The rise of artificial intelligence (AI) in the banking industry has been nothing short of phenomenal. Robo-advisors, the early adopters of this technology, have democratized wealth management, offering automated investment advice previously reserved for high-net-worth individuals. However, the story doesn’t end there. Now, the rise of generative AI in banking is poised to revolutionize how banks develop and deliver products. With GenAI in banking, financial institutions are on the brink of a transformative shift towards hyper-personalization and enhanced customer experiences.

Unlike its traditional counterpart, generative AI doesn’t just analyze data; it actively creates. Imagine a generative AI banking solution that not only understands your spending habits and financial goals but can also design a unique savings plan or craft a customized insurance policy tailored specifically to your needs. This is the power of generative AI in banking, and it has the potential to reshape the industry landscape.

State of Adoption: 2025 Banking Industry Trends

The adoption of generative AI in banking is accelerating at an unprecedented pace, driven by mounting pressure to improve efficiency, reduce costs, and unlock new revenue opportunities. What began as experimental pilots in innovation labs has now become a mainstream strategic priority for global banks. Institutions are no longer asking whether to adopt generative AI-powered banking—they are now focused on how fast they can scale it.

According to a Research and Markets report, the market size for GenAI in banking will grow from $1.16 billion in 2024 to $1.44 billion in 2025 and reach $3.39 billion in 2029 at a CAGR of 23.9%.

EY-Parthenon’s 2025 Generative AI in Banking survey notes that 77% of banks have now actively launched or soft-launched GenAI applications, with 61% reporting substantial impact from their deployments.

According to a 2025 BCG report, businesses that are leaders in personalization achieve 10% higher CAGR than those of laggards.

As generative AI moves from experimentation to execution, banks are scaling their deployments, embedding GenAI into core processes, and laying the foundation for a future where hyper-personalized, AI-driven financial services become the norm rather than the exception.

Use Cases of Generative AI in Banking

Generative AI is rapidly transforming the banking sector through solutions that boost efficiency, enhance customer experiences, and streamline complex operations. Some of the most impactful generative AI use cases in banking today include automated document generation and processing, fraud detection and prevention, credit risk assessment, regulatory compliance and reporting, and financial forecasting and scenario analysis. Apart from this, GenAI in banking is also being widely used in:

Marketing and Customer Engagement: Banks are leveraging generative AI to create highly targeted marketing content, including emails, social media posts, and personalized financial advice.

Personalized Customer Service: Generative AI-powered banking chatbots and virtual assistants can deliver highly personalized responses to customer inquiries, in real time and at scale.

GenAI Banking: A Paradigm Shift in Personalization

Traditional banking relied on a one-size-fits-all approach. Generic product offerings left many customers feeling underserved, with needs unmet and aspirations unrealized. Generative AI in banking disrupts this model by enabling banks to develop products that resonate with individual customers on a deeper level. Imagine a world where your bank proactively suggests a micro-savings plan that aligns perfectly with your upcoming vacation goals or generates a targeted investment portfolio that reflects your unique risk tolerance. This is the future that generative AI banking promises.

By harnessing the power of advanced algorithms and data analytics, generative AI in banking breathes new life into core banking operations:

- Enhanced security: By analyzing vast amounts of transaction data and customer behavior, GenAI can identify suspicious patterns and flag potential fraud attempts before they occur. This empowers banks to offer a safer banking experience for their customers. It can also analyze spending habits and alert customers to unusual or potentially risky transactions. This proactive approach creates an ecosystem that benefits both banks and customers.

- Digital transformation: GenAI isn’t about replacing human interaction; it’s about augmenting it. It enables a digital banking experience where AI chatbots provide personalized financial guidance while human advisors remain readily available for complex situations. This synergy between technology and human expertise paves the way for customer-centric innovation.

- Elevating retail banking: GenAI can personalize the onboarding process, suggest relevant financial products based on individual needs, and even automate tasks like bill payments and financial planning. This transforms retail banking from a mere service provider to a trusted financial partner.

- Lending: GenAI can revolutionize credit assessment. By analyzing a broader spectrum of data points beyond just credit scores, banks can extend lending opportunities to individuals previously overlooked by traditional methods. This benefits underserved customers and opens up new revenue streams for banks.

Unveiling the Power of Personalized Products with GenAI

GenAI’s transformative power lies in its ability to analyze vast customer data, including spending habits, income, financial goals, and risk tolerance, to create hyper-personalized banking solutions.

- Your personalized financial assistant: Genertaive AI can create a dynamic roadmap for your financial future by analyzing market trends, adjusting asset allocation, and suggesting personalized savings goals. Imagine receiving proactive alerts for unexpected expenses or opportunities to optimize your portfolio based on real-time market conditions. This empowers you to make informed financial decisions with confidence.

- Micro-savings with a macro impact: GenAI-powered systems can identify opportunities to automatically tuck away small yet impactful amounts from your everyday spending towards a dream vacation or a long-term financial goal. These micro-savings, orchestrated by GenAI, can significantly accelerate your progress towards achieving your aspirations.

- Investing aligned with your life: Gone are the days of generic investment portfolios. Generative AI can analyze customers’ risk tolerance, investment goals, and even their emotional response to market fluctuations to create a truly personalized investment strategy. This ensures the investments align with the customer’s long-term financial vision and not just generic market trends.

- Predictive banking and proactive guidance: GenAI can analyze your spending patterns and predict potential cash flow shortfalls before they happen. Imagine receiving timely notifications and proactive suggestions to manage your finances effectively, preventing future financial strains.

- Frictionless banking experiences: GenAI can streamline everyday banking interactions. Imagine voice-activated transactions, automated bill payments, and GenAI-powered assistants that anticipate your needs.

Benefits for Banks: Embracing a New Era of Customer Engagement

Adopting GenAI isn’t just about customer satisfaction; it’s a strategic move for banks to thrive in an increasingly competitive landscape.

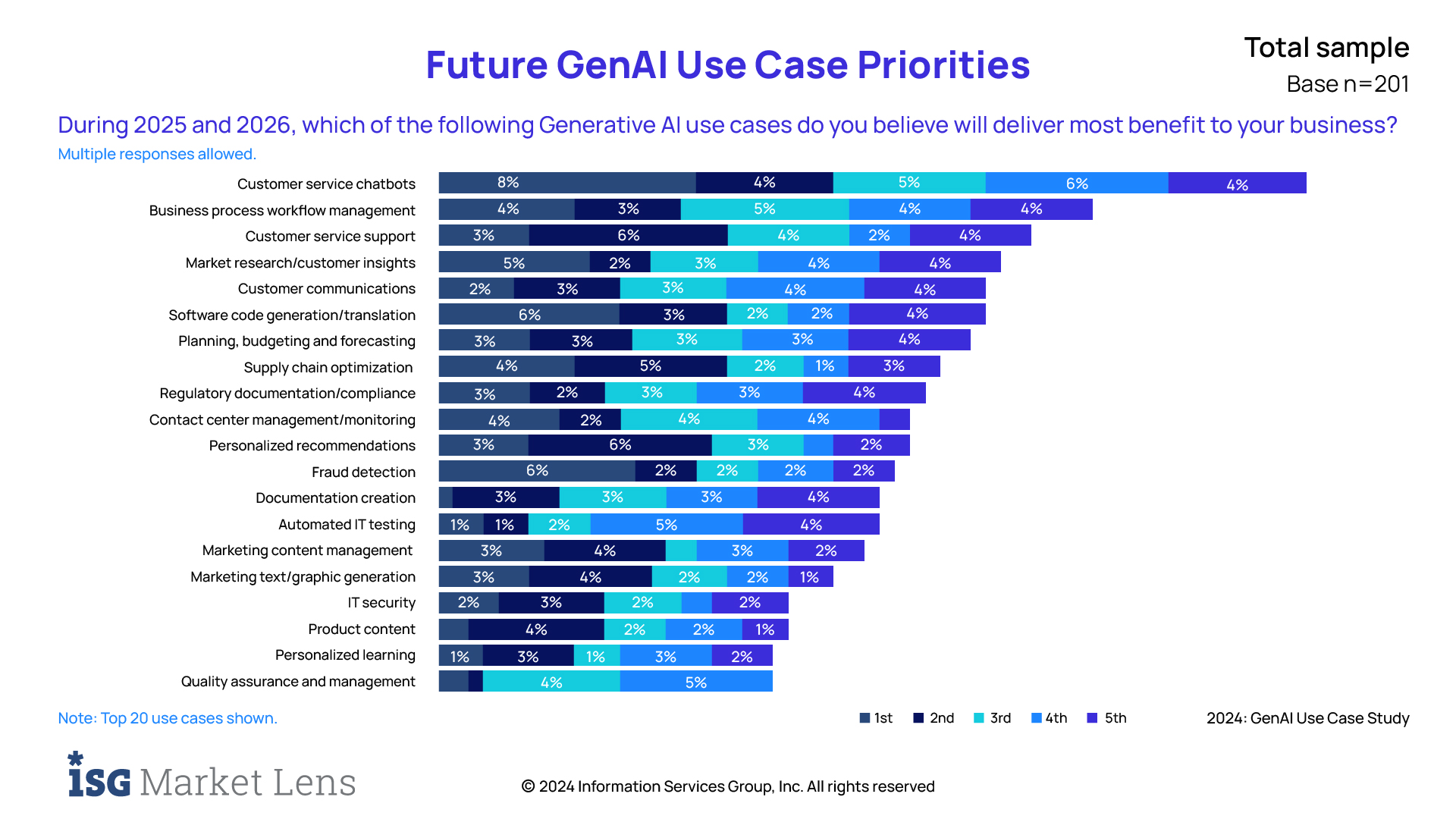

According to ISG’s August 2024 GenAI Use Case Study, personalization and customer engagement functions, such as customer service chatbots, customer service support, market research/customer insights, customer communications, contact center management/monitoring, and personalized recommendations, were among organizations’ prominent future GenAI use case priorities. The respondents were asked to identify the use cases that would benefit their business most in 2025 and 2026.

Here’s a detailed look at how implementing GenAI in banking can empower banks:

Increased customer engagement through various channels: When customers feel genuinely understood and offered products that meet their specific needs, it fosters deeper engagement and loyalty. From virtual tellers in branches to voice assistants in call centers, banks can leverage GenAI to facilitate customer interactions across various touchpoints. It enables more personalized, efficient user experiences through online platforms, mobile apps, and chatbots, and can even craft targeted communication on social media. Some GenAI models also support native language processing, ensuring that customers can interact in their preferred language. This personalizes the banking experience, transforming customers from mere account holders to valued partners.

Data-driven product development: By leveraging customer data insights, generative AI enables the development of products with a higher conversion rate. Banks can move away from generic offerings and predict customer needs with greater accuracy, leading to a more successful product portfolio. GenAI in banking can analyze vast troves of data to identify customer segments with unmet needs, allowing banks to develop targeted products that resonate with these specific demographics. This data-driven, personalized banking approach, utilizing AI, minimizes product development risks and maximizes profitability. This also allows banks to focus on upselling and cross-selling relevant financial products to existing customers, increasing customer lifetime value. From custom savings plans based on individual spending habits to auto-generating loan options best suited for a user’s credit profile, GenAI can play a pivotal role in personalizing banking services and offers.

Streamlined operations: GenAI can be leveraged for banking automation of repetitive tasks that are handled by human employees, freeing up valuable resources for more strategic endeavors. GenAI-powered systems can handle loan application processing, generate personalized financial reports, or answer frequently asked customer questions. GenAI can also be leveraged to forecast potential risks, ensure compliance through auto-generated reports, and personalize the onboarding process for new clients. This streamlining of operations reduces costs and allows banks to focus on delivering a superior customer experience.

Optimized IT infrastructure: GenAI can optimize IT infrastructure layouts and operations, leading to cost savings and better system utilization. Predictive maintenance algorithms can anticipate hardware failures and system bottlenecks, ensuring continuous service. Generative AI in banking can generate synthetic data to enhance training datasets for better system performance and create new cybersecurity threat scenarios to improve defense preparedness. It can also dynamically generate code or system updates based on evolving banking needs.

Challenges and Considerations: Navigating the Ethical Landscape

While the transformative potential of GenAI is undeniable, its implementation requires meticulous consideration of ethical and regulatory frameworks. Here are some key areas to address:

- AI bias: The algorithms that form the basis of AI are only as good as the data they are trained on. Biased data can lead to discriminatory outcomes. Banks must ensure their GenAI models are developed with fairness and inclusivity, mitigating any potential bias that could disadvantage specific customer segments.

- Hallucinations: Generative AI models have the potential to produce false data, a phenomenon known as ‘hallucinations’. If these errors go undetected, they can lead to inaccurate risk assessments, poor financial decisions, and bad investments. To prevent this, banks must implement robust validation and monitoring systems to detect and mitigate these hallucinations, ensuring the reliability and accuracy of their AI-generated outputs.

- Transparency in algorithms: The ‘black box’ nature of some AI algorithms can raise concerns about transparency. Banks need to be able to explain how GenAI models arrive at their recommendations, ensuring responsible and ethical use of this technology.

- Data privacy and regulation: The use of customer data raises privacy concerns. Banks must comply with stringent data protection regulations, such as the General Data Protection Regulation (GDPR), to ensure customer data is handled securely and ethically. Failure to comply with these privacy laws can result in heavy fines and damage to the bank’s reputation. Regulatory frameworks around AI use are also evolving, and banks must stay abreast of these developments to ensure compliance. Moreover, legal tenability is crucial—for example, the rationale for offering a particular product or denying a loan must be defensible and stand up in court.

The Future of Banking: Shaped by Generative AI

GenAI is poised to revolutionize banking, ushering in an era of hyper-personalization. Imagine a future where AI not only anticipates your needs but proactively suggests solutions tailored to your unique financial situation. Here’s a glimpse into the transformative experiences GenAI promises:

Enhanced customer interactions: Chatbots will evolve beyond scripted responses, offering natural and varied conversations that mimic human interaction. This will foster deeper customer engagement and a more positive banking experience.

Personalized content: Gone are the days of generic financial advice. GenAI can be used to personalize financial content on online platforms, tailoring articles, videos, and other resources to your specific preferences and financial behavior. It can even dynamically generate marketing materials, advertisements, and user interfaces that resonate with the customer.

Predictive services: Imagine receiving personalized offers for loans, savings plans, or investments that perfectly align with your financial goals. Personalized financial advice, tailored to the customer’s unique financial situation, will empower them to make informed decisions with confidence.

Product design: Banks can leverage GenAI to create new financial products that cater to specific customer segments and niche needs. Market trends and customer data will be transformed into innovative financial solutions that address the evolving financial landscape.

Automation: GenAI can streamline customer communications by automating the generation of content for collections, updates, and even onboarding documents. This frees up valuable resources while ensuring that customers receive timely and relevant information.

Conclusion

GenAI presents a transformative opportunity for the banking industry. By embracing this technology, banks can create a future of hyper-personalized experiences, fostering deeper customer relationships and driving long-term growth. The time for action is now. Banks that proactively implement GenAI solutions will be well-positioned to lead the way in this new era of customer-centric banking.

Ready to unlock the power of generative AI? Hexaware can help your bank develop a comprehensive GenAI strategy. Contact our experts today and discover how AI can revolutionize your customer experience and propel your business forward.