A global building‑products manufacturer overcame manual cash‑application headaches by adopting Hexaware’s NLP‑powered entity extraction, remittance parsing and Blue Prism RPA to process 1.5M invoices/year—cutting manual efforts 42%, slashing processing time by 75%, unlocking ~$1M savings over 3 years and enabling 55% automation.

Client

The client is a leading manufacturer of building products headquartered on the US East Coast. They have a presence in over 16 countries, with a workforce of more than 18,000 employees. The global manufacturer, which has several building product brands under its umbrella, reported net revenues of over $5,000 million in 2022.

Revenue: $5,000 million+

Challenge

The problem faced by the client:

The client received multiple payments from its customers on a daily basis. Given the nature of their business, each customer had numerous open invoices simultaneously. The task of reconciling these invoices posed a significant challenge for the client, due to the predominantly manual business processes and workflows. The existing legacy system with dated functionality and unstructured input templates in different formats across regions, complicated matters.

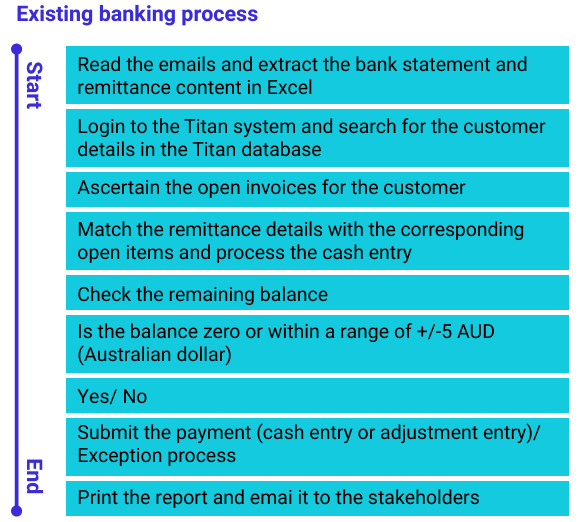

The process:

The cash application process for the client involved identifying customer details from multiple bank transactions, followed by isolating the specific invoice associated with each payment.

Customers provided payment details through narrative descriptions in their bank statements. The remittance file, consisting of invoice details and payment breakup, was received in the form of unstructured text via email.

Processing these payments required meticulous scrutiny of each transaction in the bank statement. The narrative content was reviewed to extract essential information and then cross-referenced with customer data in the CRM. Once a customer was identified, the CRM was consulted to analyze multiple remittances, matching invoice details. When a match was found, the corresponding invoices were selected and marked as closed.

Given the high volume of transactions, executing this process necessitated constant switching between bank statements, the CRM, email inbox, and the remittance file. The CRM’s design required multiple navigations to access the desired interface. Furthermore, certain remittances contained hundreds of invoices, amplifying the challenge. Transferring these details from the remittance files into the CRM demanded substantial effort and time.

What the client needed:

The focal point of the engagement was to increase process efficiency and reduce costs through automation. The objectives were to:

- Understand the current state of the business and application landscape

- Conduct prioritization and assessment workshops to define the scope of automation

- Automate banking procedures, reporting, and account opening processes within the finance and accounting (F&A) domain

The client faced difficulties in reconciling multiple daily payments from customers due to manual processes and an outdated system, highlighting the need for automation to streamline their cash application process and improve efficiency.

Solution

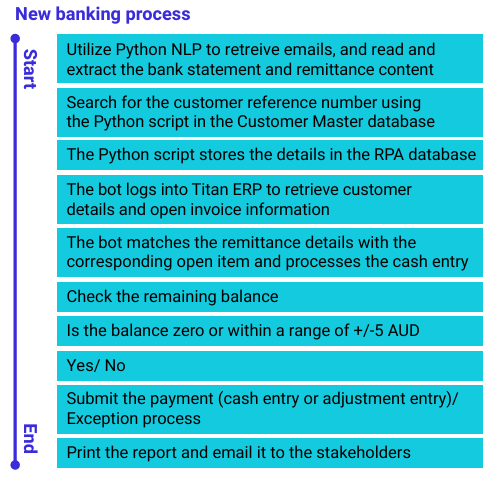

Hexaware introduced a cutting-edge cognitive automation solution, amalgamating natural language processing (NLP), expert systems, Python scripting, and the Blue Prism Robotic Process Automation (RPA) tool, to transform the client’s cash application process.

The application of NLP-based entity extraction facilitated the recognition and extraction of customer details from the narrative within bank statements. This included identifying details, such as customer names, customer reference numbers, invoice numbers, and quote numbers from the unstructured text.

Python scripting was employed to search for customers based on the details extracted by the NLP module, by directly connecting to the CRM database backend. This eliminated the need to navigate through time-consuming UI screens.

An expert system was built to parse the remittance files and extract invoice numbers and corresponding amounts. This robust remittance extraction engine was adept at handling multiple formats, including xls, pdf, doc, and HTML, thereby effectively managing a wide range of remittance templates from various customers.

The Blue Prism RPA bot would then take the inputs from the NLP module and the remittance extraction engine and close the open invoices in the client’s CRM. This would entail accessing the customer’s open invoices, generating a payment equivalent to the amount mentioned in the bank statement, selecting the invoice numbers specified in the remittance file, and updating the CRM accordingly. The bot would also generate a summary report for the entire process execution and send it to the pertinent business users and stakeholders.

Solution highlights:

- Leveraging NLP entity extraction to identify and extract customers’ details and references from unstructured text in the bank statement narrative

- Crafting a remittance extraction engine to extract invoice numbers and amounts from diverse remittance files effectively

- Harnessing RPA to establish payments and close open invoices in the client’s CRM tool

Hexaware’s advanced cognitive automation solution combined NLP, expert systems, Python scripting, and Blue Prism RPA to revolutionize the client’s cash application process, streamlining customer detail extraction, remittance file parsing, and invoice closure within the CRM.

Benefits

- $1 million in cost savings within 3 years

- Up to 55% automation potential across the applications

- 42% reduction in manual efforts through intelligent automation using NLP, Python scripting for machine learning (ML), and RPA interventions

- 75% lower processing time for finance and accounting processes

- Elimination of various legacy systems

- Enhanced process control and visibility via workflow and reporting dashboards

Hexaware’s solution led to substantial cost savings, increased automation potential, a significant reduction in manual efforts through smart automation, faster processing times, streamlined operations through legacy system elimination, and improved process control and visibility.

Summary

The client, a prominent building products manufacturer, faced challenges reconciling numerous daily customer payments due to manual processes and an outdated legacy system. Hexaware’s solution automated their cash application process by amalgamating NLP, expert systems, Python scripting, and Blue Prism RPA. The NLP-based entity extraction identified customer details from bank statement narratives, while Python scripting directly connected to the CRM database. An expert system parsed remittance files, and a robust engine handled various formats effectively. The Blue Prism RPA bot processed inputs from NLP and the engine, closing open invoices and generating summary reports.

By automating customer detail extraction, remittance file parsing, and invoice closure, the solution led to substantial cost savings, increased automation potential, faster processing times, streamlined operations, and improved process control and visibility.