While every touchpoint with your customer presents an opportunity to leave a lasting impression, traditional methods of client onboarding often fall short of meeting the expectations of digitally savvy clients. These conventional approaches, burdened by manual processes and fragmented data management, lead to operational complexities for firms. In this scenario, digital client onboarding in wealth management has become imperative in establishing a solid foundation for the relationship between wealth managers and their clients.

According to McKinsey, banks guide companies through a slow, duplicative, and overly complex onboarding process, often resulting in potential customer drop-off or significant dissatisfaction among existing clients, with the average onboarding duration spanning up to 100 days for new corporate clients.

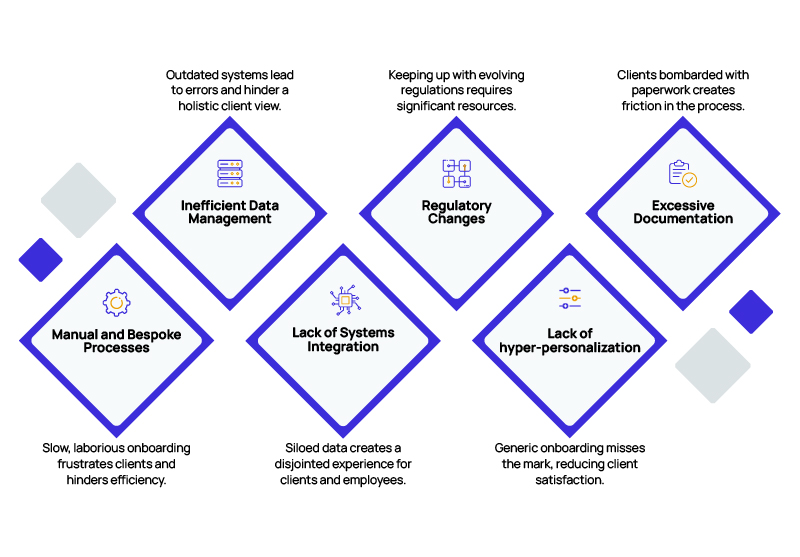

Common Challenges in Client Onboarding

- Manual and bespoke processes: The traditional wealth management client onboarding process is slow, laborious, and largely manual. As per a survey conducted by McKinsey, more than 40 percent of the time a customer spends onboarding is consumed by the KYC (know your customer) due diligence and account opening processes.

- Inefficient data management: During a standard client onboarding process, a case manager gathers approximately 100 client documents and details spanning 150 data fields, the McKinsey report adds. The reliance on outdated systems and procedures exacerbates inefficiencies, highlighting the urgent need to adopt integrated data management solutions to enhance operational efficiency and client satisfaction.

- Lack of systems integration: The absence of seamless integration makes it challenging to obtain data accuracy, timeliness, and a holistic client view. Siloed data hampers collaboration between departments, resulting in disjointed experiences for clients and employees.

- Regulatory changes: Evolving regulatory norms heavily impact onboarding due to the detailed client data involved. Adapting to these changes requires significant resources and expertise.

- Lack of hyper-personalization: Personalized onboarding enhances satisfaction and efficiency, but many firms struggle due to incomplete data, rigid workflows, and limited training. According to McKinsey’s Next in Personalization 2021 Report, 71% of consumers expect companies to deliver personalized interactions, and 76% get frustrated when it doesn’t happen.

- Extensive documentation requirements and high costs: Clients are contacted multiple times during the onboarding process and asked to submit a ton of documents. According to Fenergo, two-thirds of banks spend between $2,500 and $3,500 to conduct a KYC review, and they will struggle to manage these costs if reviews continue to increase at the current rate.

Amid these obstacles, digital client onboarding in wealth management presents the chance to draw in fresh clients through online channels and trim expenses associated with acquiring customers.

Emerging Trends Shaping the Future of Client Onboarding

- Generative AI in Client Onboarding: Firms are leveraging generative AI in wealth management technologies to optimize key processes, including client onboarding, compliance, risk assessment, and personalized insights. According to a BCG Report, industry players have observed reductions of more than 50% in the hours spent on client reviews, showcasing the transformative potential of AI-driven automation.

- Automated KYC: Firms are increasingly adopting automated KYC solutions that integrate real-time updates and continuous monitoring into the due diligence process. These approaches enhance accuracy, reduce manual effort, and ensure faster compliance with evolving regulatory norms.

- Digital Account Opening Processes: The transition to cloud-based digital account opening processes is accelerating, enabling wealth management firms to reduce onboarding times. Features like digital dashboards, e-signatures, self-service capabilities, and seamless integration between front, middle, and back office, and custodian firms enhance efficiency and client experience.

- Omnichannel Experiences: Wealth management firms are focusing on delivering integrated omnichannel onboarding experiences to ensure consistent interactions across platforms. These strategies provide seamless transitions between channels, on-the-go access for clients, and enhanced user satisfaction, aligning with the demand for modern, client-centric approaches.

- Hyper-personalization: Wealth management firms are embracing hyper-personalization to deliver contextual advice, create tailored portfolios, and elevate customer experiences. By leveraging data analytics and AI-driven insights, firms are striving to differentiate their services to attract more clients, enhance customer loyalty, and drive business growth.

The Digital Transformation Imperative

EY’s client onboarding survey 2024 cites a systemic lack of automation and technology innovation as the primary industry concerns, with more than half of the respondents identifying increased efficiency through technology as their top priority.

Top-tier wealth managers are revolutionizing client onboarding through seamless digital experiences by harnessing AI, automation, and advanced analytics. With AI and machine learning, firms obtain instant insights into clients’ financial objectives, risk preferences, and life circumstances. This comprehensive understanding enables personalized product suggestions, bespoke financial planning resources, and tailored communication. The outcome: A remarkable experience that cultivates trust and loyalty right from the initial interaction.

How Hexaware Can Transform Your Digital Client Onboarding Process

With Generative AI embedded throughout, Hexaware’s suite of specialized tools transforms digital client onboarding into a seamless and efficient process. Our solutions—including modular frameworks, digitized document management, AI-powered domain experts, digital dashboards, and scalable data models—empower wealth management firms to streamline operations, ensure compliance, and deliver hyper-personalized client experiences.

- Open Architecture and Modular Framework: Hexaware’s solutions are built on an open architecture model, providing unmatched flexibility and adaptability for your client onboarding process. Designed with interchangeable components, this framework allows wealth management firms to plug in, replace, or update individual modules without impacting the overall system.

- Digitized Document Management: Hexaware’s digitized document management leverages generative AI to convert unstructured data into structured formats. It scans, uploads, and extracts key information, automating workflows with precision. This ensures faster processing, improved data accuracy, and compliance while eliminating manual tasks and enhancing operational efficiency for clients.

- AI-powered Domain Expert: Hexaware integrates AI-driven domain expertise into your client onboarding process through intelligent, industry-aligned chatbots. This advanced virtual assistant offers real-time insights and personalized guidance at every stage of onboarding, ensuring compliance with regulatory frameworks, a smoother onboarding journey, and reduced operational inefficiencies.

- Digital Dashboard: Hexaware’s digital dashboards provide an intuitive and centralized interface to oversee the client onboarding process. It empowers organizations with real-time visibility and control, offering actionable insights and performance metrics at every stage of the workflow. For clients this translates into transparency, operational efficiency, and a streamlined onboarding experience.

- Scalable Data Models for Analytics: Hexaware provides prebuilt, comprehensive data models that streamline data ingestion and ensure robust data validation. These scalable models are designed to handle diverse data sources and enable seamless integration, offering clients a strong foundation for analytics-driven insights.

Hexaware can guide you through the digital transformation journey and facilitate the development of innovative products. Additionally, Hexaware now offers generative AI use case development and implementation across the onboarding value chain, ensuring personalized and optimized experiences for your clients.

Ready to revolutionize your onboarding process? Explore Hexaware’s innovative financial services IT solutions today!