During the Covid pandemic, banking customers have accelerated the adoption of digital transformation, opting for mobile banking instead of visiting the branch, thereby urging the banks to step up their capability in mobile apps and enabling customers to do it on their own. According to a research by Bain & Company and as per the report “Evolving the Customer Experience in Banking Report 2019”, 50% of customers would buy a product from their primary bank if it made a personalized offer. Based on unique goals and demand for products and innovation, customers want banks to tailor their recommendations and provide personalized banking experiences fueled by their own financial data.

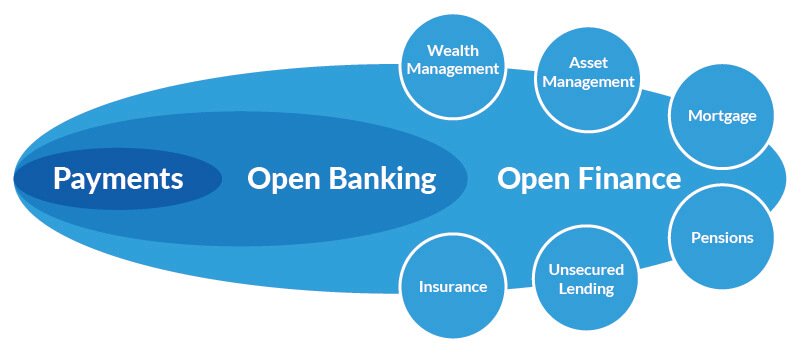

With the emergence of new business models and a shift from products to enhanced customer experience, banks are looking to utilize Open Finance to build these modernized experiences and offer value-added services that reflect the customer’s changing needs and choices. As the next step beyond Open Banking, Open Finance is an API-enabled offering that facilitates the sharing of data between independent parties, and by utilizing APIs, Open Finance solutions can be built to improve the overall customer experience. The concept is to share customer’s data via a secure channel and authorize third-party providers to access the financial footprints of customer, such as mortgages, loans, investments, wallets, and pensions, for providing personalized solutions and allowing the customers to make the right decisions on their financial well-being and leverage financial products or services meeting their tailored needs. The prime example is the credit application process, where businesses (one party) instantly share financial data with mortgage lenders (other parties) to carry out faster credibility checks and assess creditworthiness based on financial data. With Open Finance, all the personal financial data based on access would be securely delivered to the mortgage lender with the party’s consent via an API and automation of this process would improve the overall lending process.

Unlike Open Banking, Open Finance is not limited to banking but opens wider opportunities to Fintech’s, such as insurers, credit institutions, etc., and non-financial organizations, such as healthcare and government. The wider integration can be enabled by separating the core banking process from the underlying systems and exposing the APIs to third-party services, aggregating the customer data and providing a complete holistic view at a single place. It acts as a centralized financial hub for the customers to consolidate and manage all their financial accounts and transactions in one place, saving time and effort.

For Open Finance to thrive, there is an immediate need for the financial institutions to migrate and modernize the complex and siloed legacy application architectures to cloud in order to enhance the services & personalized experience for their end customers and hold their market share. The user-driven data helps these institutions to innovate, remain competitive, and reinvent their business models. The ideal approach for the financial institutions is to utilize cloud-savvy technology partners who understand the changing market needs and offer experience in harnessing public cloud differentiation to achieve application-centric outcomes with their cloud modernization offerings.

Hexaware Technologies was named a Visionary by Gartner® in their 2022 Magic Quadrant™ for Public Cloud IT Transformation Services. Hexaware empowers financial institutions by helping them realize the true benefits of an Open Finance ecosystem. We provide innovative solutions tailored to changing market demands, resulting in long-term growth opportunities, business agility, and increased operational efficiency at a reduced cost. Hexaware has supported various institutions on their cloud transformation goals by providing industry-leading solutions focused on leveraging APIs and cloud-native technologies in building Open Finance solutions on the cloud with minimal Capex and investment in partnership with hyperscalers such as AWS, Azure, and Google Cloud.

Hexaware’s US-patented cloud modernization platform amaze® helps banks and financial institutions accelerate the overall cloud journey and modernize seamlessly from monolithic to microservices architecture and scalable API-based solutions compliant on cloud and aligned with security standards. Accelerating the cloud journey would unlock greater innovation and new revenue models for institutions focused on building Open Finance solutions and they will soon be a part of a much larger client base and ecosystem where the biggest opportunity is to establish trust and improve the personalized experience for customers.