A leading bank built an ‘innovation factory’ with Hexaware to co-create MVPs across banking lines, delivering 15+ digital propositions, enhancing privacy, reducing fraud, and accelerating go-to-market.

Client

Partnering with a Customer-First Bank for Digital Transformation

A leading financial institution sought to drive digital banking transformation by enhancing its services in a rapidly evolving digital landscape. The bank aimed to deliver a seamless, fully digital experience to its personal and business clients, offering user-friendly and secure services. Their vision was to provide 100% digital convenience while developing innovative value propositions for smaller markets, achieving faster, more cost-effective results.

Challenge

Building a Scalable Innovation Accelerator

To meet their ambitious goals, the bank needed an accelerated innovation process. They sought to create customer-centric banking solutions quickly and efficiently while maintaining high standards for security and usability. The challenge was to build a scalable framework that would enable the bank to continually innovate while empowering its internal teams to keep pace with the latest digital trends and tools.

Solution

Establishing a Dynamic Innovation Factory

The bank partnered with Hexaware to establish a robust “innovation factory” that would streamline the process of bringing new ideas to life. Hexaware’s innovation teams handled the full lifecycle of innovation, from ideation to problem validation and solution prototyping. By collaborating closely with the bank’s own innovation team, Hexaware developed an MVP (Minimum Viable Product) approach, rapidly testing concepts with real clients to validate their market fit.

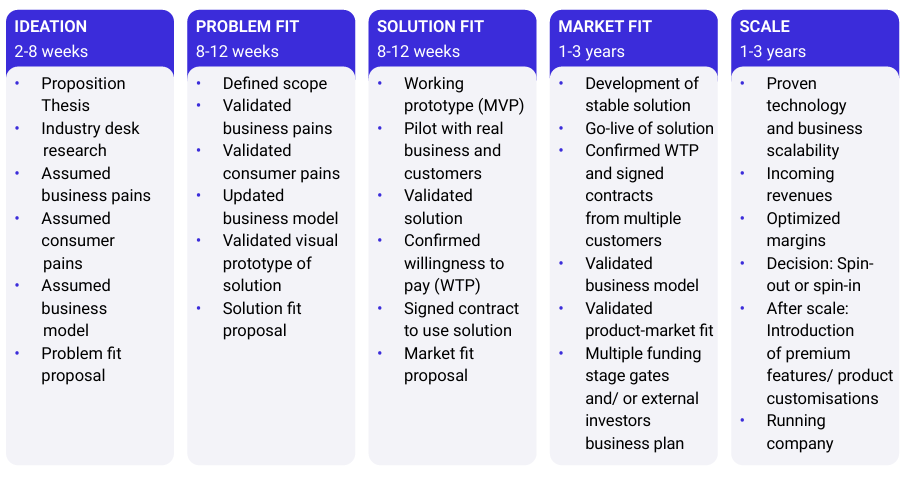

Hexaware’s role spanned across all business lines—retail, wholesale, and corporate—working on various phases, including Ideation, Problem Fit, Solution Fit, Market Fit, and Scale. In one key initiative, Hexaware supported the development of a digital identity and personal data-sharing solution. This solution allows users to have full control over their personal information, from applying for mortgages to sharing COVID-19 test results, all under the principles of Privacy by Design and Self-Sovereign Identity.

Benefits

Accelerating Innovation for Customer-Centric Banking Solutions

The innovation factory setup enabled the bank to deliver new propositions at a faster pace, with enhanced security and reduced friction for end users. The digital identity solution, for example, empowered users to control and minimize the sharing of their personal data, significantly improving privacy while reducing operational costs for businesses by verifying data authenticity upfront. The solution also helped reduce fraud and streamline customer journeys.

In three years, over 15 value propositions were developed, with several gaining significant traction in the market. One notable success was the adoption of the digital identity solution by a major event organizer in the Netherlands. Eight successful pilots allowed people to safely attend large post-pandemic events by proving their COVID-free status, boosting customer comfort and safety.

Summary

Leading Digital Transformation in Banking with an Innovation Accelerator

Through its partnership with Hexaware, our client successfully set up an innovation accelerator that has already produced multiple market-ready solutions, including a groundbreaking digital identity and data-sharing system. This collaboration has allowed the bank to stay at the forefront of digital innovation while reducing time to market, improving customer satisfaction, and enhancing operational efficiencies across various sectors. The innovation factory continues to drive impactful solutions, positioning our client as a leader in digital transformation in banking.

Ready to Transform Your Banking Experience?

Contact Hexaware today to learn how we can help you establish your own innovation accelerator or innovation factory. Let’s work together to drive digital banking transformation and create customer-centric solutions that meet the demands of the modern financial landscape.