Did you know that insurers with optimized expense ratios save millions annually, allowing them to reinvest in innovation and customer experience?

In insurance, effective insurance cost management hinges on balancing risk, operational efficiency and customer satisfaction, making the expense ratio a pivotal metric.

In this post, we’ll clarify exactly what an expense ratio is—and show why expense ratio optimization goes far beyond finance. By tightening this metric, insurers unlock operational excellence, improving customer experience and build lasting profitability.

Let’s dive into:

- The key challenges insurers face—and how a targeted approach to expense-ratio control helps overcome them

- Proven strategies to streamline operations, delight policyholders and secure a sustainable future

Challenges in the Insurance Industry

The insurance industry is navigating an increasingly challenging and dynamic business environment. Insurers are grappling with a perfect storm of pressures that threaten to erode profitability and competitiveness.

Persistently low-interest rates are squeezing investment income, while heightened competition and growing customer cost-consciousness are forcing insurers to rethink their pricing strategies. These factors are compounded by the high costs of operations, business complexity, and reliance on legacy systems, all of which are straining profit margins.

What is Expense Ratio in Insurance?

Expense ratio in insurance is defined as the ratio of operational and administrative costs to the premiums earned. It provides a clear and actionable lens through which insurers can evaluate their cost structures. Unlike broad-brush metrics like the combined ratio, which aggregates both claims and operational costs, the expense ratio focuses exclusively on areas that insurers can directly control. This makes it a far more precise and impactful tool for driving sustainable profitability.

The expense ratio serves as a barometer of an insurer’s operational efficiency. While the loss ratio (claims paid relative to premiums) is often influenced by external factors such as natural disasters or market volatility, the expense ratio reflects the insurer’s ability to manage its internal processes and costs effectively. This controllability makes it a powerful lever for insurers seeking to optimize their operations and improve their bottom line.

In today’s insurance landscape, traditional approaches to insurance cost management are no longer sufficient. Insurers must look within and focus on what’s in their control—operational efficiency and cost structure. And that’s exactly where expense ratio optimization emerges as a critical strategy. By targeting and reducing operational and administrative costs, insurers not only safeguard their profitability but also position themselves for sustainable growth in an increasingly competitive market.

Why Expense Ratio Optimization Matters?

In today’s competitive insurance landscape, the expense ratio is a reflection of an insurer’s ability to operate efficiently, adapt to market demands, and deliver value to policyholders. By prioritizing expense ratio optimization, insurers can unlock sustainable profitability and position themselves as leaders in a rapidly evolving industry. Here’s why expense ratio matters:

- Direct Control: Unlike claims-related costs, which are subject to external risks, operational expenses are entirely within an insurer’s control. This makes the expense ratio a more actionable insurance profitability metric for driving efficiency and cost savings.

- Sustainable Impact: Optimizing the expense ratio delivers long-term benefits by addressing structural inefficiencies, unlike short-term fixes that may only temporarily improve the Combined Ratio.

- Competitive Advantage: Insurers with lower expense ratios can offer more competitive pricing, attract cost-conscious customers, and reinvest savings into innovation and customer-centric initiatives.

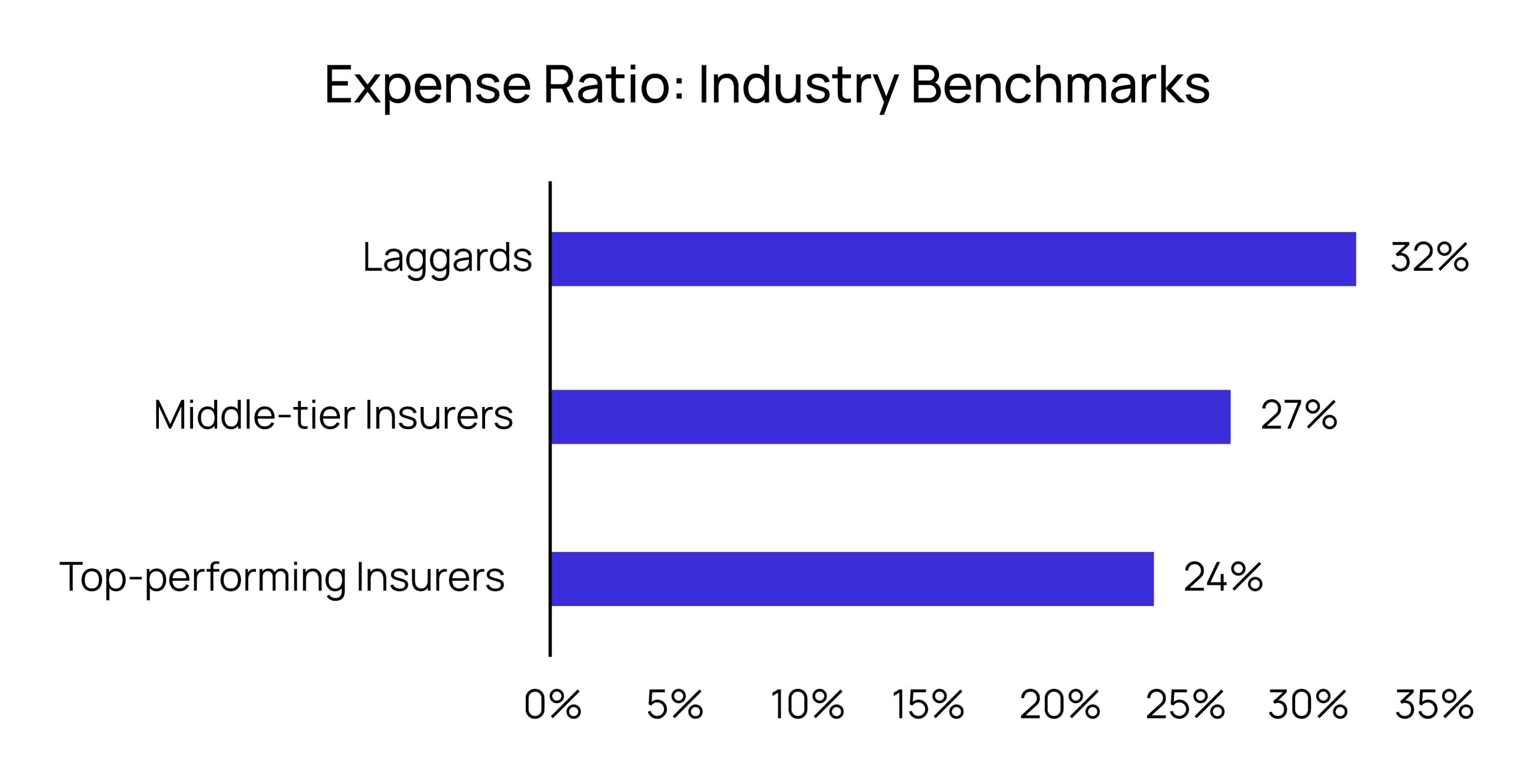

Industry Benchmarks: Where Do Insurers Stand?

To understand the significance of expense ratio optimization, consider the stark differences between industry benchmarks (a PwC study):

- Top-Performing Insurers: Average expense ratio of 24%.

- Middle-Tier Insurers: Average expense ratio of 27%.

- Laggards: Average expense ratio of 32%.

The gap of up to 8 percentage points between top performers and laggards results in millions of dollars lost to operational inefficiencies. For example, consider a mid-sized insurer with $1 billion in premiums. If this laggard incurs $320 million in operational costs, it contrasts sharply with a top-performing insurer in the same category, which manages to keep its operational costs at $240 million. This $80 million disparity is not merely a cost; it represents a significant opportunity for reinvestment in technology, customer experience, and growth initiatives.

Calculate Your Expense Ratio

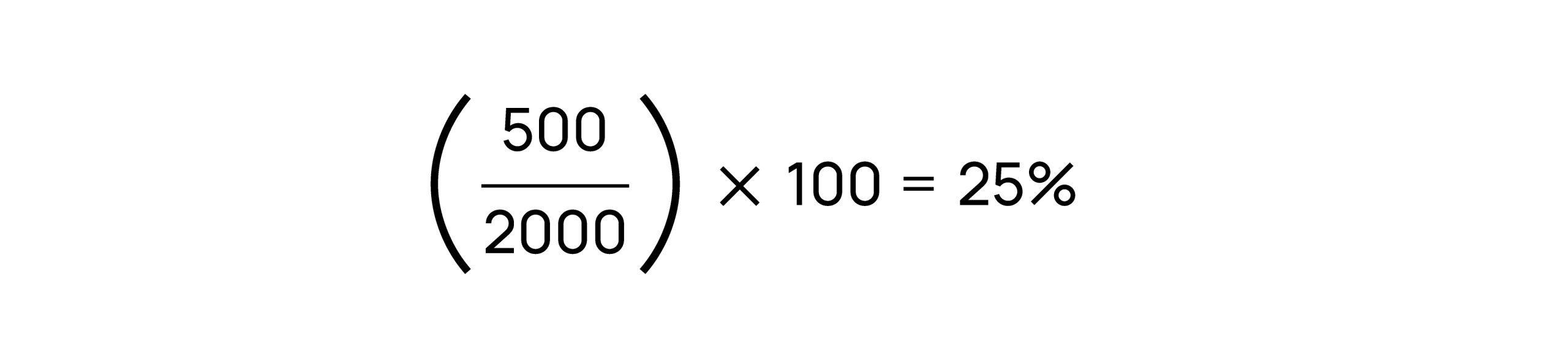

The formula for calculating the expense ratio is as follows:

Where:

Underwriting Expenses = Administrative costs, marketing, technology costs, commissions paid to agents, and other operational expenses.

Net Premiums Earned = The total premiums collected by the insurer after adjusting for policy cancellations and refunds.

For example, if an insurance company has underwriting expenses of $500 million and net premiums earned of $2 billion, the expense ratio would be:

What it means is that for every $1 in net premium earned, the company spends $0.25 in operational expenses.

Key Strategies for Expense Ratio Optimization

In the insurance industry, where operational efficiency and insurance cost management are paramount, optimizing the expense ratio is a critical strategy for achieving sustainable profitability. By focusing on specific, actionable areas, insurers can streamline their operations, reduce costs, and enhance customer satisfaction. Following are the key areas for expense ratio optimization, along with sustainable insurance practices to drive impactful results:

Operational Efficiency

Operational efficiency lies at the heart of expense ratio optimization. Insurers can achieve significant cost savings by simplifying and standardizing their processes and workflows.

- Streamlining Processes and Workflows: Simplifying complex workflows and eliminating redundancies can significantly reduce operational costs. For instance, automating routine tasks such as policy renewals and claims processing not only saves time but also frees up valuable resources for more strategic activities.

- Automating Routine Tasks: Technologies like automation and Agentic AI can handle repetitive & self-intuitive tasks with speed and accuracy. For example, automation can streamline claims intake, document verification, and policy issuance, reducing manual errors and processing times.

Technology Adoption

The adoption of advanced technologies is transforming the insurance landscape, offering new opportunities to enhance efficiency and transparency.

- Artificial Intelligence (AI) and Machine Learning: AI in insurance can automate complex tasks, provide predictive insights, and optimize decision-making processes. For example, AI can be used to predict claim likelihoods, assess underwriting risks, and identify operational bottlenecks. Read how Generative AI is transforming the insurance value chain

- Blockchain for Transparency: Blockchain technology offers a secure and immutable record of transactions, reducing the risk of fraud and enhancing trust among stakeholders. It also streamlines processes such as policy issuance and claims management.

Administrative Cost Reduction

Administrative costs often account for a significant portion of an insurer’s expense ratio. Transitioning to digital platforms and reducing reliance on legacy systems are effective ways to cut these costs.

- Digital Transformation: Moving from paper-based processes to digital platforms not only reduces administrative expenses but also improves operational speed and accuracy. For example, customer portals and mobile apps can streamline policy management and claims submissions, reducing the need for extensive back-office support.

- Legacy System Modernization: Archaic systems are a major cost driver for insurers. By investing in modern, cloud-based platforms, insurers can improve system efficiency, reduce maintenance costs, and enable seamless integration with new technologies.

Fraud Prevention

Fraudulent claims are a significant drain on an insurer’s resources, inflating both claims-related costs and administrative expenses. Advanced fraud detection methods can help mitigate this issue.

- Leveraging Advanced Fraud Detection: Machine learning algorithms and predictive analytics can identify patterns of fraudulent behavior, enabling insurers to flag suspicious claims before they are processed. This not only reduces unnecessary payouts but also streamlines claims management.

- Proactive Fraud Prevention: Implementing fraud prevention measures, such as blockchain for secure transactions and AI for anomaly detection, can significantly reduce the frequency and impact of fraudulent claims. Fraud detection technologies have been shown to reduce fraudulent claims by 15% to 25% annually, according to insurers implementing AI-based fraud detection models. These reductions have resulted in significant cost savings, ranging from $1 million to $3 million annually.

Expense Ratio Optimization is a Win-Win for Insurers and Policyholders

The insurance industry is at a crucial point where optimizing the expense ratio is no longer a choice but a necessity. As insurers face mounting pressures from low-interest rates, heightened competition, and increasingly cost-conscious customers, adopting targeted cost optimization strategies for expense ratio is crucial to remain competitive and achieve sustainable profitability.

From process automation that reduces claims handling costs to digital transformation efforts that slash administrative expenses, the benefits of expense ratio optimization are both measurable and transformative. Insurers leveraging data analytics for underwriting and risk assessment are reducing inefficiencies, while those evaluating their operating models are prioritizing high-ROI initiatives to ensure effective resource allocation.

For insurers, expense ratio optimization means improved profitability, reduced operational expenses, and enhanced agility to respond to market changes. For policyholders, it translates into more affordable premiums, better service quality, and access to innovative and personalized insurance products. This win-win scenario underscores the importance of embracing cost optimization as a strategic imperative.

Expense ratio optimization is more than a financial strategy—it is a foundation for operational excellence and industry leadership. Insurers must prioritize automation, digital transformation, and fraud prevention to unlock their full potential.

Ready to unlock the full potential of expense ratio optimization? Check out our Insurance Services page or reach out to marketing@hexaware.com today to explore innovative solutions tailored to your needs.