Insurers need to rethink how they design, underwrite, and service products when distribution is no longer in their control.

Platforms as the New Gatekeepers

Here’s the uncomfortable truth: insurers aren’t the main brand in embedded insurance. Platforms are.

Customers book through Expedia, shop on Amazon, ride with Uber, or stream on Netflix. If insurance is embedded, the platform controls the relationship. The insurer becomes invisible.

That creates both risk and opportunity:

- Risk: If you’re just the backend risk carrier, your brand may never be seen.

- Opportunity: Platforms reach millions of customers instantly, and they want trusted embedded insurance platforms that can plug in.

The strategic choice is whether to play as a white-label enabler, co-brand for visibility, or build your own ecosystem partnerships. Each requires a different balance of control, margin, and growth.

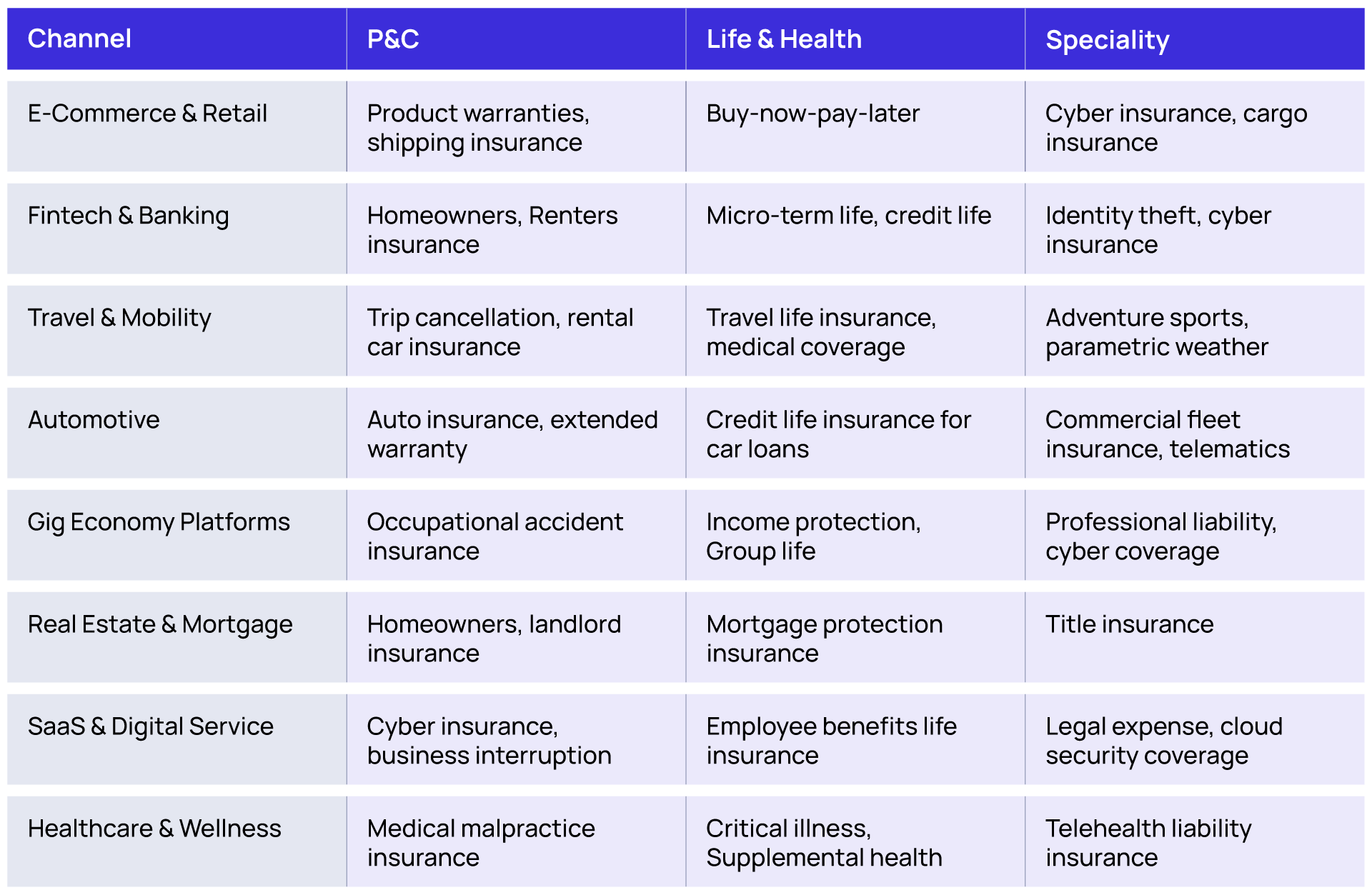

Hexaware’s Take: A Framework for Clarity

At Hexaware, we see many insurers struggling with the same questions: Where do we start? Which partnerships make sense? How do we prioritize opportunities?

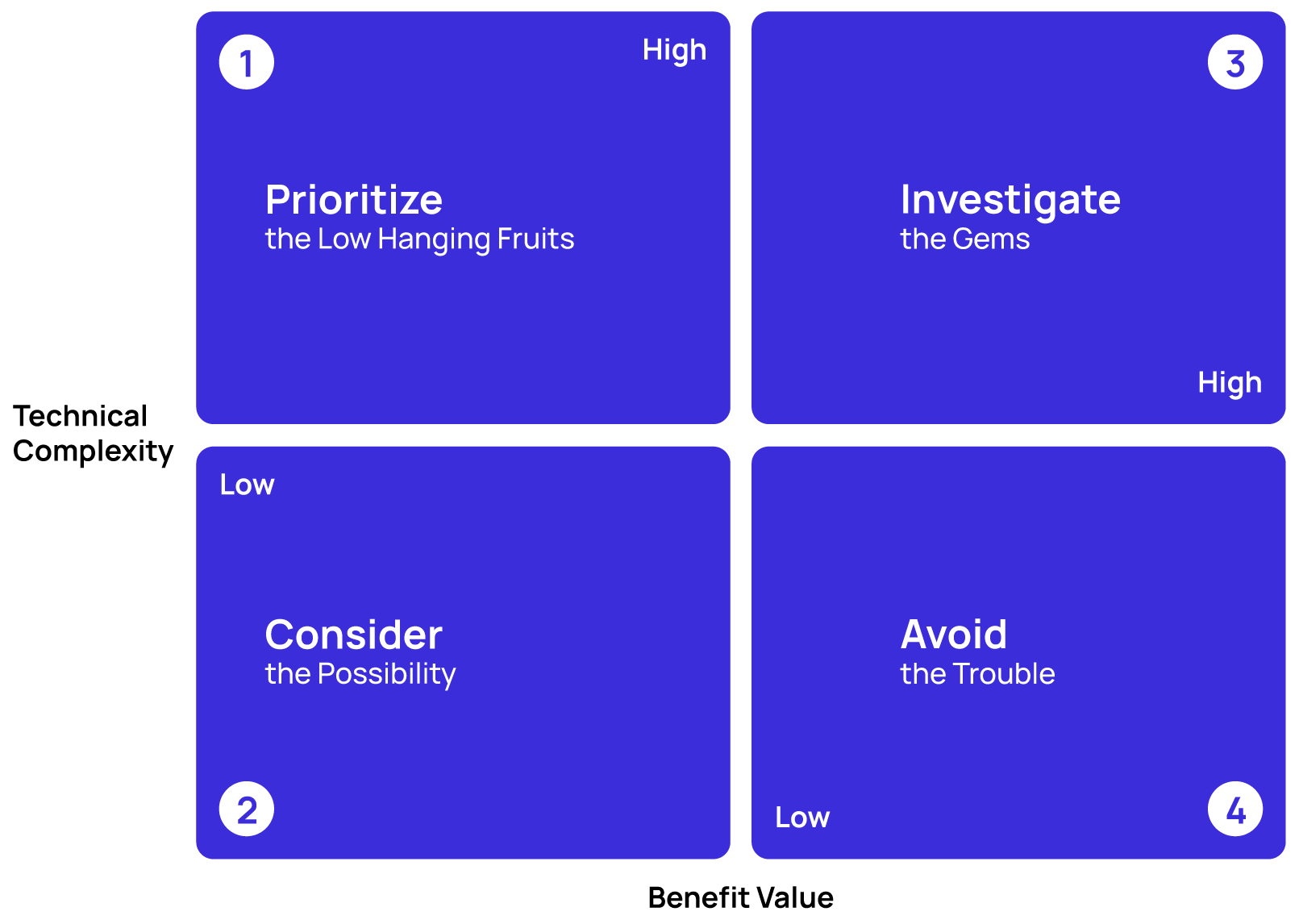

That’s why we built our Embedded Insurance Product-Channel Prioritization Matrix.

It evaluates opportunities across five dimensions:

- Industry fit

- Customer demand and behavior

- Integration feasibility

- Revenue potential

- Regulatory compliance

Then it maps them into four quadrants—prioritize, consider, investigate, avoid.

Here’s a sample outcome:

- Auto insurance + Automotive → Prioritize.

- BNPL Life + E-commerce → Consider.

- Pet Insurance + Retail → Investigate.

- Parametric Weather → Avoid.

This structured approach helps insurers cut through hype, focus resources, and build real momentum in embedded insurance opportunities.

From Strategy to Execution

Even with clarity, execution isn’t simple. That’s why our EI Transformation Framework guides clients through three phases:

- Business Feasibility: Analyze market opportunities, align with regulatory needs, identify partners, and design revenue models.

- Technology Readiness: Assess core systems, evaluate APIs and middleware, test automation capabilities, and lock down data security.

- Implementation Roadmap: Build a phased rollout—quick wins for credibility, long-term milestones for scale, and a custom embedded insurance

It’s not about theory. It’s about helping insurers move from idea to live deployment, fast.

The Future Isn’t About Products. It’s About Experiences.

The most powerful aspect of embedded insurance is that it flips the script. It’s not about selling standalone policies anymore. It’s about delivering digital insurance as part of the experience.

Customers don’t wake up wanting insurance. They want to travel without worry, ride without risk, shop with confidence, and protect what matters. Embedded insurance makes that seamless.

That’s why it’s more than a distribution play. It’s a chance for insurers to reimagine relevance. To stop pushing products and start delivering peace of mind, right when it’s needed most.

Closing Thought

Embedded insurance benefits extend beyond growth. It deepens trust, strengthens loyalty, and redefines customer value. The only question is how quickly insurers can adapt.

Those who act now will secure partnerships, scale fast, and reshape the insurance market. Those who hesitate will watch platforms define the rules without them.

The time to move is now.

Are you ready to take your place in the embedded ecosystem? Let’s build it—together.

Explore Hexaware’s Insurance Solutions

Contact us today to start the conversation.