What are Stablecoins?

A stablecoin is a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, such as a fiat currency (e.g., the US Dollar), a commodity (e.g., gold), or even another cryptocurrency. The primary goal of stablecoins is to reduce the price volatility often associated with traditional cryptocurrencies like Bitcoin or Ethereum, making them a more suitable digital currency for everyday transactions, trading, and as a store of value.

According to Bitwise’s 10 Crypto Predictions for 2025, stablecoin assets will likely increase by 2x, reaching $400 billion as the US passes stablecoin regulations. Data as of August 1, 2025, taken from CoinGecko, shows that Tether’s USDT and Circle’s USDC have the largest market shares with market capitalization of $164 billion (61%) and $64 billion (24%), respectively. Looking further into the future, a US Treasury Department presentation, citing a Standard Chartered report, notes that the market cap for stablecoins is estimated to reach $2 trillion by 2028.

Stablecoin Regulations: GENIUS Act and MiCA Regulation

The recently passed GENIUS Act in the US and MiCA Regulation in the EU provide a structured regulatory framework for the adoption of stablecoins. The following are key aspects of the respective stablecoin regulations:

GENIUS Act

- The US Senate passed the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act) in June 2025, which provides a comprehensive federal framework for stablecoin issuance, regulation, and oversight.

- Permitted Issuers: Stablecoin issuance is limited to federally insured banks/credit unions, federally licensed nonbank entities (via the Office of the Comptroller of the Currency), and state-supervised issuers under a $10 billion cap.

- Reserve Requirements: Must be fully backed 1:1 with US dollars, short-term treasuries, or other high-quality, liquid assets.

- Transparency: Monthly public disclosures of reserve composition and valuation are mandatory, along with annual independent audits.

- Regulatory Oversight:

- Federal oversight of non-bank issuers by the OCC

- Existing bank supervision continues unchanged for banks

- Dual oversight and limited federal preemption for state-chartered issuers

- Consumer Protection: Rules prohibit false representations, require standardized user disclosures, and empower federal agencies to regulate marketing.

- Compliance: Issuers must register with the Financial Crimes Enforcement Network (FinCEN) and comply with the Bank Secrecy Act, anti-money laundering (AML) regulations, and sanctions controls. Federal agencies can issue further compliance guidance as needed.

MiCA Regulation

- The Markets in Crypto-Assets Regulation (MiCA Regulation) became effective for financial institutions in the EU from December 30, 2024. MiCA harmonizes crypto regulation across the EU, creating legal clarity for digital assets and crypto businesses.

- Consumer Protection: Includes mandatory risk disclosures, strict advertising standards, protections against market manipulation, and formal complaint resolution channels.

- Operational Requirements: Stablecoin issuers must provide white-papers covering the structure and risks of their coins. Ongoing requirements include capital adequacy, cybersecurity, and regulatory reporting.

- Stablecoin Oversight: Includes mandated reserve and backing requirements, regular audits, transparency reports, and usage limits to protect financial stability.

- Compliance and Business Impact: Businesses must register with EU authorities, set up risk management systems, and implement know your customer (KYC)/AML programs as part of their operations. This requires significant updates to the business and compliance infrastructure for participants.

Also read: KYC Process in Wealth Management: Digitalization Benefits

Stablecoin compliance is now a central focus, with regulations emphasizing strong reserve backing, transparency, strict supervision, and compliance principles. As a result, industry participants are being pushed to invest in robust risk management and reporting infrastructure.

Enterprise Stablecoin Solutions

Stablecoin Benefits

- Price Stability: Stablecoins significantly mitigate volatility compared to other cryptocurrencies, which can experience drastic price swings. By maintaining consistent value, stablecoins act as a reliable store of value and medium of exchange for businesses.

- Faster Execution of Transactions: Stablecoin transactions are typically settled in minutes or seconds, unlike traditional bank transfers that can take days, especially for international payments. Stablecoin payment solutions, hence, are ideal for time-sensitive transactions, as they allow for real-time payments, improve cash flow management, and enable quicker reinvestment of funds.

- Enhanced Liquidity: Businesses benefit from immediate access to funds, supporting smoother operations.

- Lower Transaction Costs: Stablecoins enable direct transactions between parties, thereby reducing the number of intermediaries involved in executing a transaction. This reduces costs and transaction times.

- Transparency and Traceability: All stablecoin transactions can be recorded on a public blockchain, providing auditable, transparent records that simplify compliance, reconciliation, and fraud detection for businesses.

Challenges in Stablecoin Adoption

- Regulatory Uncertainty and Oversight: The regulatory landscape for stablecoins is still evolving and lacks global consistency. Different jurisdictions have varying approaches, creating confusion for businesses and hindering widespread stablecoin adoption. To address this, greater international coordination and clear, principles-based regulatory frameworks are needed. Collaboration among regulators, industry participants, and policymakers can help establish consistent standards for licensing, reserve management, and consumer protection.

- Technical Limitations: The need for robust and secure infrastructure, including seamless on- and off-ramps, digital wallets, and custody solutions, is crucial but still developing. Integrating stablecoins into existing financial systems requires specialized expertise in blockchain Investment in interoperable technology standards, stronger cybersecurity practices, and public–private partnerships can help build reliable infrastructure and support wider integration into payment networks.

- Fragmented Ecosystem and Interoperability Issues: Stablecoins often operate within closed-loop or fragmented systems, making seamless movement of assets across platforms difficult. This inhibits integration with legacy applications and hinders scalability. Promoting interoperability through open standards, cross-chain protocols, and collaboration between blockchain networks and traditional financial systems can create a more unified and efficient ecosystem.

Hexaware’s Enterprise Stablecoin Solutions

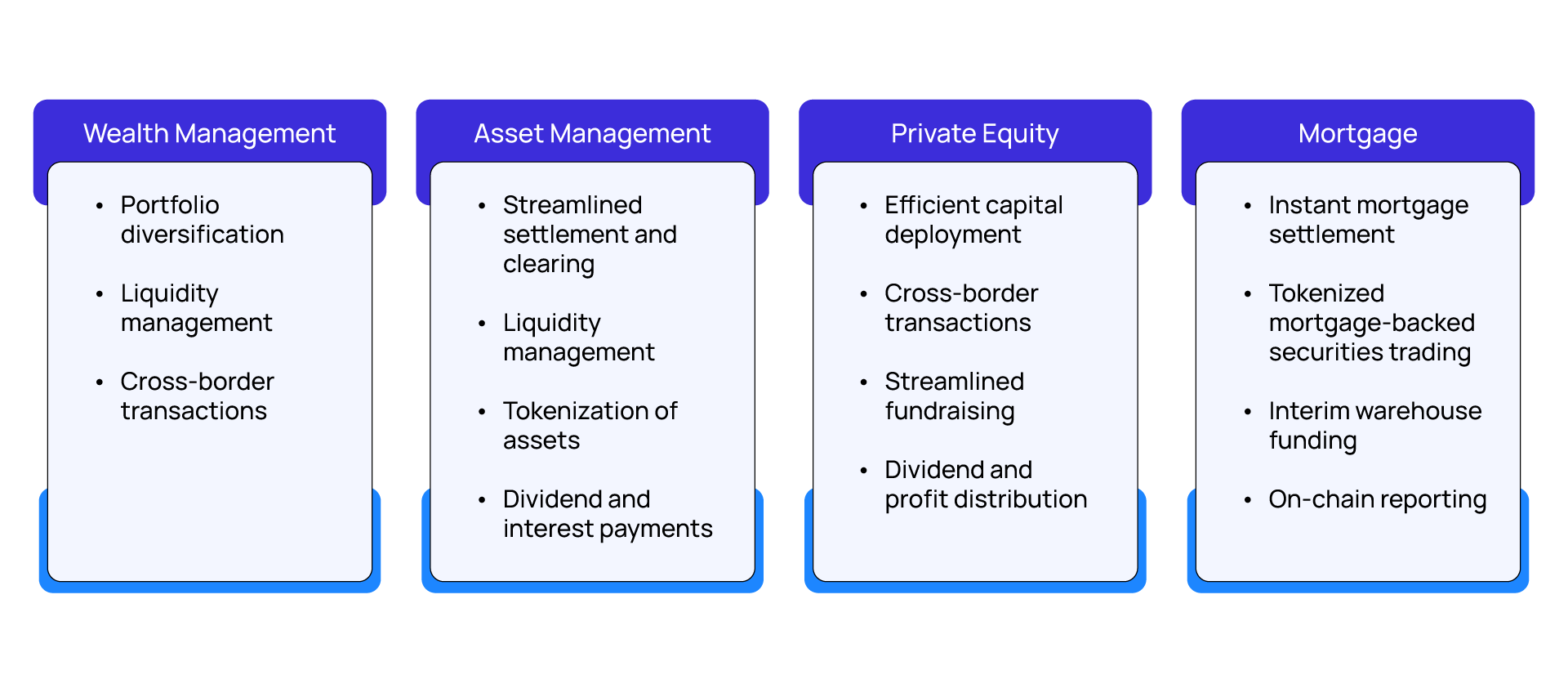

Investors are showing growing interest in stablecoins, as they offer benefits such as diversification, liquidity, and ease of use. Market participants, including asset managers, wealth managers, and payment technology companies, are gearing up to provide services based on stablecoins.

Hexaware offers a comprehensive suite of technology, compliance, integration, and risk management solutions for enterprise stablecoin adoption:

Stablecoin Compliance and Regulatory Technology

- End-to-end compliance automation: KYC/AML onboarding, transaction monitoring, sanctions screening, regulatory reporting, and investor due diligence for stablecoin activities.

- Rule engine development for legal and regulatory updates (e.g., GENIUS Act, MiCA), ensuring timely changes in risk policy and transaction logic.

- Audit trail management and reserve reporting, enabling monthly and annual reporting as per regulatory standards.

- Support for tax computation and compliance for digital asset activities.

Also read: RegTech Solutions for Banks: Radar Report

Stablecoin Integration and API Enablement

- Enterprise-grade integration of stablecoin wallets with core banking, asset servicing, wealth management, exchange, and loan origination platforms.

- Custody integration: One-click creation and management of wallets, deposit/withdrawal automation, reconciliation, and secure movement of funds across fiat and blockchain rails.

- Tokenization support: API integrations with platforms to tokenize traditional assets (equities, real estate, private equity interests) and facilitate trading or settlement in stablecoins.

Operations Automation and Stablecoin Risk Management

- Workflow automation for onboarding, settlements, dividend/interest payments, and compliance tasks, dramatically reducing operational risk and manual work.

- Automated transfers, booking, and real-time reconciliation of digital asset transactions within enterprise systems.

- Vendor risk management tools for wallet providers, settlement partners, and payment processors.

Tokenization and Asset Lifecycle Management

- Institutional platforms for full lifecycle management of stablecoin-based or tokenized securities: Onboarding, issuance, transfer, settlement, and corporate action automation.

- Integration of tokenized deposits, asset servicing, and fractional ownership for private equity, real estate, and other asset classes.

Reporting and Analytics

- Data analytics and dashboarding for portfolio monitoring, liquidity management, transaction analysis, and compliance reporting.

- Regulatory and tax reporting automation, including cross-jurisdictional disclosures and validations.

Ready to navigate the complexities of stablecoin adoption? Reach out to us by clicking on ‘Connect Now’ below, to learn how our enterprise solutions can help you innovate with confidence and compliance. You can also learn more about our comprehensive solutions for the financial services industry by visiting https://hexaware.com/industries/financial-services/.