This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Empower Digital Banking to Transform the way Finance gets done

Business Process Services

September 9, 2021

“The secret of change is to focus all of your energy, not on fighting the old, but on building the new.” – Socrates

Change is inevitable and it always brings a tumultuous wave of new events that are not easy to accept. But accepting this change and initiating a fast-tracked, positive approach to make the most of the situation is the key to thriving.

Ushering the Digital Era in Banking

We all got pushed into the whirlpool of changes in the current unpredictable world where things can change with little or no warning. Inconsistencies owing to pandemic-related disruptions in operations and systems have highlighted the urgent need to pursue and accelerate a digital transformation agenda. These call for resilient, disruption-proof and sustainable transformations that support business continuity to survive in these competitive times.

The global banking landscape is changing. This has forced a deviation from traditional, physical service methods and has thrust finance institutions to adopt a fully digital experience. While banks like all other enterprises are adopting new techniques to allure their customers, physical and branch banking is becoming a thing of the past. The concept of banking without barriers is gaining momentum as the anywhere-anytime banking with online banking facilitates instant access to all banking needs, products, and faster services, promising a better experience.

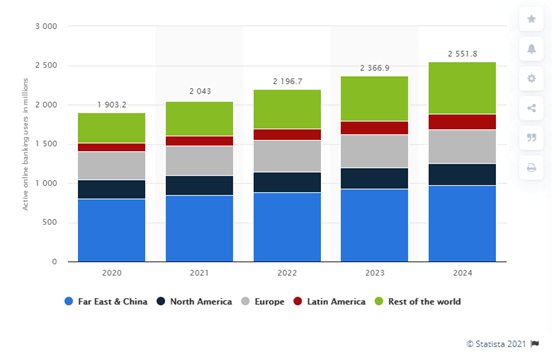

A quick glance into online banking users worldwide

In the new normal, banking is aligning itself more towards a need-based and goal-based strategy. Online facilities, eCommerce and social distancing have brought massive changes in customer behavior, media consumption, service delivery and engagement. The growing wave of internet preferring consumers are more demanding than their traditional counterparts and expect real-time services with enriching customer experiences from all service providers. These modern, fickle-minded consumers are not interested in ‘just banking’, facilitating only financial needs. They want banks to be customer-centric with 24*7 accessibility across multiple channels with maximized uptimes, digitally elevated experiences with intimate knowledge of customer needs and wants and intense personalization of products and services.

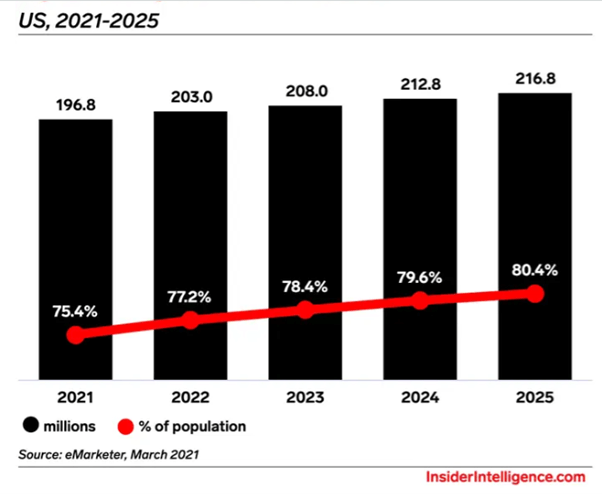

Research indicates that US digital banking users will surpass 200 million in 2022, There will be 196.8 million digital banking users in the US this year, making up 75.4% of the population. Source: https://www.businessinsider.com/current-state-of-online-banking-industry?IR=T

How fintech disrupts traditional banking

New-age banks with higher prudence levels and technology to disrupt are gaining strength by capitalizing on corporate banks’ inefficiencies and legacy systems and offering competitive pricing. They score better by improving customer-facing facets, expanded customer experience, better services branding, and impressive tools that make finance tasks seem uncomplicated and agile. New-age competitors like Alipay, Amazon Cash, PhonePe, GooglePay and few others offer high tech facilities and intelligent technology for financial payments and related activities while typically topping the customer satisfaction rankings. The only way banks can take on these newly emerging fintech firms and challenger banks is by shifting perspective and strategy to focus not only on financial aspects but also on keeping up and meeting the customers’ needs by optimizing the current state of operations to make them future ready.

Digital transformation challenges faced by banks

To create differentiated experiences, banks must focus on separating the wheat from the chaff by replacing legacy applications, accelerating digitalization of strategies, processes and core operations to lower costs, enable seamless journeys and improve the customer experience. While exploiting opportunities to streamline expenses, cut down on costs and improve efficiency, the digital transformation strategy should emphasize on quality, compliance measures, account data protection and cybersecurity. Accelerated digital transformation for disruption-proofing operations is vital while ensuring that the right tools and services are available to produce the desired outcomes while balancing the dual mandates of cost and efficiency.

Improving Customer Experience in Banking

While the pandemic has brought forth new heights in service deliveries, superior customer experience with support for areas and tools unfamiliar to customers is the basic need of the hour. A study by Salesforce points out, 63% of consumers and 74% of business buyers say that they’ll even pay more for a better experience thus, making CX a critical competitive differentiator for financial institutions in 2021 and beyond. An enhanced experience with various touchpoints like online banking systems, call centers, online services, advertising, cross and up-selling and omnichannel media play a significant role in easing financial distress and boosting end-customer morale. In the United States itself, when more than half of the populace is anxious about their financial security; reassurance, empathy and customer experience work wonders in improving the customer retention and brand loyalty.

The more pleasing the customer’s experience, the higher the loyalty quotient to the brand or institution, proving CX has the power to retain or turn away customers. Research has shown that the major contenders in the dissatisfied banking customers belong to the category wary of digital tools and those finding it inconvenient to adopt digital tools. Banks need to take a deeper interest in resolving these instances of fragmented customer experience and redouble their efforts to achieve a seamless digital customer transition journey. They need to consider enhancing digital self-service through operational trade-offs, highlight the pain areas causing fragmented customer experience and work to fix these.

Resetting the customer-experience priorities and adopting a customer-experience measurement through customer-centric approach comes highly recommended. Utilizing optimal technology innovations and data allows making information accessible for a proper, quality-laden resolution while leveraging quick delivery through innovative agent capabilities for intelligent results. Research has predicted that by 2024, organizations providing “total experience” will outperform competitors by 25% in satisfaction metrics for both customer experience (CX) and employee experience (EX). So, ensuring that employees have delightful experiences to provide elevated customer experiences is a win-win strategy.

Check out Customer experience representative is the new maven writeup to get insights on how the employee empathy, expertise and support helps gain fruitful experiences.

Automation and Conversational AI in banking

When websites are the new storefronts and banks have to accumulate end-to-end user experience, the brick-and-mortar banks are forced to reimagine and recast themselves into the “branch of the future.” This futuristic banking setup enables hyper-automation and intelligence-powered self-service options for a no-queue journey, community space and advanced technology. This allows for an extensively personalized banking experience each customer can enjoy and is specific to their unique needs; to expedite critical parts of the process, so customers can open their accounts quicker to enhance the experience journey further.

Conversational AI for banking using chatbots in financial services for virtual banking help generate efficiency gains and hyper-personalization for meeting requirement expectations to deliver the perfect experience.

To gain better insights into the leading trends governing the banking world, check out Top 5 Banking Industry Trends in 2021

Re-orient banking from Selling to Serving

Banks should start by identifying technology restrictions, replacing legacy applications and channel deficiencies and finding seamless and quicker alternatives to utilize intelligent automation instead of redundant tasks and complex high-effort points. Technologies like RPA, AI, ML, and cognitive solutions/processes and developing AI-enabled virtual assistants are optimized for automated/AI work that helps identify evolving customer expectations and provides effective solutions for routine finance functions and basic reporting. These also offer money management tips and bots to take over at least 10 to 25 percent of work across bank functions to help transform fragmented experiences into a unified flow. These technology innovations free employees from mundane tasks, decrease human errors and increase service speed while amplifying efficiency, reducing costs and ensuring quick turnaround times for a more significant ROI.

Contact Center Automation across banking utilizes intelligent bots leveraging a mix of AI and live support reflecting optimal bot-human collaboration. Predictive analytics leveraging AI and ML help monitor real-time usage data, preferences, likes, geographic location, finance and non-finance requirements, etc., to provide a deeper level of insight into customer needs. This helps banks target specific one-to-one marketing campaigns and offers. Data and analytics help enhance new products, optimize existing working, develop resilient solutions to empower customers better and improve the overall experience.

To be continued. Watch this space for the Part II of the blog.

About the Author

Amal Gabal

Read more

Related Blogs

From Manual to Machine: Maximizing Cost Savings with Intelligent Process Automation

- Business Process Services

Achieving Cost Efficiency Through Global Business Services Strategy

- Business Process Services

Generative AI for Marketing: The Future of Cost-effective Engagement

- Generative AI

- Business Process Services

Unlocking Generative AI for Hyper-personalized Customer Experiences

- Generative AI

- Business Process Services

Executive Administration Services: BFSI’s Right-hand Partner

- Generative AI

- Business Process Services

Generative AI in Customer Service: Going Beyond Traditional Chatbots

- Generative AI

- Business Process Services

Generative AI for Content Creation: The Future of Content Ops

- Business Process Services

- Generative AI

Fund Services Back Office Digitalization: A Transformation Long Overdue?

- Business Process Services

Mastering Customer Service Experience: Strategies for Success

- Business Process Services

The Rise of Omnichannel Customer Service: Unlocking Excellence in Customer Care

- Business Process Services

Ready to Pursue Opportunity?

Every outcome starts with a conversation