This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Digital Client Onboarding: A Streamlined Approach for Wealth Managers

Financial Services

May 29, 2024

While every touchpoint with your customer presents an opportunity to leave a lasting impression, traditional methods of client onboarding often fall short of meeting the expectations of digitally savvy clients. These conventional approaches, burdened by manual processes and fragmented data management, lead to operational complexities for firms. Consequently, digital client onboarding processes have become imperative in establishing a solid foundation for the relationship between wealth managers and their clients.

According to McKinsey, banks guide companies through a slow, duplicative, and overly complex onboarding process, often resulting in potential customer drop-off or significant dissatisfaction among existing clients, with the average onboarding duration spanning up to 100 days for new corporate clients.

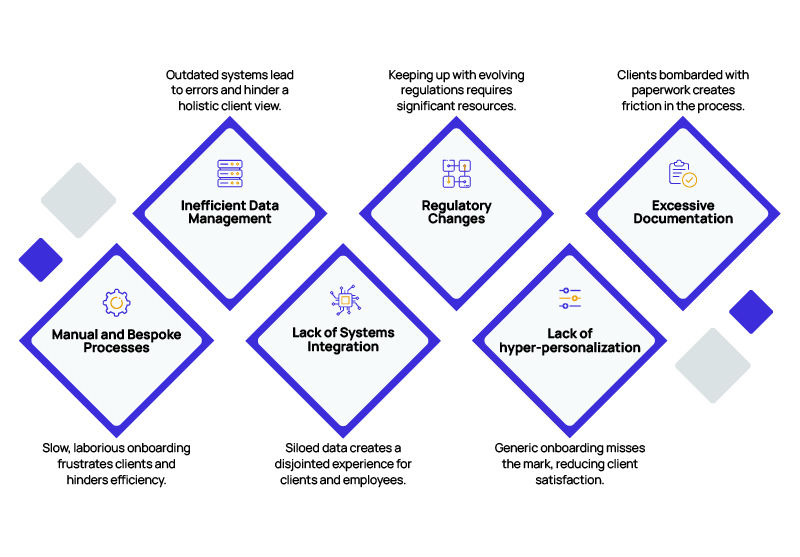

Common Challenges in Client Onboarding

- Manual and bespoke processes: Traditional client onboarding is a slow, laborious, and largely manual process. As per a survey conducted by McKinsey, more than 40 percent of the time a customer spends onboarding is consumed by the KYC (know your customer) due diligence and account opening processes.

- Inefficient data management: During a standard client onboarding process, a case manager gathers approximately 100 client documents and details spanning 150 data fields, the McKinsey report adds. The reliance on outdated systems and procedures exacerbates inefficiencies, highlighting the urgent need to adopt integrated data management solutions to enhance operational efficiency and client satisfaction.

- Lack of systems integration: The absence of seamless integration makes it challenging to obtain data accuracy, timeliness, and a holistic client view. Siloed data hampers collaboration between departments, resulting in disjointed experiences for clients and employees.

- Regulatory changes: Evolving regulatory norms heavily impact onboarding due to the detailed client data involved. Adapting to these changes requires significant resources and expertise.

- Lack of hyper-personalization: Personalized onboarding enhances satisfaction and efficiency, but many firms struggle due to incomplete data, rigid workflows, and limited training. According to McKinsey’s Next in Personalization 2021 Report, 71% of consumers expect companies to deliver personalized interactions, and 76% get frustrated when it doesn’t happen.

- Extensive documentation requirements and high costs: Clients are contacted multiple times during the onboarding process and asked to submit a ton of documents. According to Fenergo, two-thirds of banks spend between $2,500 and $3,500 to conduct a KYC review, and they will struggle to manage these costs if reviews continue to increase at the current rate.

Amid these obstacles, a digital client onboarding process presents the chance to draw in fresh clients through online channels and trim expenses associated with acquiring customers in wealth management.

Emerging Trends Shaping the Future of Client Onboarding

- Customer-centricity: Prioritizing client needs and tailoring processes accordingly.

- Stringent verification and security: Enhancing protection and fraud detection through robust security measures.

- Mobile accessibility: Providing seamless on-the-go access for clients.

- Omnichannel experiences: Enabling smooth transitions between channels for enhanced user experience.

- AI integration: AI and generative AI in client onboarding can streamline operations and reduce dropouts through personalization, automation, and data insights.

The Digital Transformation Imperative

EY’s client onboarding survey 2024 cites a systemic lack of automation and technology innovation as the primary industry concerns, with more than half of the respondents identifying increased efficiency through technology as their top priority.

Top-tier wealth managers are revolutionizing client onboarding through seamless digital experiences by harnessing AI, automation, and advanced analytics. With AI and machine learning, firms obtain instant insights into clients’ financial objectives, risk preferences, and life circumstances. This comprehensive understanding enables personalized product suggestions, bespoke financial planning resources, and tailored communication. The outcome: A remarkable experience that cultivates trust and loyalty right from the initial interaction.

A McKinsey report predicts that by 2030, up to 80% of new wealth management clients will demand a data-driven, hyper-personalized, continuous, and potentially subscription-based model for accessing advice.

Here are some ways in which digital transformation of the client onboarding process can help wealth management firms:

- Digitized document management: Automate document collection, verification, and processing for faster onboarding. Use optical character recognition (OCR) technology to extract data from scanned documents, thereby improving accuracy and compliance.

- AI chatbots for client support: Deploy AI-powered chatbots to provide personalized assistance and support. These virtual assistants use natural language processing (NLP) to guide clients through the onboarding process, reducing response times and improving satisfaction.

- Automated compliance checks: Utilize AI to automate KYC and AML (anti-money laundering) screenings, ensuring regulatory compliance in real-time. Machine learning algorithms analyze client data, flagging suspicious activities and mitigating risks.

- Personalized content generation: Leverage generative AI in client onboarding for personalized content creation tailored to the client’s preferences and goals. Natural language generation (NLG) algorithms generate customized reports and recommendations, enhancing engagement and trust.

- Data analytics for insights: Harness data analytics tools to extract actionable insights from client data. Machine learning and predictive modeling can identify trends and opportunities, enabling informed decision-making and superior outcomes.

How Can Hexaware Help?

Hexaware provides a comprehensive suite of services tailored to optimize your digital client onboarding process. The offerings include end-to-end workflow automation, data management, and reporting transformation. Hexaware can guide you through the digital transformation journey and facilitate the development of innovative products. Additionally, Hexaware now offers generative AI use case development and implementation across the onboarding value chain, ensuring personalized and optimized experiences for your clients.

Ready to revolutionize your onboarding process? Explore Hexaware’s innovative financial services IT solutions today!

About the Author

Jamir Savla

Vice-president & Global Head — Wealth Management Consulting

Jamir is an experienced professional with over 18 years in wealth management technology, specializing in digital solutions. He leverages his deep understanding of digital innovation, automation, and problem-solving to deliver strategies that help businesses reduce costs and enhance efficiency. His expertise cuts through the complexities of technology and operations, offering practical solutions and innovative approaches to streamline processes. Through his thought leadership, Jamir has established himself as a trusted resource in the wealth management technology space.

Read more

Related Blogs

Generative AI in Financial Services: Transforming Goal-based Financial Planning

- Financial Services

- Generative AI

Six Frameworks for Financial Services Modernization

- Financial Services

- Generative AI

KYC Process in Wealth Management: Digitalization Benefits

- Financial Services

Composable Enterprise Model: Unlocking New Growth Opportunities in Financial Services

- Financial Services

Generative AI in Financial Services: Top 5 Quick Wins for Maximum Impact

- Financial Services

- Generative AI

Revolutionizing Wealth Management: The Gen AI Advantage

- Financial Services

- Generative AI

Gen AI: A Game Changer in Bond Investment through Risk Assessment

- Financial Services

- Generative AI

Transforming Asset Management: The Power of Gen AI

- Financial Services

- Generative AI

Empowering Financial Institutions in the Digital Era: How Generative AI is Reshaping Business Value and Customer Journeys

- Financial Services

- Generative AI

Top 6 Technology Trends in Capital Markets

- Financial Services

Ready to Pursue Opportunity?

Every outcome starts with a conversation