Financial institutions and data always go hand-in-hand, with business units relying on data to generate revenue and derive meaningful insights. However, when data is siloed, unreliable, or excessively voluminous, it can increase business risk, lead to frustration, and fail to provide meaningful insights. Data fabric for financial services is emerging as a vital solution to overcome these challenges, connecting disparate data sources and enhancing access across the organization. Financial institutions are not just looking for data management solutions but for agile, intelligent, and secure architectures that can keep pace with emerging technologies and regulatory demands.

As heightened regulations in capital markets put additional pressure on profit margins, financial institutions are turning to cost-saving measures and efficient data strategies to stay competitive. To navigate these challenges and drive better financial decisions, reimagining data management has become essential. Organizations are now seeking modern, artificial intelligence (AI)-enabled data integration solutions with the ability to mine diverse forms of structured and unstructured data. Data fabric is one such architecture designed to address the unique data challenges in financial services, such as high costs, real-time metadata-driven data sharing, and the complexities of operating across multiple cloud environments. Increasingly, these solutions are leveraging cloud-native technologies and containerization to enhance scalability and agility.

What is Data Fabric For Financial Services?

In simple terms, think of data fabric as a network that stretches across all parts of an organization. Wherever a user is within this network, they have the freedom to access data from any location, with no constraints, and in real-time.

Data fabric unlocks business value by:

- Simplifying data access and ensuring that the correct data is available at the right time.

- Supporting informed decision-making across the organization.

- Enabling seamless data management, regardless of the applications, platforms, or locations where the data resides.

The 5 key pillars of data fabric

- Metadata management: Seamlessly identify, integrate, segment, and share large volumes and varied forms of metadata (technical, runtime, business, social) to enhance data visibility and usability.

- Active metadata analytics: Transform passive metadata into actionable insights using connected metadata and knowledge graph analytics.

- AI-driven infrastructure: Leverage AI/machine learning (ML) algorithms to dynamically deliver optimized data processing and integration workflows as needed.

- Integration backbone: Establish a robust integration framework that supports diverse data sources and scales beyond traditional use cases.

- Automated orchestration: Enable efficient, automated data movement and workflow management to streamline complex data processes.

Why Use Data Fabric for Financial Services?

Capital market trends such as multi-asset trading, private markets portfolio, sustainable investing, and tighter regulations demand a simplified data architecture. Automated data management in financial services can reduce infrastructure and control costs by streamlining data integration, reducing silos, optimizing storage, enhancing compliance, and enabling self-service access. Data fabric architecture addresses these needs by offering centralized access and a unified view of data across the firm. Moreover, modern data fabrics incorporate real-time data streaming technologies like Apache Kafka to handle the increasing velocity and volume of financial data.

It also enables faster extraction of insights while ensuring data security through embedded governance, which is crucial for the highly regulated financial services industry. The need to future-proof processes and offerings is another reason to embrace data fabric. In an era where cybersecurity threats are ever-present, data fabrics are also integrating AI-powered anomaly detection for continuous monitoring and rapid threat response.

With centralized access, security, and embedded governance, the data fabric architecture empowers firms to design well-informed solutions and provide self-service capabilities and personalized financial advice aligned with customers’ financial histories and goals. This personalization is further enhanced by the integration of FinTech innovations, embedded finance, and other digital ecosystems, allowing institutions to collaborate with non-traditional players.

Data fabric architecture can help financial services organizations overcome critical operational and regulatory challenges, enhancing data accessibility, security, and quality across the board. Here’s how:

- Legacy system integration: Many financial firms still rely on legacy systems that are difficult to modernize or integrate with newer platforms. Data fabric acts as a bridge, allowing financial services data from legacy systems to flow seamlessly and combine data from modern, cloud-based solutions without disrupting business operations.

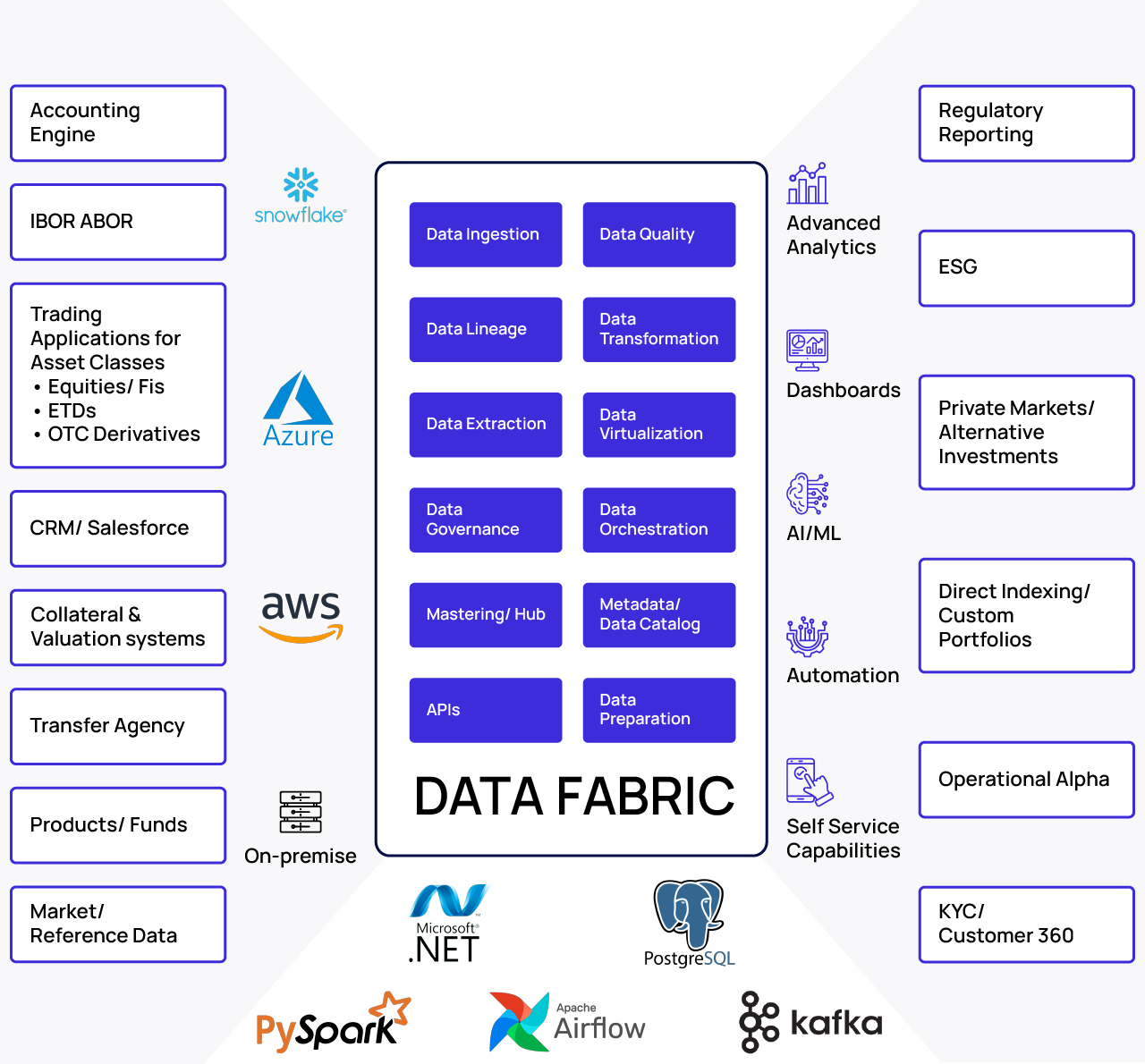

- Unifying diverse data sources: Financial services data is typically spread across different systems (accounting engine, market data, client data, and various users), customers, fund managers, and business system analysts. Data fabric architecture facilitates end-to-end integration, linking these data sources across different cloud environments to create a unified view.

- Enhancing analytics capabilities: Data fabric architecture allows the embedding of advanced tools, such as:

- Natural language processing (NLP) for interpreting and analyzing unstructured data.

- AI and ML for predictive insights and automation.

- Generative AI to automate data insights, enhance customer interactions, and support scenario planning.

- Explainable AI (XAI) to ensure transparency and trust in automated insights, especially in regulated industries.

- Data exploration tools for in-depth analysis and discovery.

Data Fabric Architecture

Benefits of Data Fabric Architecture

Data fabric works best for organizations with geographic diversity, multiple data sources, and complex data challenges. It helps organizations emerge as digital leaders by:

- Ensuring data compliance and managing regulatory complexity: Financial institutions operate under strict regulations, such as the General Data Protection Regulation (GDPR), Basel III, anti-money laundering (AML), etc. Managing compliance across multiple data environments can be complex and costly. Data fabric simplifies compliance by centralizing data governance and providing real-time monitoring and audit trails, making it easier to enforce regulations across data sources. Modern data fabrics are also incorporating privacy-enhancing technologies (PETs) and built-in compliance frameworks to adapt to evolving global standards.

- Improving decision-making: In fast-moving markets, real-time access to data is critical for decision-making, especially in areas like trading, risk assessment, and fraud detection. Data fabric enables real-time, consistent access to data across different platforms and departments, ensuring that critical insights are always available when needed.

- Overcoming scalability challenges in handling big data: As financial data volumes grow, scaling infrastructure to meet data demands becomes costly. Data fabric provides a scalable, flexible architecture that grows with data needs, allowing firms to handle large data volumes more cost-effectively. This scalability is often achieved through cloud-native architectures and container orchestration, optimizing resource utilization and reducing costs.

Also read: How to Adopt a Data Mesh Approach for Financial Services

Conclusion

Financial institutions—banks, insurance companies, asset managers, brokers, and custodians—have long recognized the importance of leveraging data for insights and decision-making. With clients now demanding better user experience, self-service capabilities, and increased access to financial services data and analytics, the need to unify data from disparate sources has become essential. Data fabric architecture is emerging as a powerful solution at the center of this shift. The focus is now shifting towards adaptive, intelligent, and secure data fabrics that can drive innovation and maintain a competitive edge.

It enables organizations to maximize the power of their data by aligning data processes across the organization and enhancing data integration. As an end-to-end management solution, data fabric helps organizations with global footprints optimize underperforming legacy systems and effectively harness existing and new data sources. By embracing data fabric, financial institutions can unlock new opportunities for growth, efficiency, and customer satisfaction in an increasingly data-driven world.

How Hexaware Can Help

Hexaware’s low-code, no-code financial services IT solutions for enterprise data management help solve the problems associated with legacy systems, generate insights for better visibility, and accelerate business innovation. Our cloud-native data management solutions leverage intelligent automation technologies to deliver self-service capabilities, superior end-user experience, and operational efficiencies.

Contact us at marketing@hexaware.com to learn more about our enterprise data management solutions that leverage data fabric principles to modernize your financial institution