Whether you are a custodian or a fund manager thinking of fund transition, all the hassles and perceived risks of migrating portfolios from in-house asset manager operations or existing custodians / fund administrators take centerstage in your mind.

In the last few years, the industry has seen increasing consolidation among asset managers, custodians and fund administrators, resulting in an increased frequency of fund transition, often having to support multiple migrations simultaneously.

Here’s something interesting:

- Historically, Fund Transitions were treated as a one-off project resulting in limited automation and the absence of a specialist transition team

- This approach led to delays in setting up project teams and getting the right tools for each migration

- Most of the data is managed on spreadsheets/ EUC-based automation

- More than 50% of transitions experience delays and have resulted in 6 to 12 months of revenue loss for custodians

- Asset managers are looking to consolidate “Front to Back” services with a single service provider

How can Hexaware aid you in achieving your Fund Transition goals?

Hexaware has supported some of the top Global Custodians and Asset Managers as a specialist Fund Transition service provider.

- Experience in managing 200+ Fund Onboarding projects across the value chain

- We bring forth the right mix of people, strategy and agility to fast-track complex transitions

- Expertise across Front to Back Office transitions in developed as well as emerging markets

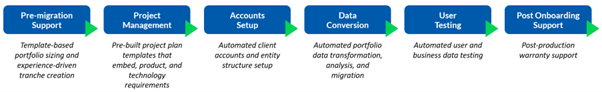

- Backed by our modular services and accelerators across various stages of the transition

- Deploying new-age tools to automate the validation and reconciliation of data sets with millions of records

Hexaware’s specialized services are designed to assist businesses in efficiently managing various stages of the fund transition lifecycle.

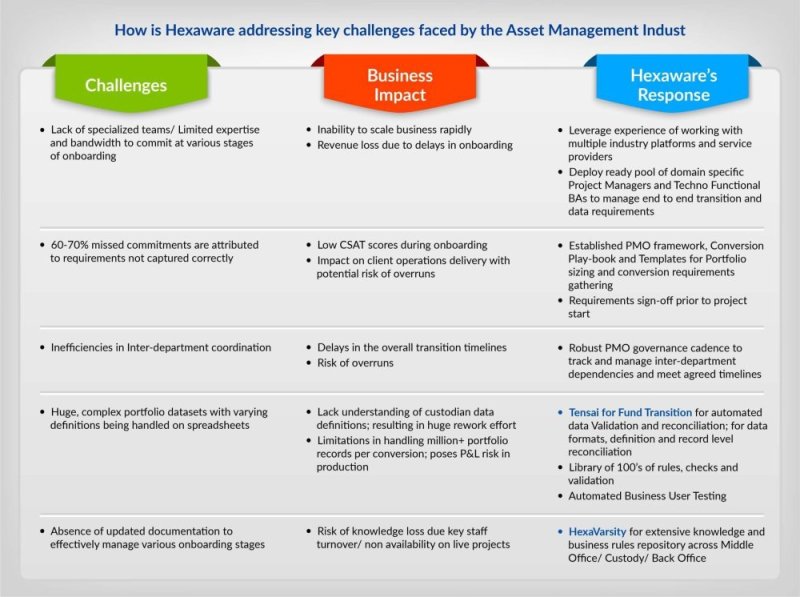

Hexaware addresses some of the key challenges faced by the industry:

Hexaware’s Tensai® framework helps embed intelligent automation across various Fund Transition value chain processes.

Our intelligent solution leverages a low code – no code platform to provide data automation capabilities and ease of data ingestion, transformation, and process digitization.

Key Features

- An integrated Workflow: End-to-end transformation of the process for data ingestion, validation, reconciliation and enterprise application integration and client outreach

- Enhanced Configurability: A fully customizable and configuration-based setup that can convert data provided into the required format

- Exhaustive Rules Library: Library of 400+ rules to automate data validation and reconciliation for data formats, definition and records

- Superior Audit trail & MI: 100% transparency of actions, on-demand reports and dashboard with real-time status updates on o/s issues in the legacy data

- Efficient Operational Controls: Defined user-level access and controls to arrest manual errors / omissions

Click here to know more on automation in the the fund conversion data validation and reconciliation process.