This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Top 5 Customer Experience Trends in Banking Industry

Business Process Services

August 11, 2021

The unprecedented crisis and newly emerging millennials are predetermining a radical transformation in the banking sector. What lends enterprises, especially financial ones, a winning edge is providing uninterrupted services and maintaining the same levels of professionalism in deliveries, even during disruptions.

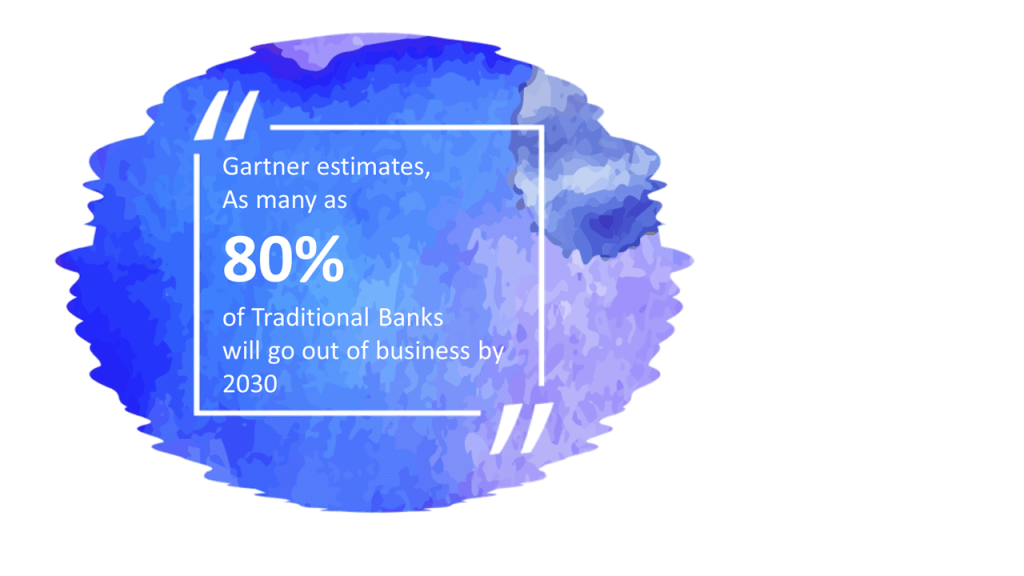

Banks must accelerate their digitalization coverage and focus on a customer-centric approach to enhance the end-customer experience and to overcome challenges, retain existing customers while attracting new ones. Even though these strategic priorities are not new, the after wave of the pandemic, operational disruptions and dampening customer demand have heightened the urgency and have enterprises in a rush to develop these measures for resilience in the long run.

Private banks face three new challenges:

- Pressures on revenues and profits from the uncertainties brought about by the COVID-19 crisis

- An acceleration in client demand for digital service,

- A shift towards remote working.

– (McKinsey, 2020).

Automated Banking Services – Making your Money Available –Anywhere, Anytime

There is a surging trend towards using online services and banking apps; these provide the customers with intuitive self-help and instant access to standard digital banking features. More and more consumers are giving up checkbooks and hard cash and using mobile payment apps for payments, online purchases, money transfers to family/friends and even utility bill payments.

Today’s customer is fickle and would have no qualms in moving from one bank to another when offered attractive options. And the vital stickiness factor that helps retain customers is digitally enabled services and omnichannel leveraged customer service that creates happy digital experiences.

We are sharing a checklist of banking trends of the future comprising of services digitalization. Financial services industry providers like banks and credit unions can consider these for streamlining and achieving better value propositions to strive in the “new normal” and the near future.

#1. Realign UX for Serving instead of only Selling to Elevate Digital Experience

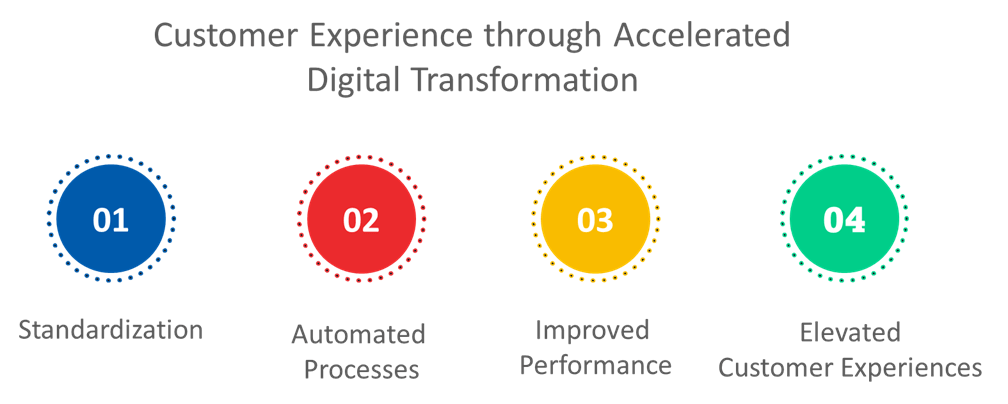

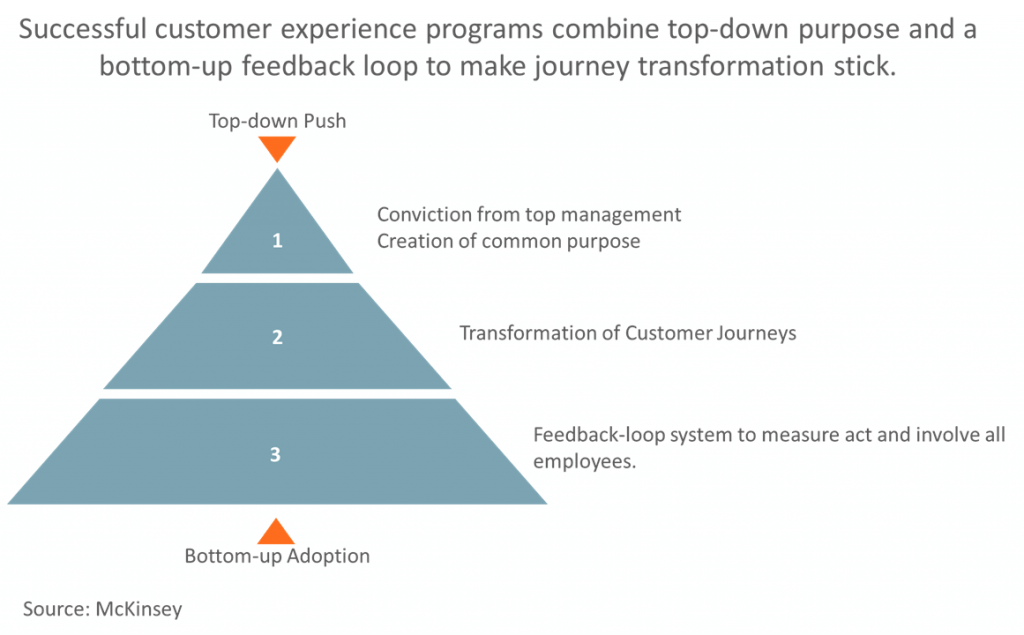

Aligning clients’ preferences towards digitally enabled remote solutions has laid the path for a customer-centric and empathic digital banking journey. Automation serves to expedite banking processes, lend a helping hand to support agents, provide 24*7 availability and provide swift resolutions with faster turnaround times. Automated processes adopt human empathy, simplistic designs, friendly UI, and personalization around customer lifestyles, focusing on user experience over information availability to set yourself apart from competitors. With the proper conviction, customer journeys would transform into digitally happy experiences for customers and employees.

- Ensure usability of the product over functionality, customer-centric strategies and solutions that are engaging and fulfill customer demands with a clear customer experience strategy for simple things like ease in customer onboarding, convenience and a positive experience

- To match the digital experience where customers can carry out transactions instantly, banks need to expedite their turnaround times, ensure 24*7 availability and be consistent

- Support should be relevant, consistent, and proactive across all channels with skilled support agents to assure quality resolutions

- Banks should consider leveraging advanced analytics, ML, AI and sophisticated technologies to define relevant offerings rich in personalized digital content experiences

- Omnichannel interaction with self-serving IVR, intelligent automatic routing and bots to handle queries even after working hours and a well-equipped next-gen contact center go a long way in winning loyalty

Conversational banking – Vocalizing your Brand Value

Building trust through video-voice call and co-browsing Conversational banking helps the financial services industry embrace the connecting bridge between face-to-face banking and human agents/non-human interactions through an omnichannel approach. These provide AI-powered chatbots for 24*7 interaction with the customers to support self-service enablement, answer queries, and provide resolutions while acting as the first level of assistance with human representatives to supplement them.

Digital tools like IVR, live chat, messaging and co-browsing help define positive omnichannel banking strategies. A hybrid model with the power of AI-automation and humans is the optimal way to resolve low-stakes issues as it helps with:

- Promoting a productive conversation between the client and the agent

- Generating more leads in real-time, are cost-efficient and least prone to disruptions

- Providing customer support and handholding to new users

- Prioritizing customer engagement, enhancing customer experience and aiding advisors with information and solutions to deliver quality services

#2. Leverage Omnichannel for Personalized Communication

Combining digital and human efforts to develop a seamless and robust omnichannel experience will be the turning point in the digitally transforming finance world. Weaving an omnichannel ecosystem into the core of all strategies helps build a solid personalized touch across services and offerings, availability 24*7, enhanced reach, meaningful cross-selling, boosting customer retention, simplifying onboarding and more.

The significant advantages of omnichannel banking are:

- A cost-effective and hyper-personalized technique for delivering superior experience branding and messaging effectively

- Automation, AI and new-age contact center modernization tools and techniques help transform banking into a rich experience in a cost-effective way by reducing support costs.

- Accurate and quicker turnaround time for a near-real-time interaction helps enhance the digital experience while increasing customer retention.

- Increase engagement with customers through social media channels and track consumer footprints to ensure seamless customer interactions.

The influencing factors that can increase the effectiveness of omnichannel experience are

- Data and analytics identify high potential and optimal value from data overloads through data mining to estimate the customer’s expectations and predict behavior and buying patterns.

- Data-driven insights into the customer’s journey help in personalizing digital touchpoints and support. Providing empathy, engaging, and staying focused on the customer’s needs are the steppingstones to a seamless customer experience.

- Move away from being bank-centric to being client-centric by shifting focus to customer needs, wants and interactions by anticipating them and providing proactive solutions

#3. Leverage Futuristic Technologies as Enablers

The mobile-savvy generation of today expects a hyperconnected bank that would understand conversational language, be aware of sentiments, emotions and inclinations, predict the customer’s intentions and preferences with little or no navigation and be able to continuously adopt and adapt to new technologies for bettering the customer experience. Matching with the lifestyles and needs of the customers, providing engagement as a service, keeping abreast of the Fintech revolution and making the most of the cutting-edge technologies to provide an uninterrupted experience so that the customer can transition from one touchpoint to another without hiccups is the game-changer.

The various touchpoints through digital channels, social media apps, intelligent devices using conversational AI and ML leveraging IoT and futuristic technologies, open APIs, cloud-native platforms, intelligent innovations, etc., play a pivotal role in digital banking. Cloud computing can help with resilience in risk management to have a secure and safe environment for the customers and financial systems. Other technology trends influencing futuristic banking are:

- Cloud technologies help evolve with technology breakthroughs, drive speedy risk handling and real-time resolutions with better alignment among teams to enable a seamless customer service

- Foolproof security and comprehensive data management technology innovations across fintech verticals for safeguarding security, with flexibility and transparency that is suited to the needs of the banking ecosystem

- Touchless transitions, immersive extended reality experiences, chatbots for preliminary assistance, intelligent automation for substituting the irregular workforce, cognitive techniques as a substitute for physical presence and many more such innovative techniques

- Business intelligence supporting AI-based system that provides seamless fluidity of transactions streamlines banking performance and provides accurate and trusted services.

- Digital banking, open banking or predictive banking, the primary foundation is based on platforms, technology, security implications, data and analytics, automation and payments innovations.

Financial institutions should utilize the right technology for continuous improvement, cost efficiency, effort-saving to drive their cost base, generate good ROI, ensure excellent investments from opportunities and maximize productivity gains.

#4. Do not just change – Transform for the better!

Mapping the customer journey with personalization and immersive design is an essential strategy. The demanding new generation clients expect an advanced UX, omnichannel availability of services and increasingly personalized experiences. Providing a differentiated and engaging customer journey with personalized in-app experiences integrated into a single online platform saves time. It offers hassle-free convenience to deliver an impactful customer experience. Research shows that more than 85% of enterprises who have made the personalized journey a part of their process are reaping success and they owe much of their success to their beautiful customer journeys. The crucial aspects involved in ensuring the best blend of customer journey and design are:

- The right technology like AI and data powered cutting edge technology platforms to complement the innovative ideas and data for improving the customer journey

- Exploiting data for not just personalization, upsell and support but also to provide a flexible pricing model and become relevant in everyday journeys

- Utilizing Design Thinking to enrich the experience by being more empathetic to customers, encompassing the apparent customer journey milestones and broadening the reach to discover and facilitate new journeys.

- Providing speedy real-time information coupled with retail-like experiences that can embody customer-centric brand philosophy.

- Keep reimagining the customer journey with constant innovation and newer approaches that enhance better services and customer experience

Banks seeking to reimagine their journeys and customer experiences should never forget that it is not easy to accomplish a seamless transition and transform how finance has existed for ages. It takes the combined efforts of an expert in technology with years of practical experience, a proven track record of futuristic technologies, streamlining operations and digitalization to transform operations and serve the customers. Only dedicated technological partners with synergy and agility to deliver better customer experiences for a coherent integration with current systems and products can provide effective results to the bank and the end customers. Make the customer journey a masterpiece in design so that the rich accolades it wins are the rewarding experience in itself.

#5. Analytics and Personalization – Being Relevant and Engaging Wins

The fruits of consistent customer engagement are sweet and rewarding. Providing seamless connectivity across devices globally, a wider choice of service offerings, a unified interface for all banking and finance services, engagement and data-driven recommendations are all that it takes for your customer to be your loyal brand advocate.

While data analysis helps prevent irregularities and saves revenues, data analytics helps track real-time insights to provide accurate decision-making. Utilizing analytics and AI to build a 360° view of the customer is vital to develop the relevant approach and services for customers while gaining their trust, driving adoption and improving retention. Personalizing experience through campaigns helps maximize conversions, cross-selling and retention. Apart from aiding in sentiment analysis of the user through behavior and attributes to identify opportunities and maximize conversion, the advantages of analytics are multifold:

- The correct data enables sending out the proper communication at the right time instead of bombarding customers with offers that might not interest them

- Analytics and ML enable enforcement of regulatory compliances

- Personalization helps engage the customer to enhance the experience and build-up on retention

- Build and maintain customer trust by eliminating random choices, presenting the customer with the right offer, and never losing an opportunity to engage.

- Categorizing and predicting customer expectations accurately will aid in engaging various personas for successful conversions

Banking as a Service is the new Entrant

Embracing disruptions while technology trends reshape the financial outlook and business models and leverage digital innovations at an accelerating pace is the reckoning force behind fintech success. Business process transformation in the fintech world can be unique with brilliant transformations, conversational AI, digital cognitive innovations and more to revolutionize the financial services value chain. Know how Hexaware and its partners can help accelerate your digitalization journey in banking and carry you from the current unpredictability wave to surf the swells with resolve and resilience. Reach out for an analysis of how your financial ecosystem can explore more benefits from day1.

Take the following survey:

About the Author

Sai Subramaniam

Read more

Related Blogs

From Manual to Machine: Maximizing Cost Savings with Intelligent Process Automation

- Business Process Services

Achieving Cost Efficiency Through Global Business Services Strategy

- Business Process Services

Generative AI for Marketing: The Future of Cost-effective Engagement

- Generative AI

- Business Process Services

Unlocking Generative AI for Hyper-personalized Customer Experiences

- Generative AI

- Business Process Services

Executive Administration Services: BFSI’s Right-hand Partner

- Generative AI

- Business Process Services

Generative AI in Customer Service: Going Beyond Traditional Chatbots

- Generative AI

- Business Process Services

Generative AI for Content Creation: The Future of Content Ops

- Business Process Services

- Generative AI

Fund Services Back Office Digitalization: A Transformation Long Overdue?

- Business Process Services

Mastering Customer Service Experience: Strategies for Success

- Business Process Services

The Rise of Omnichannel Customer Service: Unlocking Excellence in Customer Care

- Business Process Services

Ready to Pursue Opportunity?

Every outcome starts with a conversation