This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Empathic Banking: Customer Engagement through Conversational AI

Business Process Services

August 23, 2021

Customer experience/engagement done right can make all the difference not only to the bottom line, but also the institutional reputation. The scope of customer engagement is not limited to sales, support, or services but it is a continuous exercise by brands anticipating customers’ needs and keeping in touch with them. In this blog we will focus on customer engagement through conversational AI platforms.

Virtual assistants as a self-service channel are evolving rapidly. People are interacting with some form of conversational AI in their day to day life whether it is the built-in voice assistant OR the smart speakers ( Alexa echo, Google Home) in their homes that allow various features such as remote temperature control in rooms, music and banking services etc.

The conversational data from these channels (over time) provide a rich source of information, to predict or even steer the course of the conversation. There are also many open source libraries that can be tapped into to craft conversational journeys that strike a chord with the user.

When a user comes to the conversational channel the first couple of utterances can give insights into their mindset at that point in time.

If they start with a relaxed ‘Hello!’ followed by ‘Can you help apply for a loan? Or ‘ What is the annual fee on Signature credit card’ , system can understand that the user is in a discovery mode and respond with matter of fact responses, ‘Our signature credit cards are by invite only and we don’t charge our users for the first 2 years’. Adding a dash of humour also helps to engage the user better.

Now imagine the user is rushing in with an utterance like ‘hey! I just found out my card is not with me. I should have dropped it somewhere. What should I do?’. This will not be the time for bells and whistles. Rather the system should directly address the issue to make the user feel safe about banking with you by saying “Relax! I have got your back. I am going to place a temporary block on your card ending 5677. Unless you let me know otherwise, this will be converted to a permanent block in 24 hours and a new card will be issued to you. Shall I proceed?” and take a confirmation.

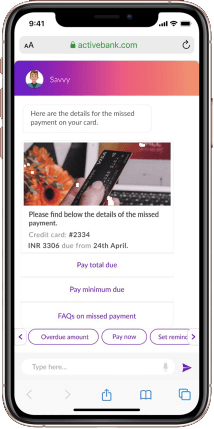

Another case in point is collections in consumer lending. The pandemic induced stay at home working parent is all the more likely to miss one or two due dates for bills. A non-intrusive reminder message ahead of the due date OR a gentle nudge on having just missed a payment, while keeping their honor intact, will be definitely appreciated.

Other scenarios to make a difference are to understand the sentiment of the user when they want to report a suspicious transaction on their card OR when they are going beyond the budgeted amount on ‘shopping online’. I guess most people would prefer option B anytime, compared to the rudimentary message in option A

A: You have spent $30 more on Amazon & Walmart combined already in this month

B: Your spending on online shopping is $30 more than the budgeted amount. This could impact your Paris holiday savings goal. Let me know if I should bring that up for edits

Owing to the unstructured nature of the conversational AI enabled interactions, it is quite possible that the system does not always completely understand what the user is asking or instructing. At these times, it is important to respond with a suitable message like “At the moment, my training does not allow me to respond appropriately. Kindly consider rephrasing your request” rather than just saying “I am sorry! I do not understand”.

We can also consider adding suggestions that closely resemble user requests likefor ex: user asked a question like ‘ How can I open a health savings account?’ . If there are not relevant trained questions, the system can respond like

| “I am currently not trained on this request. However, kindly check if some of these suggestions are useful “ |

| How do I open an IRA? |

| Can you help me to open a checking account? |

| How can I get health insurance? |

Users should also be guided with actionable buttons (Call to Actions or CTAs) wherever feasible. This will lead them on a guided journey. A user who is more chatty can always provide the equivalent input in the form of text

Ex: When the system responds with a message and CTAs ‘Yes’ & ‘No’ , the system should interpret a “Sure” typed out by the user as ‘Yes’.

In short, an assistant should be a good listener and demonstrate an effort to understand what user is trying to communicate by doing one or more of the following

- provide options to user to choose and help disambiguate

- paraphrase to clarify in case user input is only partially clear

- keep track of the conversation and make logical inferences wherever possible

- be aware of how the conversation is shaping and proactively suggest interventions like a web link, video or live chat handover

We should realise that we are living in a highly distractible environment and allowing users to pick up conversations from where they left (across channels) will help build trust and confidence.

About the Author

Subramanian Ganesan

Read more

Related Blogs

From Manual to Machine: Maximizing Cost Savings with Intelligent Process Automation

- Business Process Services

Achieving Cost Efficiency Through Global Business Services Strategy

- Business Process Services

Generative AI for Marketing: The Future of Cost-effective Engagement

- Generative AI

- Business Process Services

Unlocking Generative AI for Hyper-personalized Customer Experiences

- Generative AI

- Business Process Services

Executive Administration Services: BFSI’s Right-hand Partner

- Generative AI

- Business Process Services

Generative AI in Customer Service: Going Beyond Traditional Chatbots

- Generative AI

- Business Process Services

Generative AI for Content Creation: The Future of Content Ops

- Business Process Services

- Generative AI

Fund Services Back Office Digitalization: A Transformation Long Overdue?

- Business Process Services

Mastering Customer Service Experience: Strategies for Success

- Business Process Services

The Rise of Omnichannel Customer Service: Unlocking Excellence in Customer Care

- Business Process Services

Ready to Pursue Opportunity?

Every outcome starts with a conversation