This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Self-Service API is the New Way to Insurance Digital Transformation?

Digital transformation has brought about accelerated changes in the insurance industry by offering personalized insurance services, connected homes, connected auto, mobile and wearable devices. Amazon and Airbnb have raised the bar of customer satisfaction by offering next-gen services, thus allowing today’s customers demand similar experiences from insurers.

Building the Digital Technology Foundation in Insurance

The insurance industry has been slow in adopting innovation. As per a leading industry analysis, 74% of insurers lacked internal skills and technology foundation to drive digital innovation. However, now insurers are looking beyond traditional products and services, for simple, transparent products and true value in their relationships.

Insurers are striving to digitally transform customer interactions, enabling customers to get information dynamically faster, within a limited waiting time. They are looking to deliver core insurance services such as submission, policy changes, claims intake across multiple channels, in a relatively short time.

Implementing any changes or enhancements to the tightly integrated core packages and portals would burden the whole IT landscape. This necessitates the bringing in of composable services, which can be reused across multiple channels and platforms.

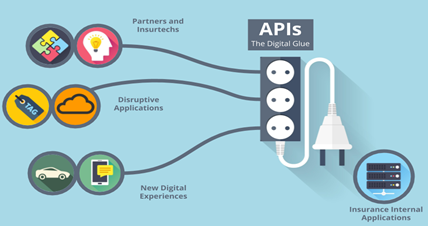

Insurers are embracing APIs to bring together multiple data sources in a flexible, reliable, and cost-effective manner.

Accelerating Digitalization through APIs

API technology is a smart way to introduce digital innovation and transformation to the insurance industry, allowing insurers to securely expose data and services to varied businesses, attracting new clients. Insurers can recommend personalized products and services to customers, based on their digital footprints, through API framework. Data can be shared across any device, any channel, at anytime and anywhere including web, tablet, mobile form factors, voice assistant engagement and chatbot interactions using APIs. As per MuleSoft’s 2017 connectivity benchmark report, 94% of IT leaders say they can deliver new products and services to market faster with APIs.

Leveraging the Right Type of API

Choosing the right API and designing it to work effectively, will give the desired benefits.

The best approach for enabling digital transformation is by building and managing APIs with a three-layered API architecture (System API, Process API and Experience API) to enable maximum reusability and agility.

- Experience API: These APIs are user interface specific catering to multiple subscribers, for e.g., CRM system, Voice and Chat Robots, Telematics and other IoT devices, Portal and Mobile apps etc. A new interaction level layer needs to be created when new channel is forayed.

- Process API: This allows you to design orchestration across processes e.g., Quote, Claim Status, Claim Recovery etc. Any new channel needs minimal customization to the orchestration layer.

- System API: System API helps in service integration with core business functionalities, for e.g., Submission, Policy Change, Renewals, Claims Intake, Claim Reserve etc. There is no change needed while exposing the system APIs to a new channel of service. Vendors like Guidewire have developed reusable enterprise edge services which enables faster digital enablement for insurance organizations.

Transforming your Business through APIs

APIs hold great potential for Insurers in their digital journey. For digitalization to be successful, an effective API strategy must be in place. APIs help in empowering an ecosystem of related service partners like banks, motor dealers, independent agents, MGA’s and brokers, enabling them to deliver digital offerings and services to their clients. It has also resulted in accelerated transaction efficiencies like leaner claims and underwriting cycles, digitalization of back-end systems, with fewer corrections.

CIOs and CTOs have already geared up to deliver robust API-driven strategies and have significantly reduced the cost of product distribution while addressing high-cost growth constraints.

Posted by :

Tapas Vyas

TapasV@hexaware.com

Ranu Nagdia

RanuN@hexaware.com

Related Blogs

Modernizing Legacy Insurance Systems: A Unified and Phased Approach to Becoming Truly Digital

- Insurance

Co-Pilots and Agentic AI in Insurance: Delivering Excellence Across the Underwriting Value Chain

- Insurance

Generative AI in Claims Processing: The AI Station for the Claims Ecosystem

- Insurance

- Generative AI

Agentic AI in Insurance: Transforming the Industry with Enterprise AI

- Insurance

- Generative AI

How Agentic AI is Transforming Pharma Sales: Hexaware’s Agentic AI Solutions

- Life Sciences & Healthcare

- Generative AI

Generative AI in Insurance: Transforming Challenges into Opportunities

- Insurance

- Generative AI

Ready to Pursue Opportunity?

Every outcome starts with a conversation