This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Digital Banking – Delivering Frictionless Customer Experience

Business Process Services

September 21, 2021

While Financial Institutions, over the last few decades have gradually added self-service digital channels, many institutions even today face challenges in those being adopted by their end customers.

Barring certain exceptions, such interfaces have not been able to deliver value to its true potential. The reasons attributed for this conundrum would lead to aspects, including the following:

- Friction in even getting started: There are inherent friction points when it comes to Mobile Apps. Customers have to overcome several of them, from discovery of the app through registration and then getting started with the same. Many customers would prefer to go through these only for their primary institution alone. Some institutions have developed partnerships with OEMs to reduce friction w.r.t discovery of the app itself, ex.: BBVA and Xiaomi have tied up to offer BBVA Mobile Banking Application pre-installed in Spain to the users, without having to download it.

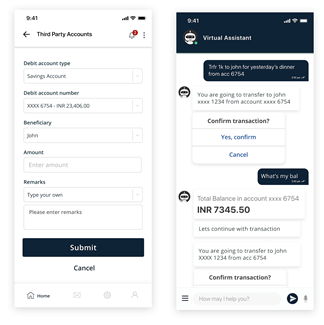

- Design and Experience: These are cornerstones which determine how a customer perceives an institution and hence engages more with one over another. The limited amount of real estate on Internet Banking and in particular Mobile Banking enables only Limited menus to be available upfront. This at times leads the customers to directly pick up the phone and call the contact centre if anything more than the upfront menu options is needed. Additionally, digital banking channels, if not designed intuitively, have a learning curve for the customer. Moreover, as new features are made available or if the user interface is updated, then again the customer has to go through the same journey all over. For certain features, which are not obvious, the resource guides & support manuals are at times not updated as the interface on mobile or Internet Banking changes, which keeps customer guessing how to access what they need.

- Too technical and bulky: Internet and Mobile Banking don’t appeal to non tech savvy users. Moreover millennials & Gen Z don’t want to download yet another mobile app, when many of them are hogging for space on their phones. This is where it becomes far more pertinent to have a touch point which is simple, light and relevant for the customers.

- Generalised for everyone: Today’s customers are addicted to feed based interfaces like Instagram, Facebook, Twitter, which are very dynamic and are continuously updated rather than be monotonous and constant. Personalization and customer centricity is what today’s customers want and look forward to.

Recent times have seen upsurge of Conversational channels which started off more on the personal and social side of consumers but now are being enabled for businesses. Channels starting from WhatsApp, FB Messenger to IOT devices like Alexa and Google Home enables Businesses to connect with their end users completely friction free. With extendibility to multitude of other conversational channels, the variability of region level adoption of such channels is as well taken care of.

Additionally, the conversational interface can enhance engagement on the existing digital assets of Financial institutions as well and complement them.

Mobile Banking: Conventional Interface v/s Conversational Interface

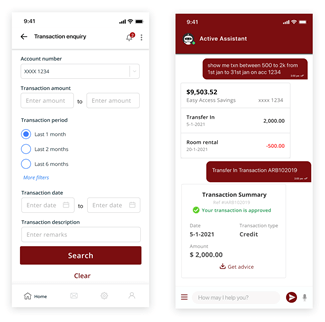

Conversational interfaces have instantly given a lot of power to Financial Institutions to be available to its customers where they are. Advancements in AI have enabled this connect to happen in customer’s language, words, tone and dialects. It can’t get more customer centric than this. As a result, many institutions have seen huge adoption of such interfaces amongst its customers.

- 95%+ of total incoming customer enquiries at one of the large digital bank in China is served by the Chatbot

- In 2020, Bank of America’s AI-driven virtual financial assistant – Erica has helped more than 7 million new clients and helped clients with over 135 million requests

The complete conversation data moreover enables the Financial institution to be much more aware of their customers and be more insightful and personalised when they interact with the customer next. The future, in the conversational AI space will unfold many more use cases around Automated IVR, Automated email, content summarisation and Emotive AI, all of which will start with the base implementation of conversational AI.

The big tech players are known to WoW the end users when it comes to experience and hence, here lies an opportunity for the Financial Institutions to ride on experience delivery of such players and use that to power their Product and Service delivery. This intersection of domain and tech, powered by AI, is certainly inclined to go long haul and deliver value to the real potential of self-service digital channels and beyond.

What’s in a Name! Digital Banking Channel by any other name would only serve to enhance Customer Experience! After all what matters is not the name, whether its Multi-channel, Omni-channel or Opti-channel, what really matters is whether ‘Are the Financial Institutions available to their customers where they are and how they want it to be’ !

About the Author

Ashutosh Nautiyal

Read more

Related Blogs

From Manual to Machine: Maximizing Cost Savings with Intelligent Process Automation

- Business Process Services

Achieving Cost Efficiency Through Global Business Services Strategy

- Business Process Services

Generative AI for Marketing: The Future of Cost-effective Engagement

- Generative AI

- Business Process Services

Unlocking Generative AI for Hyper-personalized Customer Experiences

- Generative AI

- Business Process Services

Executive Administration Services: BFSI’s Right-hand Partner

- Generative AI

- Business Process Services

Generative AI in Customer Service: Going Beyond Traditional Chatbots

- Generative AI

- Business Process Services

Generative AI for Content Creation: The Future of Content Ops

- Business Process Services

- Generative AI

Fund Services Back Office Digitalization: A Transformation Long Overdue?

- Business Process Services

Mastering Customer Service Experience: Strategies for Success

- Business Process Services

The Rise of Omnichannel Customer Service: Unlocking Excellence in Customer Care

- Business Process Services

Ready to Pursue Opportunity?

Every outcome starts with a conversation