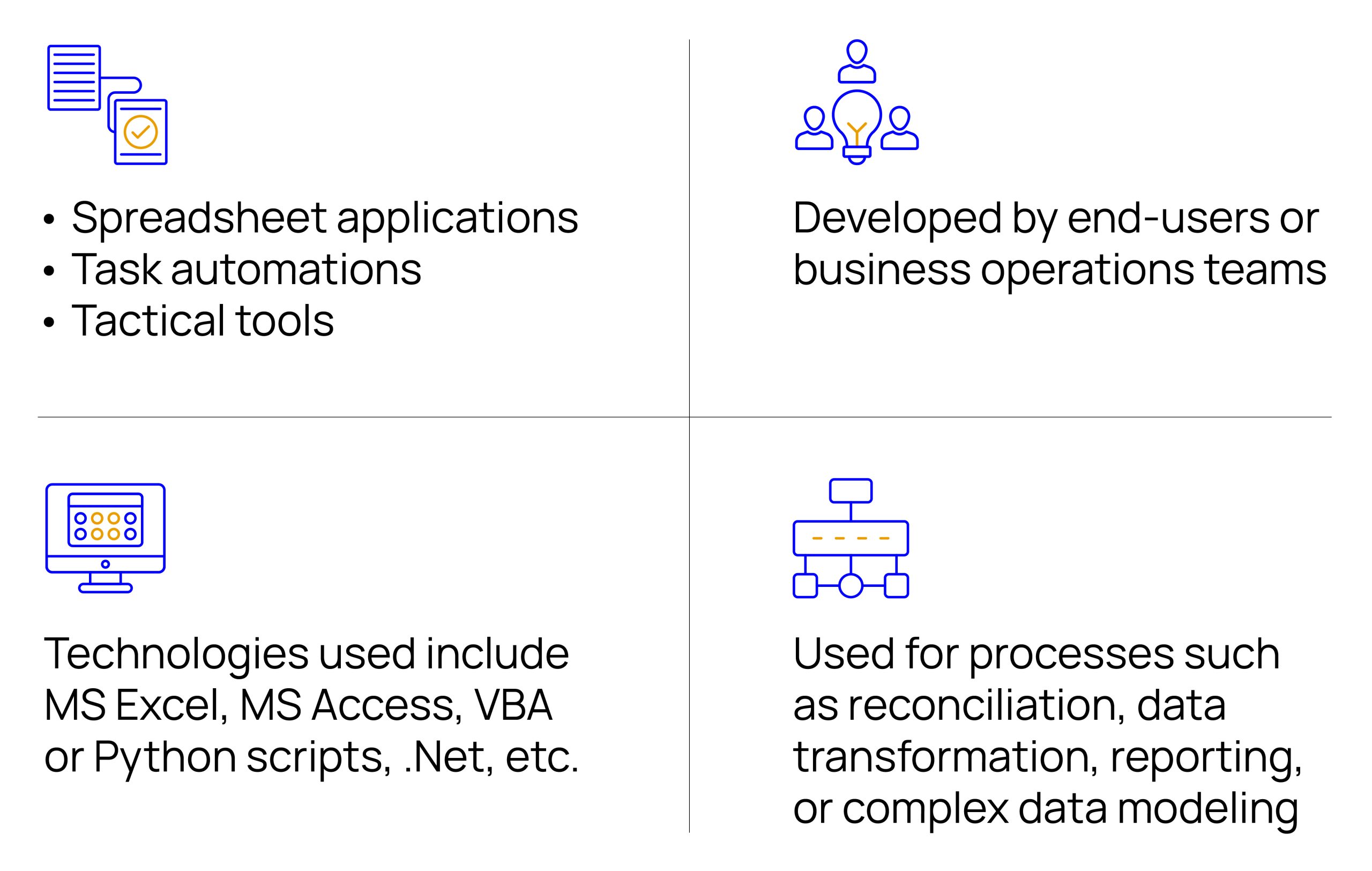

Hidden EUC Risks in Everyday Business Tools

Let’s be honest, most of us have leaned on a trusty Excel macro or a quick Python script to get things done. These end-user computing (EUC) tools are the unsung heroes of daily operations. Built by business users themselves, they’re fast, flexible, and incredibly useful when you need to solve a problem quickly. But here’s the catch: they often live outside the safety net of IT governance. That means no formal checks, no backups, and no documentation. It’s like building a house without a blueprint. This makes EUC remediation essential, especially in industries such as banking and back-office operations, where the risk can be immense.

Here are some of the risks lurking beneath the surface:

- No formal workflows or governance: EUC applications are rarely built with standardized processes. This opens the door to inconsistencies and errors.

- Prone to corruption and manipulation: Without version control or backups, one wrong move can wipe out critical data.

- Lack of documentation: When the creator leaves, their knowledge often leaves with them. What’s left is a tool no one fully understands.

- Regulatory non-compliance: End-user computing remediation is crucial because these tools can easily violate the General Data Protection Regulation (GDPR) or Sarbanes-Oxley Act (SOX), especially when handling sensitive data.

And if you think these risks are rare, think again. Studies show that nearly 90% of spreadsheets contain errors.

Why EUC Remediation Isn’t Optional Anymore

EUC applications often sit at the heart of critical processes, including finance, compliance, reporting, and even customer data management. If they fail, the ripple effect can be enormous. Imagine a financial analyst relying on a spreadsheet to calculate quarterly results. A single formula error could distort the numbers, leading to wrong decisions at the board level. Or picture a compliance officer using a macro to track sensitive data. If that macro breaks or mishandles information, the organization could face regulatory fines and reputational damage.

EUC Applications: A Snapshot

The risks of unmanaged EUC applications aren’t just theoretical; they’re hitting businesses where it hurts—the bottom line. For example, US bank regulators have imposed fines worth $400 million and $136 million on Citigroup for data management issues. Apart from losses, there’s also a recurring cost to maintain, audit, and correct EUCs. According to a Mitratech whitepaper, the ongoing operational cost per EUC is ~US$400/month, assuming 100 operational EUCs, with ~8 hours/month of effort per EUC (for users managing, fixing, and updating them) and a cost rate of US$50/hour.

EUC remediation solutions, hence, are a business necessity. By cleaning up and securing EUCs, companies can:

- Protect sensitive data from unauthorized access.

- Stay compliant with regulations and avoid legal trouble.

- Prevent operational disruptions caused by outdated or broken tools.

- Build trust in data by ensuring consistency and traceability.

- Boost efficiency by ensuring teams spend less time fixing errors and more time focusing on growth.

- Enable scalability by allowing businesses to expand without worrying about fragile, undocumented tools that could fail.

In short, end-user computing remediation helps organizations regain control and establish a stronger, safer digital foundation.

Hexaware’s End-to-end EUC Remediation Framework

At Hexaware, we’ve built a solution that does more than just patch the problem. Our EUC remediation framework is a comprehensive, scalable approach that turns EUC chaos into clarity.

Here’s how it works:

- Stage 1—Accumulator: Maps out all EUCs across departments, giving full visibility into what’s out there.

- Stage 2—Remediator: Identifies risky EUCs and either eliminates or re-engineers them to be secure and compliant.

- Stage 3—Accelerator: Uses AI, NLP, and RPA to automate and speed up the entire remediation process.

- Stage 4—Assimilator: Smoothly integrates remediated tools into everyday operations so teams can keep moving without disruption.

And it’s not just about technology. Our framework includes:

- Fast identification and classification of EUCs.

- Automated generation of business requirement documents using GenAI.

- Custom remediation strategies based on risk and complexity.

- Seamless integration with platforms like Xceptor and MultiFonds.

- An agile POD-based delivery model that scales across teams and geographies.

It’s a future-ready approach that doesn’t just address today’s problems; it lays the foundation for tomorrow’s governance.

Agentic AI for EUC Remediation

For years, companies have attempted to control EUCs through manual audits or rigid automation. These efforts help, but they’re often slow and reactive. They catch problems after they’ve already caused damage. What’s needed is something smarter, faster, and more proactive. That’s where agentic AI comes in.

Agentic AI transforms EUC remediation from a reactive clean-up exercise into a proactive governance model. Think of agentic AI less like a tool and more like a colleague who’s always watching out for you. Instead of waiting for instructions, it takes initiative. It scans for risks, evaluates their impact, and addresses issues before they escalate out of control.

Here’s how it makes a difference:

- Finding what’s hidden: It continuously uncovers EUC applications across the organization, even the ones no one remembers exist.

- Judging context: Not all EUCs are equally risky. Agentic AI weighs the EUC’s importance, regulatory exposure, and business impact before taking action.

- Fixing problems on the fly: It can repair corrupted files, restore lost data, or redesign workflows without waiting for human intervention.

- Ensuring compliance: As regulations evolve, agentic AI can update governance controls in real time.

- Working with people, not against them: It can explain its decisions, offer recommendations, and learn from feedback to get better over time.

EUC Remediation Benefits

Hexaware’s EUC remediation framework delivers real, measurable results. Clients who’ve adopted it have seen:

- 30–45% faster remediation timelines, meaning quicker risk reduction and smoother operations.

- 25%+ cost savings, thanks to automation and streamlined processes.

- Scalable delivery, with domain experts tailoring solutions to each organization’s needs.

- Accelerated transformation, using AI to modernize EUC applications and future-proof systems.

Hexaware helps businesses take control of their EUC applications, reduce risk, and unlock new levels of efficiency and compliance in back-office operations. Reach out to us at marketing@hexaware.com, and we’ll be glad to provide a demo of our EUC remediation solution for your organization.