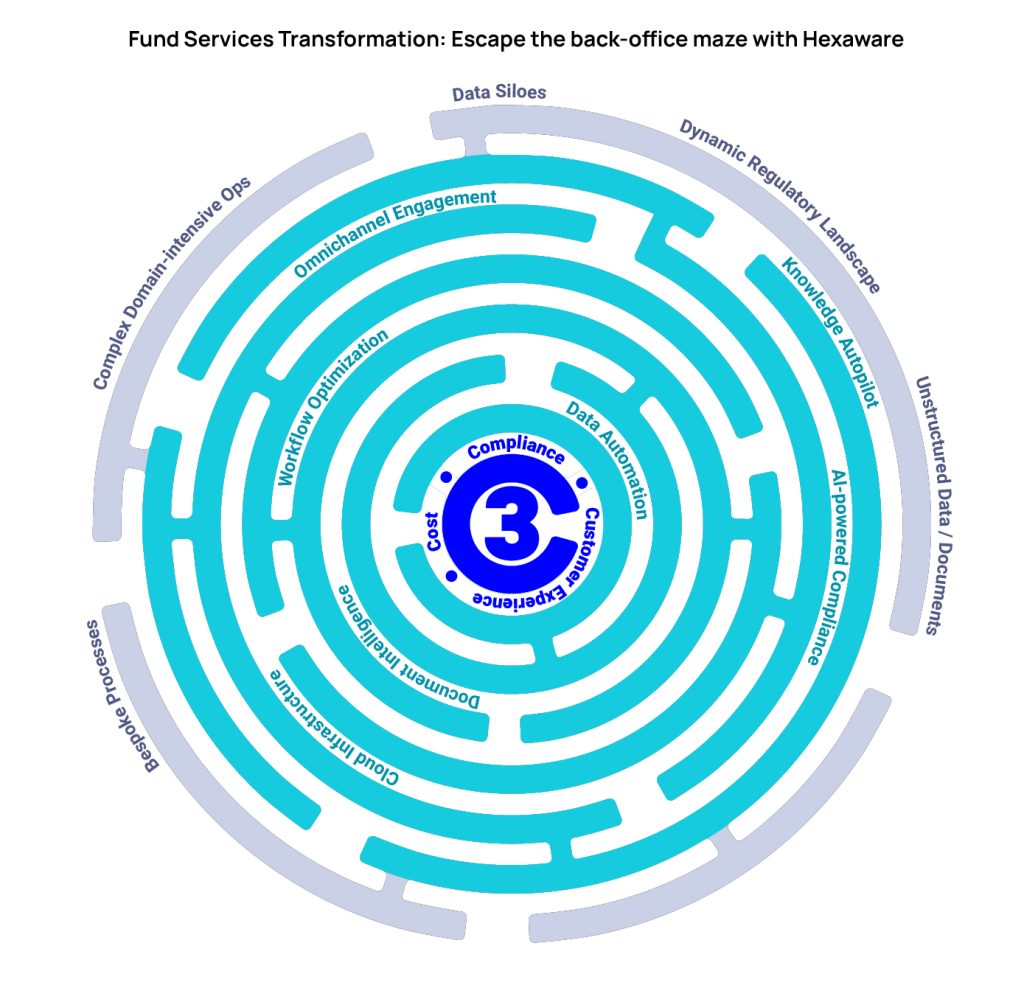

The global fund services industry is booming, with assets under management (AuM) expected to cross $147 trillion by 2027, according to PwC. Yet, its back-office process maturity appears to be lagging, resembling a state from a decade ago. The system is burdened with manual processes, siloed data, absence of real-time insights, a large number of end-user computing (EUC) applications, and disparate legacy systems. This inefficiency impedes growth, hampers time-to-market, and creates a fertile ground for errors, delays, and compliance issues, affecting investor experience. Investors’ demand for cost optimization, seamless interactions, on-time reporting, and digital experiences further add to the complications in the back office. At Hexaware, we firmly believe that the industry cannot afford to delay the imperative journey through these complexities toward achieving comprehensive digitalization.

The Operational Labyrinth and Challenges in Digitalization of the Fund Services Back Office

- Consolidation: Mergers and acquisitions are the new normal, creating a tangled web of data silos and manual operations. Each acquired entity brings its own systems and processes, leading to disparate application landscapes and multiple versions of the same process. According to a 2023 survey by PwC, “Nearly three-quarters (73%) of asset managers are considering a strategic consolidation with another asset manager.”

- Multiple ecosystems: Fund services firms, like other participants within the banking and financial Services industry, must interface with various constituents as part of their BAU. These external stakeholders—custodians, investors, agent banks, distributors, and regulators—exchange data and documents through channels such as emails, secured FTP, portals, etc. The sheer variety and lack of structure in the data, documents, and templates, are huge barriers to end-to-end automation.

- Workflow bottlenecks: The absence of smart workflows can lead to lost communications and missed deadlines. Rudimentary workflows and heavy reliance on email (used as a makeshift workflow tool) can impede processes, compromising communication transparency and hindering auditability.

- Bespoke processes: Complex funds and other asset classes, such as alternative investments like real estate and private equity funds, demand specialized processes, often bespoke and manual, adding another layer of complexity to the already manual process landscape. These processes also require deep domain expertise to run and manage, leading to a lop-sided dependency on a few SMEs.

- Unstructured documentation: Fund services firms deal with enormous volumes of documents such as know your customer (KYC) documents, tax forms, invoices, bank statements, contracts, fact sheets, prospectuses, and several others. Unstructured documents demand extensive manual effort for digitization, introducing delays and room for error.

- Dynamic regulatory environment: Changing regulatory requirements necessitate manual compliance checks and reporting, which are prone to errors and delays. Regulations such as Markets in Financial Instruments Directive II (MiFID II), Undertaking for Collective Investment in Transferable Securities (UCITS), Foreign Account Tax Compliance Act (FATCA), and Environment, Social, and Governance (ESG) have impacted the way funds are marketed, distributed, taxed, and reported, leading to increased costs and complexity for fund services firms.

Advantages of Automation for the Fund Services Back Office

Amid these challenges, there exists an opportunity for transformation. The era of change is upon us, marked by progress in generative AI, API-fication, micro services, and automation platforms. Embracing back-office automation across crucial areas is the key to unlocking this potential. This can be done in several ways:

Automating Data Flows

- Chart the journey of data from source to consumption, leveraging the capabilities of AI-enabled automation for tasks such as data ingestion, classification, extraction, validation, modeling, and reporting. This can eliminate manual data entry and result in seamless, error-free data flow.

- Migrate data residing in spreadsheets and other EUC applications to enterprise-grade automation platforms. This results in clear data lineage, an audit trail, and a single trusted version of data for downstream consumption.

Automating Workflows

- Realize a significant reduction in manual tasks, freeing up back-office staff from repetitive, time-consuming activities, allowing them to focus on higher-value knowledge work.

- Use automated workflows to control and regulate sub-processes and downstream actions based on business rules, reducing complexity across various applications. Business rules can also be implemented as part of workflow, eliminating the need for human intervention and ensuring a seamless flow of information between applications.

- No-code workflow automation and app development tools drastically improve the time-to-value for automation, making the back office more responsive to business demands.

- Explore the potential of capturing process performance and risk data, converting it into deep insights for operational and business decision-making.

Automating Document Flows

- Enable automated document ingestion from various channels. Once ingested, the document can be classified, and the entity data can be extracted, validated, and modeled as per business needs. AI-enabled advanced applications, including handwriting recognition, clause extraction, and table extraction, enhance the automation process, which can also include document generation, where needed.

Automating Knowledge Tasks

- A knowledge task is one that requires deep subject matter expertise to execute. Examples of these could be solving valuation breaks, responding to investor queries on tax or charges, making sense of the legal nuances within a contract, etc. These tasks, which were traditionally beyond the scope of automation, now fall within its ambit with the advent of generative AI and large language models (). Empower your workforce with AI-enabled deep domain assistance, reducing the analyst’s time to find the right solution and gradually de-skill the operations, reducing dependency on subject matter experts.

Automating Operational Controls and Regulatory Reporting

- Automate compliance checks and reporting, ensuring accuracy and adherence to ever-changing regulations. Regulatory reporting becomes more manageable as data flows are automated, and responsiveness to regulatory changes improves due to a configuration-based automation paradigm and agile-based deployments.

How Hexaware Can Help

Hexaware’s tested domain-intensive frameworks can assist you in evaluating your back-office operations’ current maturity level and guide you in creating a roadmap to elevate it.

In the realm of fund services, where efficiency and compliance are urgent priorities, the time for digital transformation in fund services back offices is now. By embracing comprehensive automation, organizations can unlock unparalleled operational efficiency, reduce costs, and successfully navigate complex business scenarios. The path to a digitalized future is clear, and the benefits are not just transformative; they’re imperative for sustained success in an ever-evolving financial landscape.

Ready to transform your fund services? Explore Hexaware’s comprehensive solutions today!