This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Re-examining the Value Chain – An essential step towards Automation and Digitization in Corporate Action

Financial Services

February 13, 2019

The digital age has forever changed the way banking and financial services offer and build products in the near future. Fintech players are rapidly disrupting traditional banking methods with newer business ventures. These shifts in traditional methods have urged the financial industry to rethink their core business models and navigate ways to incorporate digital solutions. Identifying new areas to cut cost is no longer viable. The key question that arises is – can digital technology solutions propel top-line growth? To address this, many firms have responded to the changing landscape by rolling out aggressive digital transformation initiatives.

There is a sharp contrast between bold visions of the digital future and the immediate challenges that organizations face in managing digital transformation programs. Most digital transformation models are proving to be ineffective as they either fail to exploit the full potential of technological upgradations or are unable to sustain the novel nature of these initiatives. It is clear that, banking and financial organizations still lack internal capabilities to change, build and respond to the fast-paced digital world.

Introduction to traditional Corporate Actions (CA)

A corporate action is best defined as an event initiated by a public limited company that will bring an actual change to securities—equity or debt—issued by a company. A CA is typically agreed upon by the board of directors and is authorized by shareholders. Some of the common corporate actions are dividends, stock splits, mergers and acquisitions, rights issues, and spin-offs. As an after-effect of a CA, there can be an increase in the position holder’s securities or cash position, without altering the underlying security. An example of such an event would be the issuance of bonuses.

Keeping pace with surging CA Announcement Data Volumes

The volume of CA related messages have grown significantly. According to a result from the DTCC/SWIFT corporate action survey, the intermediaries have handled over 4.5 million separate messages per year. With the growth in the financial markets and the number of companies listed on stock exchanges that have gone up by over 41% in the last decade. The volume of CA events are likely to grow. Statistics around CA shows an average data growth by 12% annually, resulting in an overwhelming growth in the influx of complex manual processes. There is a strong case for rethinking CA process automation. Will digitalization and automation of CA processes in silos hold the key to address this industry challenge?

Corporate Action digitalization – Revisiting the Investment Management value chain

While creating the digital roadmap for CA processes, analysis of the end-to-end investment management value chain should be the starting point. Re-examining and analyzing the value chain not only uncovers the potential areas for intelligent automation, but it even helps in identifying the right stakeholders that should participate in the program. Additionally, this exercise establishes the impact of including all relevant external and internal factors.

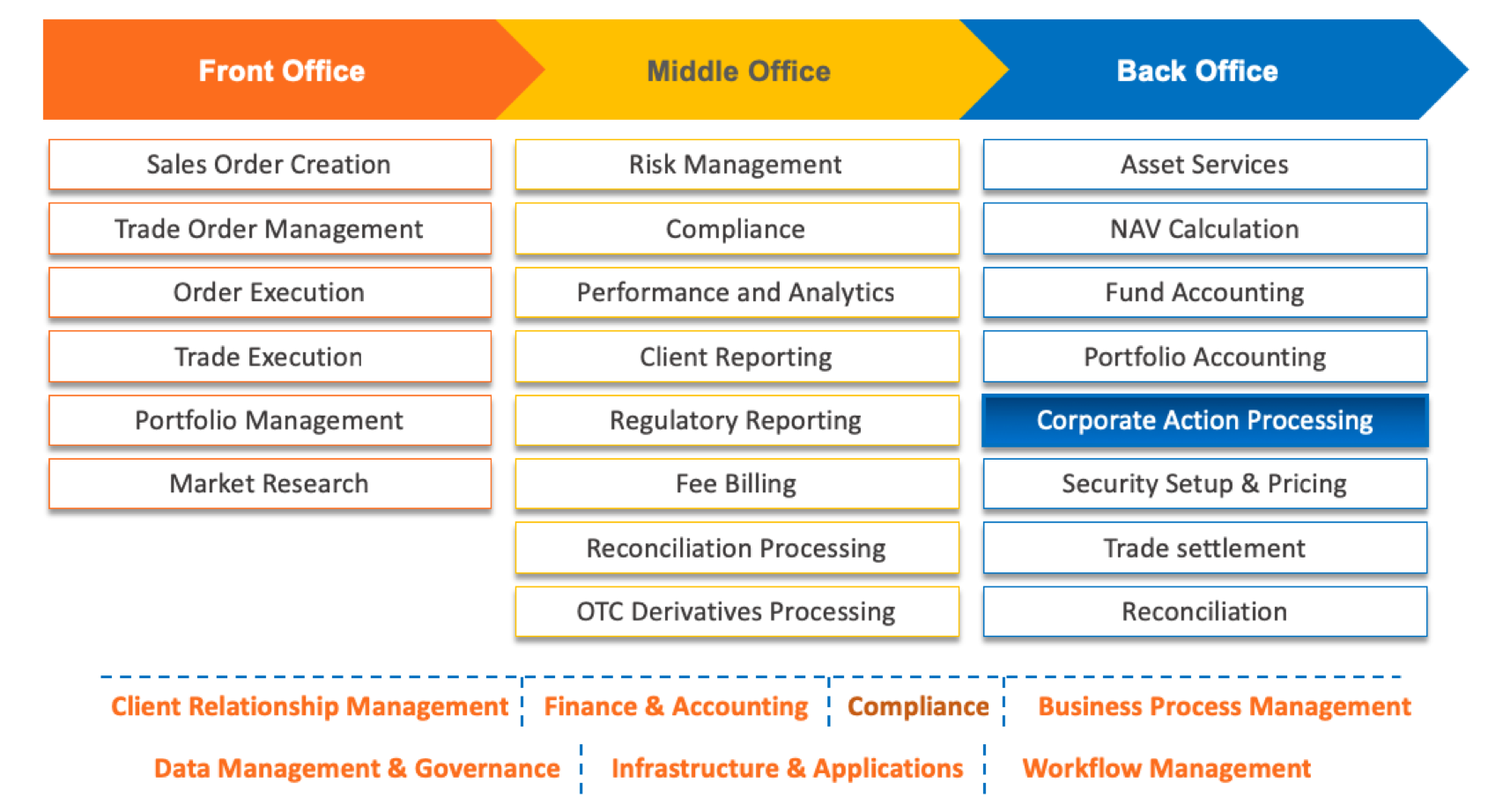

Figure 1. depicts the key role Corporate Action play in the investment management value chain. While creating the digital roadmap for CA, it will make sense to take a holistic view, considering all the Front-office (FO), Middle office (MO) and the Back Office (BO) activities.

Finding the right Digital Model

To create the best fit Model, specific areas where digitalization can bring maximum value should be prioritized first. Organizations generally overlook external factors like market trends, regulations, competitor analysis and internal factors like end-to-end view of the value chain, top pain areas, inefficiencies in process flow, potential to redefine the data usage etc. It is critical to not overlook the inter-dependencies. E.g.: the effectiveness of the OTC derivatives processing in Middle Office is dependent on the trade order management platform in the Front Office, as well as, the security setup and pricing process in the Back Office. In addition, all these functions are strengthened by a good IT infrastructure and effective data governance.

Are modern day Corporate Action processes harnessing automation?

The magnitude of manual activities and inefficiencies in CAs hinder the organization’s goal to create an enterprise-wide digital transformation. For e.g., as CAs reshape or restructure the beneficiary’s underlying securities position, they often result in a cash payout, the issue of rights, subscriptions, etc. followed by a magnitude of transactions.

Top challenges in traditional CA processes:

- CA announcement data is not always standardized and structured, often causing manual efforts for further investigation and verification.

- Notifications, reconciliations with external parties are iterative and mostly manual.

- Recurring reconciliation issues with external parties is a norm. E.g. claims processing at times takes 90 days or more in case of disputes.

- Incorrect or untimely processing potentially causes operational problems and financial exposure.

Not surprisingly, very little automation on voluntary events and complex mandatory events have been achieved. To ensure CA processes are in complete harmony, the digital strategy should encapsulate all the factors – internal and external and yet be feasible.

Applying Value-Stream Mapping to Corporate Action processing

Hexaware provides automation opportunities across the investment management value chain by transforming the front, middle and back office operations.

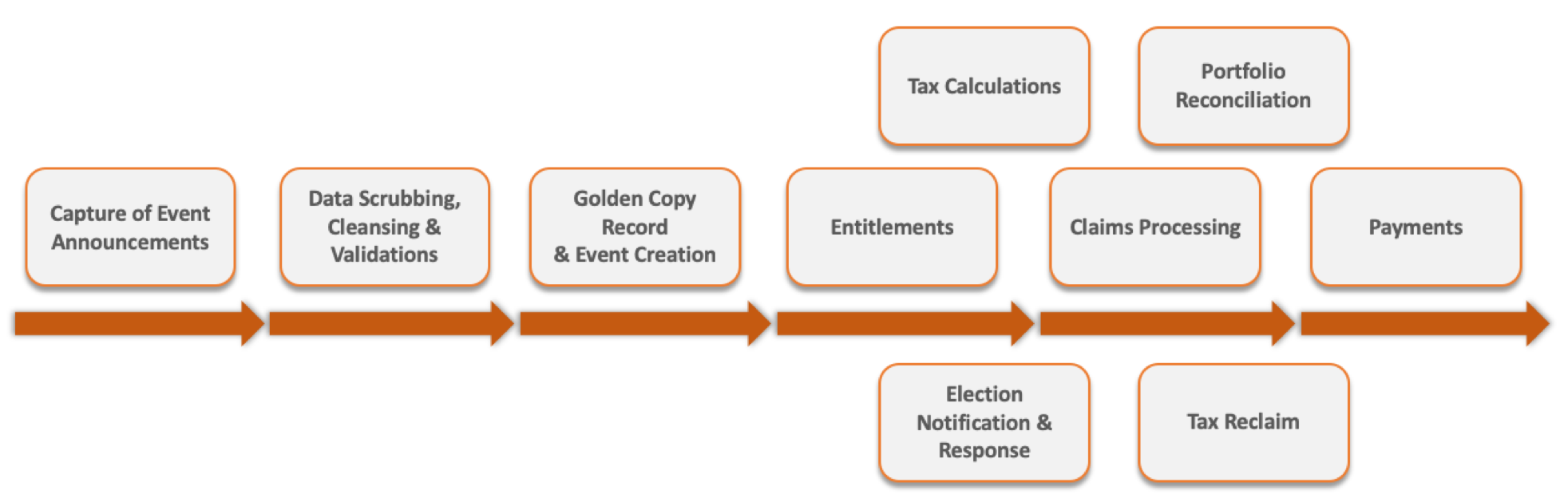

In order to digitalize CA processes, Hexaware’s banking and financial services experts propose creating a value-map, which breaks down processes into various value-stages and identifies the potential for using the Hexaware’s automation techniques. Going with the same approach, the value chain should be looked at end-to-end. Each block should be revisited with detailed activities listed down. Activities with manual intervention or inefficiencies can be researched further. Analyzing the value stream mapping brings out the core areas where digitalization should be done along with the degree to which it is possible. To illustrate how exactly value stream mapping can be useful in identifying the digitalization potential in a business function, let us take the below figure as an example:

Hexaware’s Digitalization & Automation approach for complex CA processes

Once the value stream mapping is established, Hexaware recommends the below automation levers to bring viable results across CA processing:

- Unstructured data that is sourced can be auto-processed and integrated with the golden copy creation process using Hexaware’s natural language processing and machine learning

- Our intuitive chatbots can enable a superior customer experience

- Election response by customer can be determined by using our predictive analytics, auto-notified to the customer and the customer’s response can then be auto-captured

- Manually intensive and time-consuming processes like claims processing and tax reclaims can be automated using Hexaware’s solutions on RPA tools

As there are millions of CAs per month that require significant degree of human intervention, being able to automate these complex activities is a major step towards streamlining the process and further improving the customer experience. Furthermore, the same automation and digitalization principles can be applied to any other process within the investment management value chain. The right technology provider is the one that offers a collaborative model and empowers its client with continuous innovation opportunities.

For more information, please contact us at marketing@hexaware.com. We will be glad to assist you.

Related Blogs

Generative AI in Financial Services: Transforming Goal-based Financial Planning

- Financial Services

- Generative AI

Six Frameworks for Financial Services Modernization

- Financial Services

- Generative AI

KYC Process in Wealth Management: Digitalization Benefits

- Financial Services

Composable Enterprise Model: Unlocking New Growth Opportunities in Financial Services

- Financial Services

Generative AI in Financial Services: Reshaping Business Value and Customer Journeys

- Financial Services

- Generative AI

Revolutionizing Wealth Management: The Gen AI Advantage

- Financial Services

- Generative AI

Gen AI: A Game Changer in Bond Investment through Risk Assessment

- Financial Services

- Generative AI

Transforming Asset Management: The Power of Gen AI

- Financial Services

- Generative AI

Empowering Financial Institutions in the Digital Era: How Generative AI is Reshaping Business Value and Customer Journeys

- Financial Services

- Generative AI

Ready to Pursue Opportunity?

Every outcome starts with a conversation