Data Mesh is an approach based on a distributed architecture for data management and evaluation. Users can easily access and leverage data without any bottlenecks from the central data team. Though the new generation of centralized data architectures — including data warehouses, data lakes, and cloud data lakes seemed it would overcome the drawbacks of the spaghetti architecture, they failed in addressing scale in other dimensions like changes in the data landscapes, proliferation of data sources, diversity and complexity of data use cases and users, and speed of response to change. From processing bottlenecks and data quality issues, to the inability to turn data into value at speed, fundamental issues persist in centralized architectures.

The two major approaches to data management we see today rely either on data warehouse or data lake technologies. Data warehouses usually store structured data in queryable formats. A data lake, in its simplest form, stores raw data from various sources. With this approach, the data can retain whatever schema the source system dictates until it is time to conduct an analysis. But both have a centralized approach which lacks proper data governance and accessibility of data which is a major pushback for data management in regulated areas like capital markets and banking.

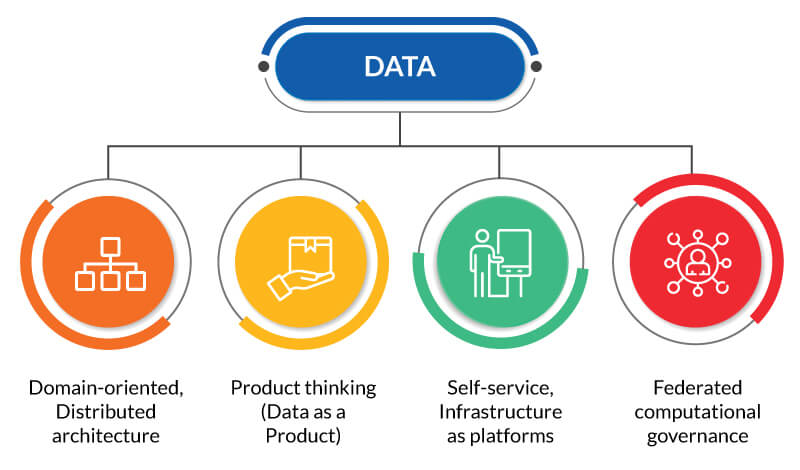

A data mesh on the other hand is a decentralized approach to data ownership and architecture. It is focused on domain-driven design principles and patterns which are technology agnostic. It is founded in following principles borrowed from production IT architecture, but applied to data:

Adopting Data Mesh Approaches

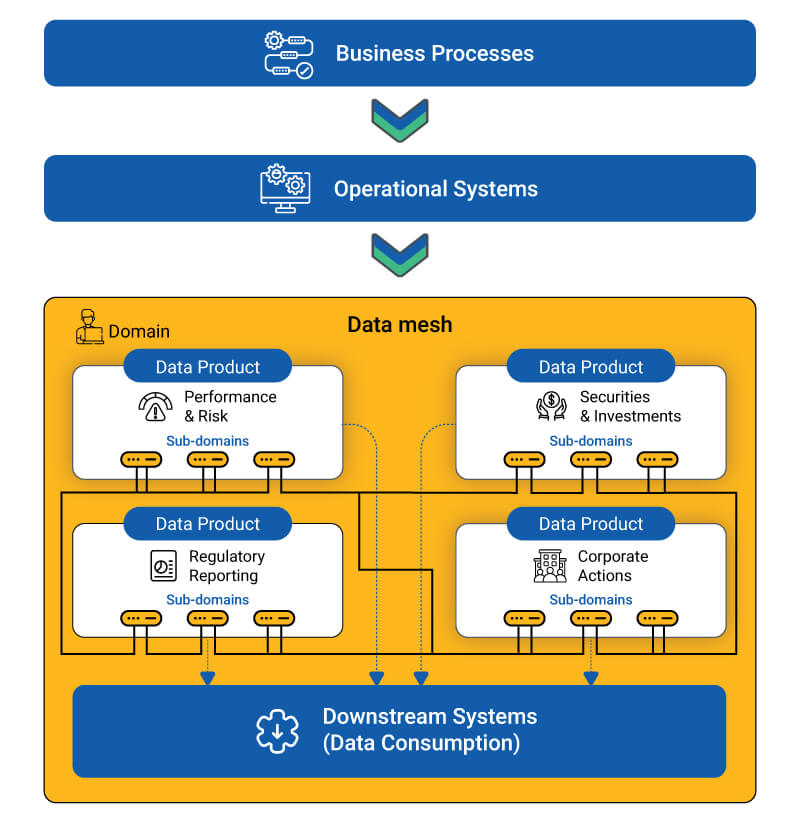

On contrary to existing spaghetti and centralized data architectures, data mesh interconnects specific lakes which can act like separate data products and the application domains that consume from data lakes. Data mesh is the network of distributed data nodes linked together to ensure that data is secure, highly available, and easily discoverable. The following diagram illustrates the data mesh architecture.

Challenges in Adopting a Data Mesh Architecture

On contrary to existing spaghetti and centralized data architectures, data mesh interconnects specific lakes which can act like separate data products and the application domains that consume from data lakes. Data mesh is the network of distributed data nodes linked together to ensure that data is secure, highly available, and easily discoverable. The following diagram illustrates the data mesh architecture.

Here to solve some major challenges organizations face, data mesh creates a network of data sources and uses advanced algorithms to channelize data effectiveness. Some of the challenges faced include-

- Data consistency across different data sources

- Developing a robust governance framework for data management

- Entailing trust among data users

- Leveraging automation for ease of accessibility and analysis

Data mesh is revolutionizing the way organizations manage and use data. With data playing a critical role in the financial services ecosystem, the quality of data is a thing of concern. However, data mesh can address it by creating a network of data sources, which in turn can ensure accuracy overall.

Benefits of Data Mesh in Financial Services

Data mesh has the potential to augment customer experiences by personalizing customer interactions and making it data driven. It also brings operational efficiency by minimizing costs and improving data quality. As the data is structured to be distributed in the data mesh architecture, the tracking of data for accessibility and updates, is convenient. Following a decentralized approach, the data mesh is more resilient to outages and easily scalable. Enterprises are becoming vendor-agnostic and no longer want to be associated to a single data platform. The distributed architecture allows them unrivalled flexibility and choices. Data is transmitted, transferred, etc. in numerous ways on a daily basis and this raises concerns about its security. Data mesh eliminates the risk of a data breach improving its overall performance through its distributed model.

Data mesh approach when applied correctly brings the needed order to the unstructured system, resulting in mature and more manageable data architecture. This concept of data mesh has organizational and technological dimensions. With this, businesses are creating so-called data products — decentralized expert offerings that focus on one domain and align data ownership and consumption. Data products can be groups of related data from the systems that support various business operations like trades, transactions, portfolio management, regulatory reporting, corporate actions, performance, risk management, cash management, etc.

Conclusion

Data mesh unlocks countless possibilities for organizations including analytics and data intensive applications. The distributed architecture facilitates data accessibility, security, governance and quality. For a highly regulated area like financial services where strong support for data governance is sought, quality of the data products being controlled directly gives an edge for this model. Domain- driven approach could be highly beneficial for data management in capital markets space given the complexity of data in this domain. Reference data such as security data and price data can stand alone as a data product whereas investment data like trades and positions data can function as independent yet interconnected with other data products and downstream systems. Working together and on top of each other, these data products exhibit a network effect which allows for an ongoing cycle of data, analysis, and action, resulting in a continuous flow of business value.

Hexaware’s Amaze® for capital markets is a low-code no-code data management platform that will accelerate implementation of data mesh architecture. It is a financial services cloud solution, it helps solve the problems associated with legacy solutions and generates insights to customers for better visibility and to accelerate business innovation. Amaze® offers rich business glossary providing business definition for each capital market domain addressing different domains which gets enriched periodically as adaptors are implemented for data providers or index providers or even client specific domain feeds. This domain-driven approach gives superior end-user experience to the business users where they can perform configurations and customizations. Data monetization opportunities in the data marketplace also can be easily unlocked with Amaze®’s data as a product in addition to its categorized business layer.