Hexaware Acquires SMC Squared, a Leader in Building Global Capability Centers-Rolls Out GCC 2.0 Service Line. Learn More

This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

The Legacy Contract Killer: Insuring Outsourcing Service Providers

Imagine this. You have a job. Now, you are quite skilled and adept with the work practices of the current industries and best practices. In this way, you give the job a great couple of years. You create cost savings for your employer and deliver great service. As time goes on, you start to gain trust of your employer and can now afford to relax without being truly exceptional.

Sounds like fun, doesn’t it? We’d all love to be in that place and have an employer like that.

Now swap yourself out with your IT and BPO outsourcing service provider. See what I mean? A majority of legacy contracts provide little in the way of transformation apart from insuring the service provider against loss in revenue. Outsourcing has changed unimaginably over the last two decades with the latest technology being trotted out to win multi-million dollar deals and with capabilities ranging from deep learning to computer vision, RPA to machine learning. Yet the penetration in service delivery remains far removed. Why then, despite clear evidence of these capabilities being possessed by your service providers?

There are multiple reasons, a few of which are enumerated below:

- FTE based pricing: Need I say more? With revenue pressures and shareholders having quarterly trials of fire, how can you reduce your guaranteed revenue through automation? Some clients were able to drive a bargain, with negotiations on cost. However, the deeper issue that has merely been put off is that processes remained as they were for years and years.

- Enterprise footprint: Service providers are so thoroughly embedded in the enterprise that they can get by, while showing results in some areas and letting the others drift. Old relationships and long contracts are particularly conducive to this slacking off in terms of transformational focus.

- Account showcase: Its incredible how many billion-dollar customers I’ve talked to that feel ignored by their service providers. IT and BPO outsourcing Service partners are driven by a focus to have some signature showcase accounts with the reality that most of their engagements do not see much, in the way of transformation.

That seems like a formidable bunch of problems. But insurers being heavy on outsourcing acumen have already started to turn things around. More and more contracts are being renegotiated and answers are being sought from complacent service providers. I must reiterate here, it is not a question of capability to transform operations but the willingness to do so. Legacy contracts were negotiated when machine learning and robotic process automation were distant specks on the horizon in operational terms. This ensures a hindrance in transformation as financial contractual considerations in the past did not account for the speed of change that technologies have enabled.

As with each industry, there are laggards and there are leaders. Same is the case with the insurance world as well.

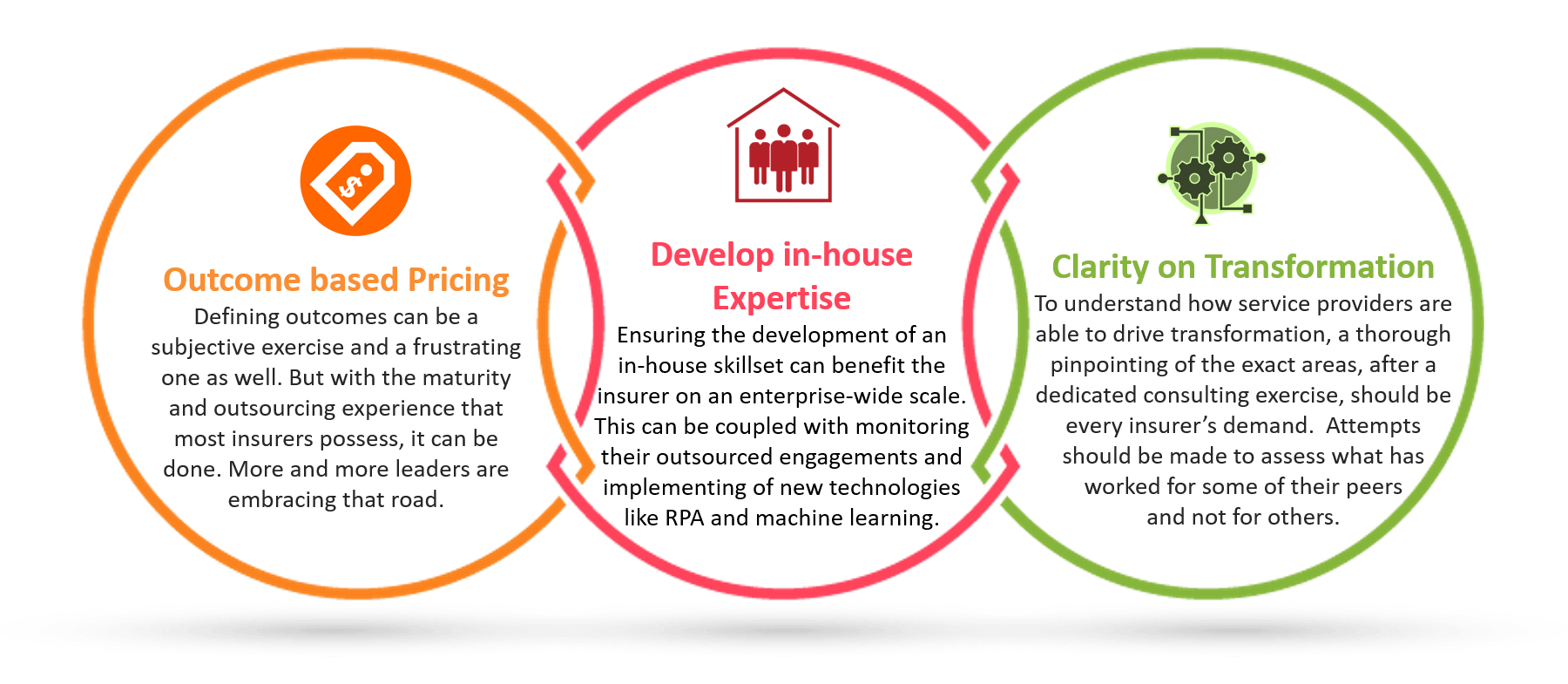

Here are some practices followed by insurance leaders:

A detailed vendor due diligence must be carried out to ascertain the operational and technological excellence, through an analysis of the vendor’s other customers, technology investments etc.

This is not an attempt to decry some of these contracts. There have been some great transformation journeys that have revitalized operations and client cost bases. Times are changing though and cost pressures are as pronounced as ever. So is the need to go digital.

A key part of Hexaware’s strategy has been to enter accounts through aggressively automating operations. This has been a notable success for us primarily due to complacent incumbents, who have been unable to drive digital transformation for their clients. A major case in point here was an engagement we undertook with a European bank and insurer, where we were selected over a much larger incumbent to be the partner-of-choice for their automation journey. We set up a Centre of Excellence and have been successful with over 12 bots live, across two tools and multiple legacy applications. We have a broad suite of insurance operations services that incorporate automation with operational expertise to deliver benefits to our customers.

Our Approach:

Hexaware has been able to transform insurance operations for many of our customers by bringing in levers such as process excellence, robotic process automation and machine learning through our targeted and effective solutions.

Our delivery excellence has led to us being ranked as ‘High Performers‘ by HfS in their Insurance as a Service report. We have worked with insurers across the globe for over 20+ years future proofing and transforming operations.

This is the 3rd part in our series, the Brave New Insurer, focusing on navigating the choppy waters of digital disruption in insurance operations.

Related Blogs

Modernizing Legacy Insurance Systems: A Unified and Phased Approach to Becoming Truly Digital

- Insurance

Co-Pilots and Agentic AI in Insurance: Delivering Excellence Across the Underwriting Value Chain

- Insurance

Generative AI in Claims Processing: The AI Station for the Claims Ecosystem

- Insurance

- Generative AI

Agentic AI in Insurance: Transforming the Industry with Enterprise AI

- Insurance

- Generative AI

Generative AI in Insurance: Transforming Challenges into Opportunities

- Insurance

- Generative AI

Ready to Pursue Opportunity?

Every outcome starts with a conversation