Since 2003, regulation has been one of the primary drivers for change in the AML (Anti-Money Laundering) and the KYC operations landscape. While the first five years have focused heavily on identification/disclosure of the sources of funds and cash flow movement, the overall requirements evolved manifold in 2010-11.

Banks and financial institutions have since invested heavily on the underlying technology to process KYC requirements efficiently. Although, over the last seven years; with increasing AML and sanctions compliance requirements, most banks and financial institutions [commonly referred to as Banks] have opted to invest more in a people-centric strategy. One of the main reasons for this change has been banks’ IT platform upgrade schedules, running for as long as three years. We need to question, what is at stake for a delayed IT upgrade and the resulting inefficient AML / KYC operations? Banks of big or small repute have suffered dearly, with the closure of specific branches and regulatory penalties ranging as high as $12bn.

While most heads of businesses have been encouraged to do more with less, in this age of cut-throat competition, increasing regulatory pressure has forced most players to double the team strength in their AML and KYC programs. A Thompson Reuters report (Thomson Reuters, 2017 Global KYC Surveys) suggests that an average KYC operations team at banks and financial institutions with >$10bn revenue, today have well over 300 processors in-house. The report highlights many alarming statistics on the state of KYC operations, gathered through interviews across 1,000+ key decision makers; each from financial institutions and corporates consuming services from the industry.

Below are some of the critical concerns that have made banks change or evaluate the change in their KYC operations:

- Regulations

- Evolving set of regulations and guidelines established by the AML / CFT, FINRA, FSA, FATF, and FinCEN among others

- Penalties

- $12bn+ in fines, penalties, and forfeitures for violations of the rules of BSA / AML, U.S. sanctions, OFAC, and FCPA since 2009

- Cost Escalation

- $150mn+ – Average spend on KYC related operations (for FIs larger than $10 billion in revenue)

- Lower C-Sat Scores

- 12% of corporate clients have changed their banks owing to KYC issues

- Banks reach out to the corporates approximately eight times during the onboarding process

- Banks have identified the following key challenges in managing KYC operations:

- 34% banks highlight lack of skilled resources availability onshore

- The complexity and increasing number of regional regulations demand KYC operations keep growing in their level of scrutiny, having higher operations learning curve for each new regulation change and have resulted in y-o-y 8% increase in time to review KYC and onboard customers

- Only 18% banks are able to proactively refresh KYC on an event trigger, owing to capacity constraints

Owing to the above challenges, banks have significantly tightened their scrutiny norms to onboard customers. As a result, many high-risk category entities have had poor customer experience, which has translated in loss of business and reputation for many players in the industry.

Adding more people is not the solution to meeting your KYC requirements.

Based on the empirical research, our interactions with customers and experience, we understand that adding people is not the solution to address present-day concerns around managing KYC operations. This is evident when banks have to perform remediation projects, due to regulatory changes in a region. KYC teams are severely crunched in bandwidth to complete the onboarding and ongoing renewals.

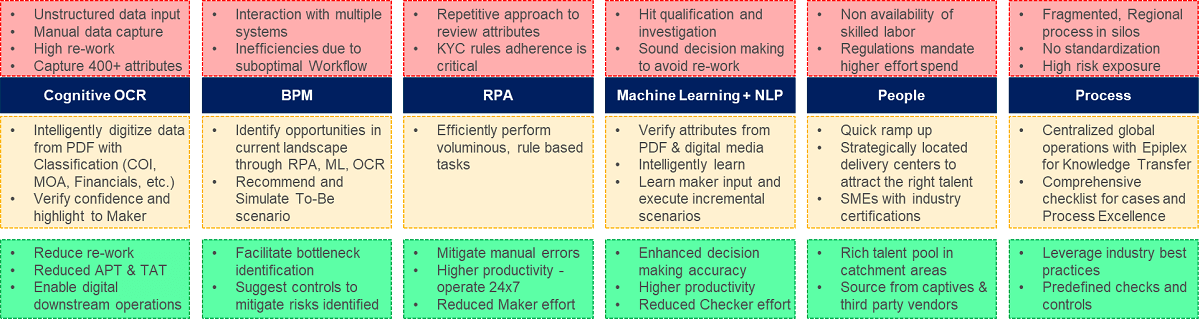

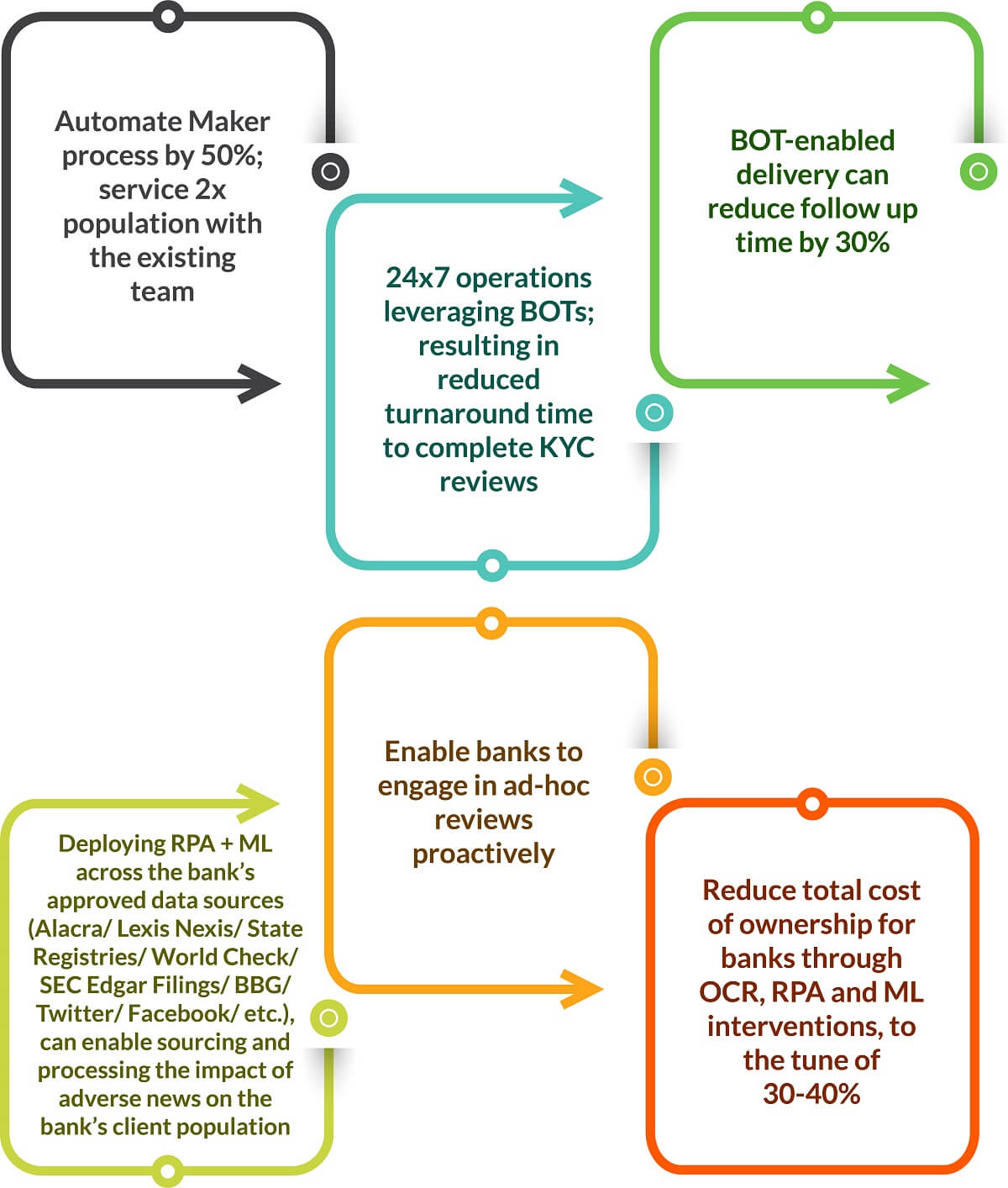

The two ways to overcome this situation are either through CapEx in upgrading the underlying KYC / AML platform or to invest in a non-invasive layer of the digital workforce, enabled with OCR, RPA and Artificial Intelligence / Machine Learning (AI/ML). While banks have evaluated use cases for AI/ML and RPA, many have not seen true value for their buck, owing to the assessment of technologies in isolation.

We at Hexaware BPS have identified this problem and are in constant conversation with players across capital markets and banking to educate and implement solutions, which are: a) focused on operational excellence, through elimination of non-value adds upfront and deployment of experienced KYC personnel offshore b) digitization of the processor landscape, leveraging the abovementioned automation levers, rendering continuous improvement.

An optimized target state is achieved when the underlying OCR feeds into the ML analytics engine, to churn higher capture rate and accuracy, from the entity’s documentation. Post this, RPA will input these details onto the workflow tool (in the absence of an ETL layer), perform a search on the bank’s approved list of data sources. The ML engine will analyze details from documents and information fetched from the banks’ approved data sources to

- Give a risk classification to the entity

- Analyze the 300+ pager reports from data providers

- Identify and flag any adverse news, PEP and OFAC hits for the body and its Beneficial Ownership

- Have it all ready for the Checker to review and signoff

- RPA will then archive the evidence and send triggers to Relationship Managers / Onboarding / Legal & Compliance for their review and signoff

Figure 1: Levers to Transform your KYC Landscape

Below are the key benefits that KYC operation units can quickly imbibe, should they decide to embrace automation:

Our Approach

Hexaware partners with banks and financial institutions to enter into engagements as a challenger to their incumbent operating model and aggressively automate operations leveraging the levers mentioned above. Moreover, the results of transformation are guaranteed to our customers in a Digital Managed Services engagement model. This strategy has been successful primarily due to the complacent incumbents who lack the drive to transform the operations and IT landscape at the back of their legacy contract commitments.

Visit our Banking and Financial Services and RPA pages to know more about Hexaware’s offerings and approach. Visit our pages below for more information on automation across Banking and Capital Markets:

- Automation in Banking & Financial Services: BFS firms need to rapidly transform their business to address the industry disruptions through new entrants and advent of digital technologies. Read how Hexaware implements Robotic Process Automation for the Global Banking and Financial Services industry.

- Automation in Capital Markets Operations: Hexaware has helped the leading capital markets companies in different domains with RPA and ML delivering 45% automation in services with 47% savings in TCO for a leading global Bank.