Introduction

Goal-based financial planning is a modern approach to wealth management that focuses on setting specific financial objectives and tailoring strategies to achieve them. This approach provides clarity and direction by aligning financial plans with personal milestones like buying a home or planning for retirement. Regular reassessment ensures these strategies adapt to changing circumstances, keeping individuals on track to meet their goals. This blog will examine how generative AI in finance can be leveraged to improve goal-based planning.

Tools for Financial Planning: From Traditional to AI-driven Solutions

Traditionally, financial planning was a tedious and time-consuming process, heavily dependent on human advisors. However, technology has dramatically transformed this landscape, automating and streamlining workflows, enhancing overall efficiency, and fostering greater trust and confidence among clients.

Here are some modern tools used for financial planning:

- Robo-advisors: These platforms use algorithms to provide automated, low-cost financial planning By analyzing client inputs and market data, they offer investment recommendations that make financial planning more accessible and affordable.

- AI-driven Financial Planning: Advanced AI systems leverage vast datasets and machine learning to deliver more sophisticated financial planning and monitoring. These tools broaden the range of products and services available, providing deeper insights and more customized financial strategies.

- Gen AI-based Personalized Planning: Generative AI (gen AI) elevates AI-driven planning by generating highly personalized content and strategies. It tailors financial plans to an individual’s unique goals and circumstances, offering a level of personalization that goes beyond traditional methods.

Generative AI in Finance for Goal-based Planning

According to an AI and Financial Reporting Survey by KPMG, a majority of financial reporting leaders (65%) are already utilizing AI functions in their reporting workflows, while 48% have piloted or deployed some form of Gen AI solution. Additionally, 71% expect AI solutions to be used extensively in 3 years.

Gen AI serves as an invaluable assistant in creating goals-based financial plans. Here’s how:

- Goals Identification: Thoroughly evaluates an individual’s financial landscape, helping to identify and prioritize specific financial goals.

- Risk Management: Assesses risks and provides customized mitigation strategies, using advanced analytics and decision support systems to model risk scenarios and offer data-driven advice.

- Actionable Recommendations: Delivers highly personalized advice tailored to the client’s specific circumstances and goals, ensuring that every recommendation is relevant and actionable.

- Financial Literacy: Simplifies complex financial concepts, empowering clients to improve their financial literacy and make more informed decisions.

- Conversational Interface: AI-powered chatbots function as virtual financial advisors, providing guidance and answering questions through an interactive, user-friendly interface.

- Report Generation: Generates detailed, personalized reports with visual aids like charts and graphs, making it easier for clients to understand their financial data and make informed planning decisions.

Real-world Applications: Companies Leading with Gen AI

Several leading financial institutions are harnessing the power of gen AI to enhance their personalized services:

- Morgan Stanley utilizes gen AI to empower financial advisors with insights on market trends, investment research, and client recommendations, improving decision-making and overall efficiency.

- Northern Trust is actively experimenting with gen AI in a controlled environment to explore potential applications for optimizing portfolio strategies and advancing investment analytics.

- JP Morgan Chase has applied for a trademark for IndexGPT, a software that taps into artificial intelligence for ‘analyzing and selecting securities tailored to customer needs’, according to a filing with the United States Patent and Trademark Office.

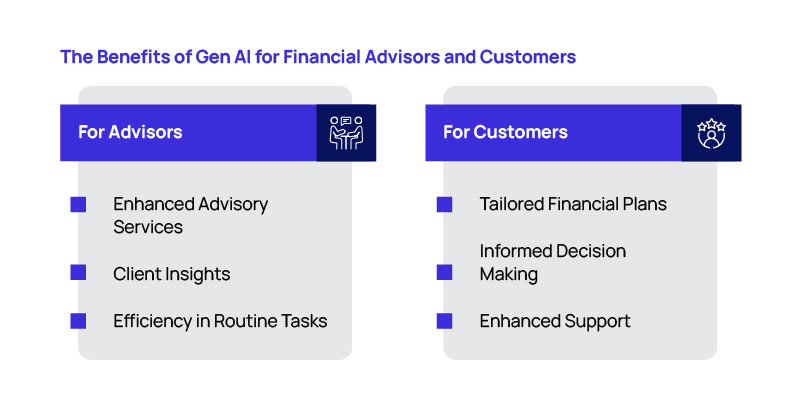

The Benefits of Gen AI for Financial Advisors and Customers

For Advisors

Generative AI can provide financial advisors with actionable insights, streamlining routine tasks, and enabling more personalized client interactions.

- Enhanced Advisory Services: Generative AI provides financial advisors with real-time insights on market trends, investment research, and tailored recommendations for clients. For example, a financial services company can utilize gen AI to analyze vast amounts of market data quickly. This allows advisors to offer more informed advice, helping clients to navigate volatile markets with confidence.

- Client Insights: Understanding client behavior and preferences is crucial for delivering personalized advice. Generative AI analyzes patterns in clients’ financial activities, preferences, and goals, enabling advisors to offer tailored solutions. For example, a financial institution can use gen AI to track client interactions across various channels, providing insights into individual preferences and behaviors. This data enables advisors to anticipate client needs, offering proactive advice that resonates with each client’s unique financial situation.

- Efficiency in Routine Tasks: Generative AI significantly reduces the time advisors spend on routine tasks, allowing them to focus on high-value activities such as client conversations and strategic planning. For example, AI-powered tools can automate the preparation of financial reports, pulling data from multiple sources and presenting it in a clear, actionable format. This not only saves time but also improves the accuracy and consistency of the reports.

For Customers

For customers, generative AI can unlock tailored financial plans and provide data-driven guidance and continuous support to help them achieve their financial goals.

- Tailored Financial Plans: Generative AI can create highly personalized financial plans that are uniquely tailored to each customer’s circumstances and goals. For example, a young professional looking to save for a home might receive a plan focused on aggressive savings and investment strategies, while a retiree might receive advice on wealth preservation and income generation. These AI-generated plans are dynamically adjusted based on real-time data, ensuring that the financial strategies remain relevant as market conditions and personal situations change.

- Informed Decision-making: By analyzing vast amounts of data, generative AI provides customers with clear, data-driven recommendations. For example, if a customer is considering multiple investment options, AI can assess risk, historical performance, and market trends to suggest the most appropriate investment. This enables customers to make well-informed decisions, minimizing risks and maximizing potential returns.

- Enhanced Support: Generative AI-powered tools offer continuous monitoring of a customer’s financial health, providing adaptive recommendations that ensure clients stay on track with their financial goals. If market conditions shift or a customer’s spending habits change, the AI system can send alerts and suggest adjustments to their financial plan. Additionally, AI-driven chatbots and virtual assistants offer 24/7 support, answering questions and providing guidance, ensuring that customers have access to financial advice whenever they need it.

Regulatory Considerations While Using Gen AI for Financial Planning

While comprehensive AI or genAI regulations are yet to be implemented globally, significant strides are being made in this direction. According to an article by Mckinsey, legislative efforts are being led by countries and regions such as the

Following are some recent examples of regulatory advancements concerning the usage of AI/gen AI:

- The United States: The SEC has proposed new rules requiring broker-dealers and investment advisers to address conflicts of interest arising from the use of predictive data analytics and AI.

- The European Union: The EU has proposed the AI Act, emphasizing transparency, categorizing AI systems by risk, and ensuring compliance with the General Data Protection Regulation (GDPR).

- Brazil and Singapore: These countries have adopted flexible, principles-based AI regulation, with Singapore offering an AI governance toolkit and a generative AI evaluation sandbox.

- South Korea: South Korea has integrated AI regulation with data protection and cybersecurity laws, focusing on ethical, transparent, and accountable AI usage.

Hexaware: Your Strategic Partner in Gen AI-enhanced Financial Planning

By integrating advanced AI technologies with robust data analytics and regulatory compliance frameworks, Hexaware helps advisors provide highly personalized and adaptive financial planning services. Hexaware’s expertise in digital transformation ensures that financial institutions can efficiently implement and benefit from gen AI-driven financial planning solutions.

Learn more about our financial services IT solutions, or connect with us at marketing@hexaware.com to leverage generative AI in your business.