This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Top challenges in Policy Data Migration

During one of the major milestone meetings of a PAS (Policy Administration System) implementation project, the CIO of the client addressed the PAS implementation team. His opening statement was, “Do you know the single most important item that keeps me awake in the middle of the night…” With a short pause he looked at the audience and completed his statement Data Migration.

It was the early days of our career and we just kept guessing why he singled out Data Migration as his most challenging piece in the complex world of PAS implementations. Years later, working on multiple data migration projects, we now understand that he was absolutely right. Data Migration is one of the few critical activities that typically enters the lime light for all wrong reasons and that too only towards the end of most projects and poses a new set of challenges for PAS implementations.

In this blogpost, we have summarized the major challenges encountered in a typical data migration project in Insurance package implementations.

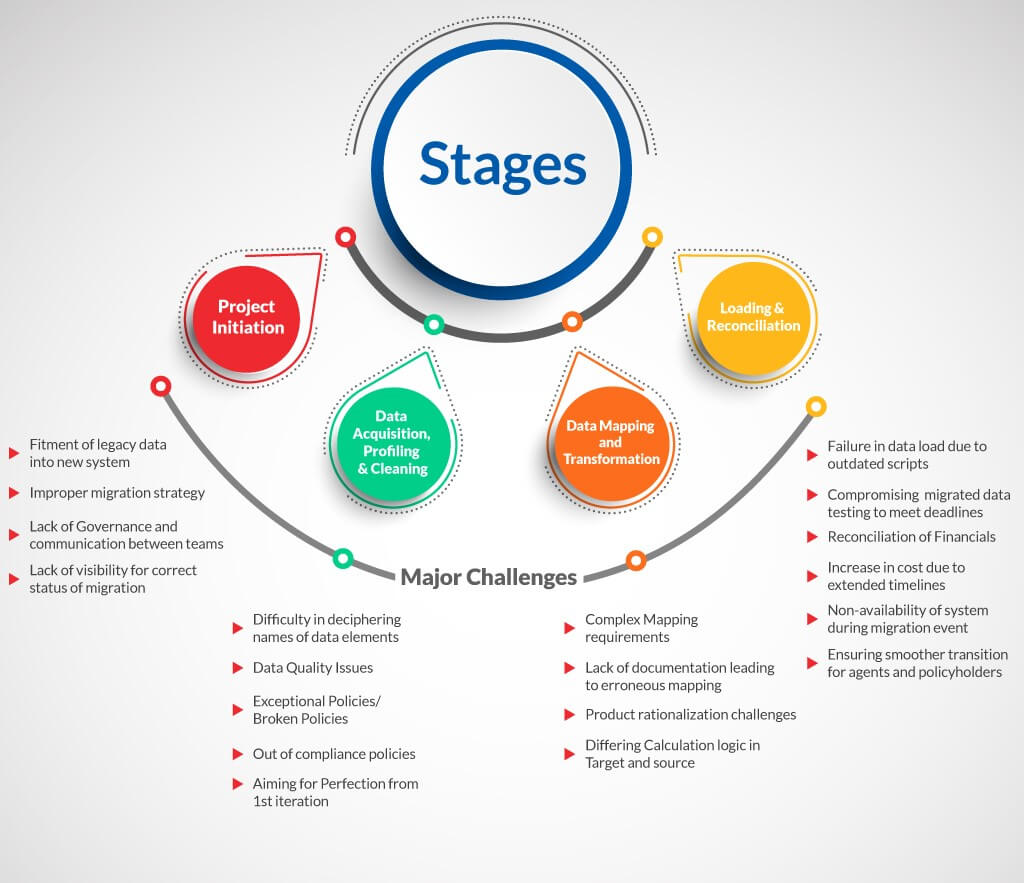

Project Initiation Phase:

Data Migration Strategy Definition: While choosing the new system, clients tend to focus on how the new system is equipped to incorporate the current and future requirements of business. This aspect is obviously essential; however, insurers should also consider the fitment of legacy data into new system as one of the selection criteria.

Before the start of migration,data migration strategy is crucial, whether we would be opting big bang approach, Product / State wise migration, Conversion on renewal, automatic vs manual conversion for few complex cases etc. In addition, client should focus on identifying the right partner with automation capabilities and ability to deliver repeatable conversion events with high degree of success and history of successful conversion and proven automation tools. In many projects, the management tends to overlook the necessity to adopt the optimum migration strategy and allocate adequate budget which results in cost overrun in future.

Lack of Governance and communication between teams: It is critical that implementation team considers migration impact while making business decisions on product configuration as it may invalidate legacy data. Data model changes are done by the configuration / customization team which are not communicated to migration team. These get discovered only after the migration cycle is run. All changes to the data model needed by configuration team is to be governed by Data governance team. A clear governance and communication structure needs to be defined during the project planning phase

Lack of visibility in migration: A common complaint by client business team is lack of visibility of correct status of migrated data in terms of number of products, plans, policies, policies and claims migrated. A clear reporting guideline depicting the status and success of migrated data is essential

Data Acquisition, Profiling and Cleaning Phase:

Unknown Data Elements Challenges: Some of the common woes heard from insurers: “Many a time, the names of data elements used in the model are too technical to interpret and it is not feasible to understand even after analyzing the data it holds. Data Dictionary is usually not available. There is dependency on data model Subject Matter Experts to convert all technical names to business parlance.”

Data Quality Issues: Many of the legacy systems existing today, do not have edits for mandatory fields and invalid data type validations and illogical combination of riders, claim types etc. Hence, the data fails to load due to product rule validations in target systems which is based on ideal business practices.

Some examples are as follows:

- Date fields with blank or invalid data which fails to migrate to new system with date validation rules

- A claim type missing on a declined claim on source system where target system requires a claim type even when claim is declined.

Non-standard free text clauses are put by underwriters in many policies which needs special attention to migrate.

Exceptional Policies/Broken Policies: Most of the legacy systems have some “Broken” policies handled manually outside of legacy system with workaround solutions. Migration of those would require individual attention and involvement of actuaries.

Out of Compliance Policies: This could happen when one tries to migrate old policies as per current regulatory mandate setup in the target system, which would be conflicting. Co-ordination with business and actuaries will be required to resolve these issues. Few examples are state-specific rules, product age limits, out of benefit /premium limits in source system.

Aiming for Perfection: Stakeholders put considerable effort and strive to have a perfect data in the first iteration. Significant time is spent to resolve all issues even before moving the first set of data. New unexpected issues are usually discovered when data is migrated and hence an iterative approach is essential so that issues are discovered and resolved as the migration progresses. Moreover, the team tries to resolve all issues in source system. Legacy data is prone to quality issues. Management should consider and determine reasonable tolerances to achieve Go-Live within reasonable timeline. Openness to accept workarounds addresses some of the low impact issues and training improves the chances of a timely cost-effective completion. Achieving a perfect 10 may result in delays and considerably higher costs.

Data Mapping and Transformation Phase:

Complex Data Mapping requirement : Typically, there are multiple source systems involved and one-to-one mapping is a remote possibility. Lack of documentation or out-of-date documentation of source and target system schema could lead to erroneous mapping logic based on assumptions that could later result in significant rework, in future. This is particularly true for older products which are no longer sold.

Product Rationalization Challenges: During transformation, it is not uncommon to have multiple insurance plans/products merged into one product or vice versa because of simplifications which the business wants or change in the business strategy. This results in a change in data model, rating calculation, clauses, warranties etc. Product rationalization requirements may also arise due to mergers & acquisitions or to reduce maintenance cost of a product which is no longer sold. Making the legacy data fit into revised product structure without loss of benefit to the existing policy holder is a challenge.

Basic differences in rounding and order of operations could result in policy value mismatch over a period of time. Workarounds available are to agree on an acceptable tolerance limit or to apply rate adjustments to match the premiums.

Loading & Reconciliation Phase:

Loading scripts from staging to application database: Many a time, the data model is updated, however the scripts are not properly updated by product vendor resulting in failure of data load.

While customizing application data model, internal loading scripts from staging to application database, also needs to be updated.

Quality Control Constraints: Reconciliation of financials such as Gross and Net Premium, Taxes, Commissions etc. is a big challenge due to various factors in calculation logic and many other issues. Conventional approach undermines the importance of testing the migrated data in target environment, integrated with upstream and downstream systems. To achieve predefined timelines, level of testing is compromised, which puts the whole project in jeopardy.

Managing Cost over a Shifting Timeline: A common challenge in a migration project is increase in cost of migration due to extended project implementation timelines.

Migration Event-specific Window: Final movement of data from legacy to new system needs a specific time window and system is usually down during this time. This leads to sales and customer service issues. A weekend movement when customer traffic is less being usually recommended. Coordinating Go-Live with various stakeholders within the company and external stakeholders and interfacing to ensure a smooth transition experience for agents and policy holders.

Each of the above risks and challenges needs to be identified and a mitigation strategy should be planned towards the beginning of the project itself. Having considered these, it is not that there will not be any challenges in a migration project, however some of the basic ones can be overcome to ensure timely completion of the project.

Migration commands attention and it is fun to work with new challenges in every project.

Posted by :

Premgopal Nair

premgopaln@hexaware.com

Contribution by:

Satish kumar Shukla

SatishkumarS@hexaware.com

Related Blogs

Modernizing Legacy Insurance Systems: A Unified and Phased Approach to Becoming Truly Digital

- Insurance

Co-Pilots and Agentic AI in Insurance: Delivering Excellence Across the Underwriting Value Chain

- Insurance

Generative AI in Claims Processing: The AI Station for the Claims Ecosystem

- Insurance

- Generative AI

Agentic AI in Insurance: Transforming the Industry with Enterprise AI

- Insurance

- Generative AI

How Agentic AI is Transforming Pharma Sales: Hexaware’s Agentic AI Solutions

- Life Sciences & Healthcare

- Generative AI

Generative AI in Insurance: Transforming Challenges into Opportunities

- Insurance

- Generative AI

Ready to Pursue Opportunity?

Every outcome starts with a conversation